Why Apple's guidance is still conservative

The main reason that many on Wall Street believe Apple has changed its guidance practices to a more "realistic" approach for fiscal Q1 is due to the fact that Apple gave very strong revenue guidance that was a full $1.6 billion above the consensus.

Because there has been so much press over the years about how Apple is comically conservative with its guidance, this concept has become so deeply ingrained in the collective thinking of Wall Street that everyone blindly accepts it as the truth. I mean, it's obvious, right? Apple is very conservative with its guidance. Everyone knows this, right?

Thus, upon seeing Apple guide above Wall Street on revenue by such a massive margin as $1.6 billion, it has lead many to conclude that Apple must have shifted to a more aggressive stance with its guidance. Since Apple is so conservative, it must mean that Apple never guides above the Street, right?

What if I were to tell you that Apple isn't as conservative as everyone might think? What if I were to tell you that this isn't the first time that Apple has guided above the Street on revenue? Indeed, what if I were to tell you that the assumption that Apple sandbags the street with conservative guidance is entirely false? What if Apple has been aggressive all along, but every quarter that goes by you are told that Apple's guiding above the Street was just another outlier? What if the fact that Apple consistently guides above the Street on revenue and by a very significant margin has fallen out of the collective memory of investors? What if it has fallen out of the collective memory of Wall Street?

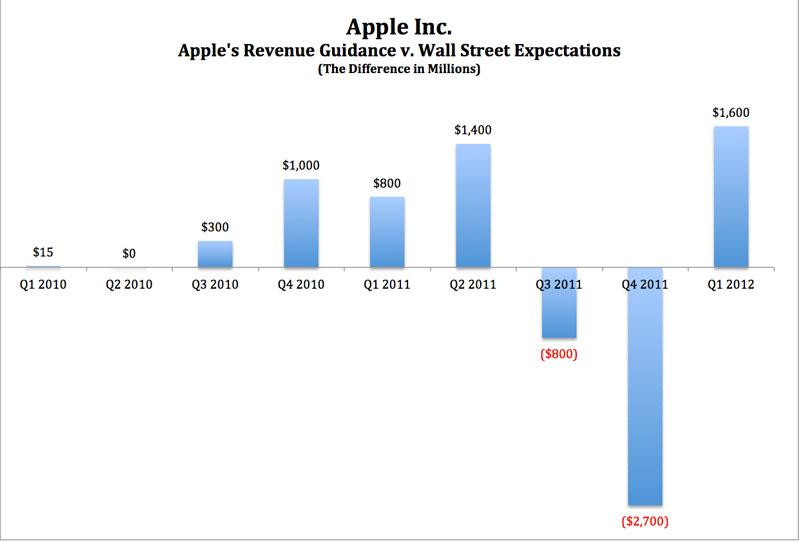

Believe it or not, Apple has guided above the Street on revenue in six out of the last eight quarters since it underwent a major accounting change that allowed the company to finally include iPhone revenue as part of its total sales. Ever since Apple shifted away from subscription accounting, the company has guided above the Wall Street consensus in six out of the last eight quarters.

This has been largely the result of Wall Street simply being unable to comprehend how a company of Apple's size can continue to grow by such a dramatic fashion. It is no secret that Wall Street simply does not understand Apple.

For example, as we headed into Apple's 2011 fiscal year last September (2010), the Wall Street consensus for Apple's 2011 earnings was extremely low. The Street was looking for Apple to report 2011 EPS of $17.43 on revenues of about $70 billion. Apple ended up reporting $27.68 in EPS (58.8 percent higher) on $108 billion in revenue (54.2 percent higher). Wall Street is doing the very same thing this year. Even though Apple's fiscal Q1 guidance pretty much indicates that the company is going to report about $44.00 in EPS on $160 billion in revenue in 2012, the Wall Street consensus is looking for $34.76 in EPS on $140 billion in revenue.

Every single year Wall Street expectations for Apple are almost 50 percent lower than what Apple ends up reporting. Unfortunately for Apple investors, Apple trades on future expectations. Thus, every year that goes by, investors ignore the fact that Apple just beat the consensus by 50 percent and then trades on flawed forward expectations. The real problem is that this cycle continues into perpetuity. So while Apple might very well deliver $44.00 in EPS in 2012, that won't matter at all because by the time Apple demonstrates that expectations are too low, it is already trading on the next set of flawed expectations. There hasn't been a year since 2006 where the initial consensus heading into the next year wasn't beaten by at least 50 percent, including 2011. That's a big reason why Apple is the most undervalued large-cap stock in America.

Getting back to the point at hand: In four out of the last six quarters including this one, Apple has guided about $1 billion or more above the street on revenue. And yet even after guiding so heavily above the street in four out of the last six quarters, Apple has still managed to blowout expectations.

As you can see from the chart below, aside from this quarter, Apple guided $1.4 billion above the street for fiscal Q2 2011, it guided $800 million above the Street for fiscal Q1 (last year) and $1 billion above the street in fiscal Q4.

This directly contradicts the assumption that Apple "regularly" sandbags the Street. Since fiscal Q1 2010, Apple has only ever guided below the Wall Street consensus on revenue twice. Once was in fiscal Q3 2011 and the other was in fiscal Q4 2011. Notice that in fiscal Q4 2011, Apple guided a full $2.7 billion below the Street on revenue and everyone dismissed it — including myself — as being overly conservative. This ended up leading to the earning's miss in fiscal Q4.

But the point here is this: One cannot conclude that Apple has become "more aggressive" with its guidance for fiscal Q1 solely based on the idea that Apple guided $1.6 billion above the Street on revenue. Apple has guided by $1 billion+ above the Street on three other recent occasions. So that goes out the window entirely.

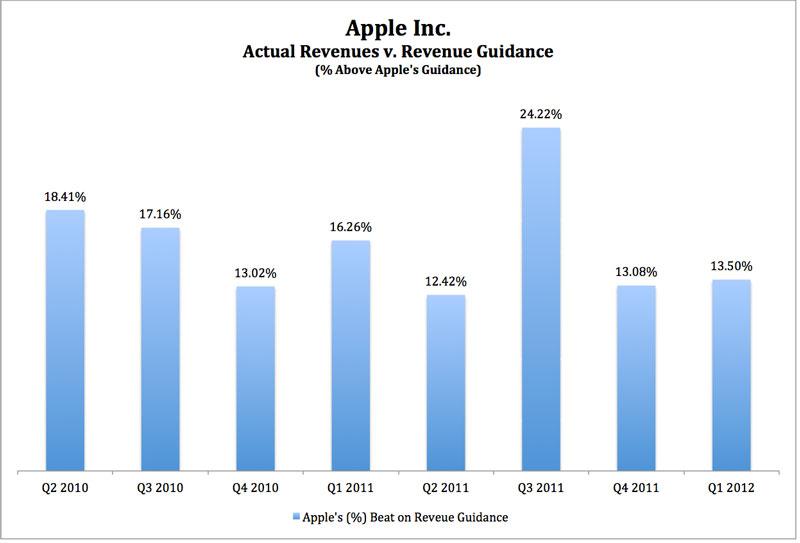

On top of that, what really kills the argument that Apple has become more aggressive with its guidance is the fact that nothing in Apple's recent reporting would suggest such a conclusion. If you look at the past two years as exhibited in this chart below, Apple has consistently beaten its revenue guidance by 12-18 percent every quarter. That means regardless of whatever Wall Street is doing or thinking, Apple continues to deliver the same type of beat on its guidance. Whether Apple meets or beats Wall Street expectations doesn't really figure into Apple's thought process. The chart below clearly demonstrates this statement.

Now what's very interesting about this chart above is that when Apple first reported its fiscal Q4 earnings which fell short of Wall Street expectations, many tried to argue that it must mean that either Apple's sales were slowing or that Apple got overly aggressive with its guidance. No one stopped to think that it wasn't Apple's fault at all.

This chart above clearly demonstrates that Apple knew exactly what it was doing when it gave revenue guidance that was $2.7 billion below the street going into fiscal Q4. All analysts —- both Wall Street and independents (including myself) —- completely ignored the warning signs. Everyone blew-off Apple's very serious guidance as being just "merely conservative." I will tell you this: That will be the very last time I ever question the validity of Apple's guidance. When Apple guides above the street, they mean it. When they guide below the street, they really mean it. That's the way to interpret the new era for Apple. You must accept the warning signs when Apple gives them to you or you're going to be very disappointed. That was the lesson in fiscal Q4.

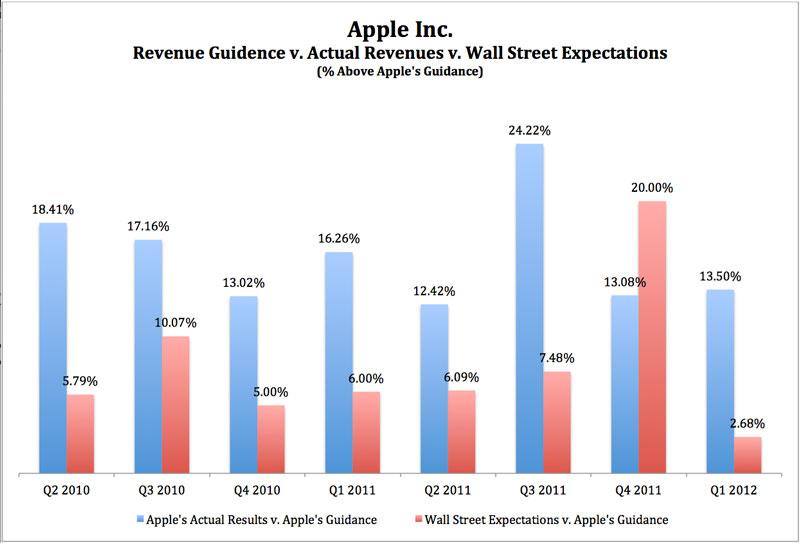

Another piece of significant evidence which suggests that Apple hasn't changed anything with respect to its guidance, and that the fiscal Q4 anomaly was merely the result of analyst error, is demonstrated in variations in the consensus.

Before Apple's recently reported fiscal Q4, the Wall Street consensus estimate for Apple's revenue over the past two years has tended to range between 5 percent and 7 percent in the typical quarter. This gave Apple plenty of room to beat on the upside given that Apple tends to beat its own revenue guidance by between 12-18 percent.

Yet, because things got so out of hand in fiscal Q4 as a result of the huge beat in fiscal Q3, the Wall Street consensus on revenue was 20 percent above Apple's guidance by the time the company reported earnings. That consensus estimate was so high that it would have amounted to an earnings miss by Apple in a whopping 7 out the last 8 quarters. This suggests that Apple was basically set-up to miss Wall Street expectations in fiscal Q4, and couldn't have done anything about it. Apple's fiscal Q3 blowout, basically sealed Apple's fate for fiscal Q4. This chart below clearly demonstrates that to be the case.

And to be honest, it was just an unfortunate series of events that lead Wall Street analysts to hold such high expectations. If Apple hadn't absolutely decimating expectations in fiscal Q3, Wall Street wouldn't have ignored Apple's warnings with its fiscal Q4 guidance and we wouldn't have had this miss. The fact that everyone accepted the belief that Apple is always conservative with its guidance also played a massive role in the fiscal Q4 earnings miss. Hopefully this article will help correct that viewpoint with respect to Apple's guidance.

But what this should demonstrate is that Apple doesn't try to play games. They guide where they believe they can reasonable beat expectations. If that means guiding $2.7 billion below the Street, then by golly they will guide $2.7 billion below the Street. If it means guiding $1.6 billion above the Street, then so be it. Apple has no problem guiding $1.4 billion above the Street and in fact when it did so in fiscal Q2, it was offering a more aggressive guidance than it is this quarter. Yet, as aggressive as that guidance was in fiscal Q2, Apple still beat its revenue guidance by the same old 12-18 percent range notwithstanding.

That tells you that what Apple is doing with its revenue guidance is it's trying to set the right type of expectations. Here that means telling the Street that the company internally believes that Apple will report anywhere from $41.6 billion to $43.7 billion in fiscal Q1 2012. That $2 billion range is how the company has done it in the past. Pretty much every quarter since Q1 2010 has fallen within that $2 billion range. The determination of where Apple's earnings will ultimately fall within that $2 billion range will largely depend on the analysis of research data.

Remember that $2 billion is merely the difference between 3.3 million iOS Devices i.e. iPhones + iPads. So for example, if Apple reports sales of 32 million iPhones and 13.5 million iPads, that would amount to $42 billion in revenue all else being equal. But suppose Apple were to sell 35 million iPhones and 13.8 million iPads. That would result in Apple reporting a revenue number in the upper end of its range. Doesn't this sound kind of ridiculous?

Who is going to really know for sure whether Apple sells an extra 3.3 million iOS devices? No one. That's the best anyone can hope to do without insider information. Apple has told us that it will report between 32 million and 35 million iPhones or 13.5 to 14.5 million iPads. How much more specificity do we really need in our forecasting? Bullish Cross holds an expectation that Apple will report $42 billion in revenue on 32 million iPhones and 13.5 million iPads. The reason? We don't really care to risk missing. We're fine with our forecast. If Apple beats us and reports a few more million iPhones, then so be it. But we take comfort in knowing that our forecast will be within a 5 percent margin of error.

Andy M. Zaky is a fund manager at Bullish Cross Capital and the editor of the Bullish Cross Financial Newsletter. Bullish Cross Capital owns a significant long position in Apple, Inc.

Andy M. Zaky, Bullish Cross, Special to AppleInsider

Andy M. Zaky, Bullish Cross, Special to AppleInsider

Andrew Orr

Andrew Orr

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

Mike Wuerthele

Mike Wuerthele

Christine McKee

Christine McKee