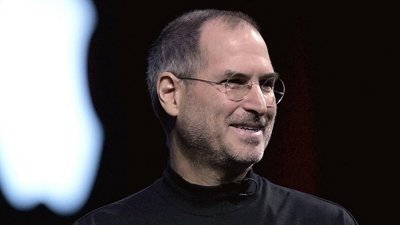

Gov't unlikely to 'nail Apple and Steve Jobs'

Renewed concerns over Apple Computer's options issues are "valid but overdone," according to one Wall Street analyst, who says it is unlikely that the federal government is looking to make an example out of the corporate icon or its well-respected chief executive.

"In our view, given the seriousness of this investigation, we are surprised Steve Jobs didn't hire personal legal help earlier," Wu told clients. "Nonetheless, we continue to believe in our long-standing view that even in the worst case scenario where Apple is guilty of improper options grants, we do not believe Steve Jobs is liable, the reason being that the compensation committee at Apple is run by an independent board that is not comprised of Apple employees."

The analyst said he recently consulted with some of his most trusted sources regarding Apple's overall options matter, including a Harvard-law educated, former SEC employee with nearly a decade of Wall Street experience. Those sources, Wu said, indicated that options backdating is a widespread and commonplace problem affecting as many as 30 to 35 percent of Fortune 500 companies.

"Given the widespread nature, we doubt the SEC and Department of Justice will pursue a broad 'witchhunt' forcing key executives to step down that would undermine the recovery of the US economy," he wrote. "Not to sound like conspiracy theorists, but we do not believe it makes sense for the US government to nail Apple and Steve Jobs, one of the most respected American companies and businessmen of the past 100 years."

The analyst said a more likely scenario would be for the feds to tighten their enforcement on options backdating to ensure it doesn't happen in the future. He therefore views the recent pull-backs in Apple's share price as an opportunity for nimble investors to buy into the company during a slow week, when many Wall Street figures are away from their desks on vacation.

"For those of you who missed yesterday's window, we do not think it is too late to begin stepping in," he wrote. "That said, we encourage investors (particularly those with a longer term investment horizon) to be buying Apple on dips as we believe Apple shares have upside to $99 based on our checks of strong December quarter momentum and a strong product pipeline in 2007."

Some of the positive catalysts the analyst expects will buoy the company's shares in the near-term are: Mac OS X Leopard in in the first half of 2007, iTV in the first quarter, new movie content partners, a new widescreen and Bluetooth iPod features, and cell phones.

In the meantime, Wu said the issue at hand is the quality of evidence that is being discovered by federal investigators digging into Apple's options mess. "The type of crime that is alleged is very serious from the standpoint of prosecutors and shareholders, whether the prosecutions are made under the rubric of forgery, fraud, misappropriation of assets or some other crime," he wrote. "The news from Law.com may be significant because the prosecutors may have discovered a documentary 'smoking gun' (i.e. a document that was clearly forged) that would make their case much easier to prosecute (and therefore more likely to proceed) than if they were relying solely on oral testimony from those involved."

Still, it's the analyst's belief that prosecutors are unlikely to be leaking such evidence at this stage and it would therefore "be imprudent to speculate about the strength of their case" based on news reports alone.

"The bottom line is that 'falsification of documents' and 'options backdating' are serious yet closely inter-related, and we do not think it is likely that Apple will be used to make an example by the government," he told clients.

Wu maintained his Buy rating on shares of Apple, forecasting the company to report earnings-per-share of $0.79 on sales of $6.4 billion for its fiscal first quarter of 2007 come January.

Katie Marsal

Katie Marsal

Wesley Hilliard

Wesley Hilliard

Andrew Orr

Andrew Orr

Amber Neely

Amber Neely

William Gallagher

William Gallagher