Wowed Wall Street watchers raise forecasts after Apple's 'perfect' $46B quarter

Apple's first quarter of its fiscal 2012 was so good, analyst Brian Marshall called it "the perfect quarter." Other analysts weighed in with descriptions including "supersized," "exceptional" and "iDominance."

Analysts also took the opportunity to increase their price targets for AAPL stock, with the most bullish of forecasts now calling for it to hit $670.

Piper Jaffray

Analyst Gene Munster has the highest price target amongst his peers, with the $670 forecast. AAPL is his top pick for 2012, as Apple's success is "a market expansion story as well as an upgrade cycle story."

While Munster was impressed by Apple's holiday quarter, he sees it as a precursor to 2012, which he previously said will be a "monster" year. He expects the "true force" of Apple's December quarter will be felt throughout calendar year 2012.

Munster also said that though investors getting numb to Apple's impressive results, he expects earnings revisions will move higher faster than the iPhone maker's declining earnings multiple.

"For the last eight years, Apple has been blowing away analyst estimates," he wrote. "Last night's $7B revenue upside was particularly impressive given it equaled Apple's total revenue for the Jun-08 quarter. While we are raising our earnings numbers for (calendar year 2012) by 24%, shares of AAPL were only up 8% in the aftermarket."

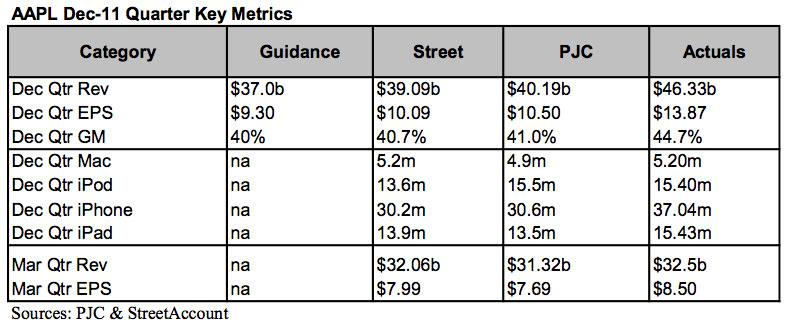

ISI Group

"The perfect quarter," in Marshall's eyes, was due to the fact that the iPhone and iPad generated about 85 percent of Apple's total gross profits. This helped the company beat its revenue guidance by about $9.3 billion and earnings per share guidance by $4.60.

"With minimal 'real' competitive threats to AAPL's major product families in (calendar year 2012), we believe the outlook for the next 4 quarters can be characterized as 'smooth sailing,'" Marshall wrote. "In our view, if something were to go wrong with the story, it would most likely result from idiosyncratic mis-execution on the part of AAPL or a material change in support from the global carrier community."

But Marshall said that's unlikely given Apple's historical track record. He expects an iPad 3 launch in March and a sixth-generation iPhone to arrive in the September-October timeframe to go smoothly.

Marshall also said that Apple possesses a revenue stream similar to a cable company, as though users are iOS "subscribers," but he still doubts that the market will apply a "full valuation" to the company and give it a decent price-to-earnings multiple.

Because of that, he's applied a 12-times multiple to his new calendar year earnings per share estimate of $41.50, up about 9 percent from his previous projection of $39. Adding in 25 percent credit of net cash, he arrived at a new price target of $525, up from $500.

UBS

"Let me get a Q1... supersized," analyst Maynard Um joked. With Apple firing on all cylinders to end 2011, he said it's set up the company nicely for another strong performance in 2012.

"The magnitude of the upside is quite impressive," he said. He sees iPhone demand carrying into the March quarter, while an impending third-generation iPad launch will continue to drive growth.

And those trends will carry Apple into the fall of 2012, when the company is expected to introduce its next iPhone. UBS has maintained its buy rating for AAPL stock, and has a price target of $550.

Needham Research

Analyst Charlie Wolf was at a loss when trying to describe Apple's holiday quarter: "There is no other way to describe it. Apple crushed its first quarter."

He was most impressed by Apple's 110 percent increase in iPhone sales to 37 million, which easily bested his forecast of 32 million units. He also said that sales of 15.4 million iPads "put to rest the notion that underpriced and underpowered compelling tablets would have any affect on iPad sales."

Wolf also noted that with 5.2 million Macs sold last quarter, quarterly Mac sales now exceed annual Mac shipments through 2005.

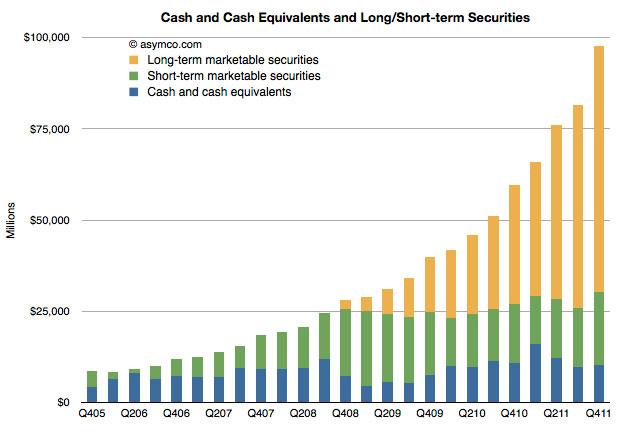

He also took note of Apple's growing cash hoard, which is now worth nearly $100 billion. Wolf is hopeful that Apple Chief Executive Tim Cook will offer investors some sort of dividend out of its cash and reserves.

Needham Research has set a 12-month price target for AAPL stock of $540. Wolf said the major risk in the company's story is whether it can continue to innovate at the same rapid pace for years to come without late co-founder Steve Jobs at the helm.

Morgan Stanley

Beyond product upgrades like the next iPad and a future iPhone, analyst Katy Huberty sees Apple's distribution in China as a major part of its growth going forward. She believes Apple will ink a deal with China Telecom for the iPhone in the near future, while China Mobile will also come on board in late 2012 and early 2013.

"Adding the additional carriers in China helps open up access to the 150M high-end subscribers, 80% of which are on China Mobile's network," she said.

Morgan Stanley has maintained its "overweight" rating for AAPL stock with a price target of $515, though the firm's "bull case" scenario calls for the company's stock to hit $600.

RBC Capital Markets

"iDominance!" declared analyst Mike Abramsky, who raised his price target to $600 from $525 after Apple easily bested his projected iPhone sales of 32 million.

He also noted that Apple now has $104 per share in cash, after having its operating cash flow increase by $17.5 billion in the holiday quarter.

Abramsky sees Apple selling 81.4 million iPhones, 33.4 million iPads and 25.8 million Macs in the company's fiscal 2012. With a projected $160.7 billion in revenue, he sees the company growing 48.5 percent this year.

Deutsche Bank

Analyst Chris Whitmore has increased his price target for AAPL to $600 from $530. He said Apple's new product portfolio remains "incredibly strong" with new iPhone and iPad models expected this year.

"In addition, we expect Macs with Ivy Bridge should support incremental gains and Apple TV appears set to graduate from an 'Apple hobby' later this year," he wrote. "We anticipate an iOS device with Siri user interface and iCloud syncing has the potential to redefine the smart TV category in the same way the iPhone and iPad impacted the smartphone and tablet markets, respectively."

As for the third-generation iPad, Whitmore said he believes it will arrive early this year while the rest of the industry is refocusing its efforts on Windows 8-based tablets. That will give Apple even longer to extend its lead over the competition.

Sterne Agee

With a new price target of $550 (from $540), analyst Shaw Wu believes Apple remains in a position to outperform in a tough macro-econonmic environment. He has forecast $156.4 billion in revenue from Apple in its fiscal year 2012 with $43 in earnings per share.

Looking beyond to fiscal 2013, he sees Apple with $175.7 billion in revenue and $48 earnings per share.

Evercore

"That's a lotta iPhones," analyst Robert Cihra said to kick off his note to investors. He said Apple's guidance for the March quarter looks conservative, as usual.

"But we see demand plus supply-chain momentum continuing to look strong across iPhone cycling (e.g., incremental geo/carrier launches), upcoming refresh of iPad (March) and MacBook Air," he wrote.

Cihra reiterated his "overweight" rating for Apple stock, and increase his price target to $650, from $600. He sees Apple netting revenues of $161 billion in fiscal 2012, up 49 percent year over year.

JMP Securities

Despite Apple's blowout quarter, analyst Alex Gauna has maintained a "market perform" rating for Apple. Gauna admitted it's "embarrassing" for him to have that rating for such a "powerful result," but said he's electing to remain on the sidelines for now, "given the risk of this proving to be a peak margins and growth quarter."

Gauna also cited "elevated litigation uncertainty" and "management transitions" as factors that could hurt Apple going forward. JMP Securities does not have a target price set for AAPL.

Neil Hughes

Neil Hughes

Marko Zivkovic

Marko Zivkovic

Amber Neely

Amber Neely

Christine McKee

Christine McKee

Malcolm Owen

Malcolm Owen

Mike Wuerthele and Malcolm Owen

Mike Wuerthele and Malcolm Owen

William Gallagher

William Gallagher