Greenlight Capital drops lawsuit against Apple over $137B cash reserves

After making waves with a lawsuit and public push for Apple to issue preferred stock, Greenlight Capital withdrew its complaint from court on Friday.

David Einhorn's hedge fund officially dropped its lawsuit following this week's annual shareholder meeting. Apple Chief Executive Tim Cook had dismissed the suit as a "silly sideshow."

"I find it bizarre we find ourselves being sued for doing something that's good for shareholders," Cook said of the lawsuit.

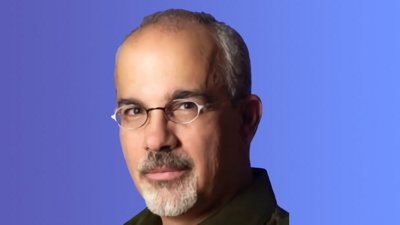

Last month, Greenlight Capital sued Apple and accused the company of having a "problem" with hoarding cash. Einhorn and his fund argued that the company was accruing cash in a manner that hurts investors.David Einhorn of Greenlight Capital believes Apple should return more cash to investors, but Apple CEO Tim Cook dismissed Greenlight's lawsuit as a "silly sideshow."

The lawsuit took specific issue with Proposal 2, an item that was on Apple's shareholder meeting agenda that would have restricted the issuance of preferred stock. The item was eventually pulled from the agenda after a court sided with Greenlight Capital.

Last week, ahead of Apple's shareholder meeting, Einhorn held a conference call with investors and the media where he pushed for Apple to adopt his "iPref" preferred share plan. He believes Apple should offer preferred shares with a dividend of 50 cents per quarter as a use for the company's $137 cash pile.

The lawsuit was dropped on Friday as Apple's stock price reached its lowest point in more than a year. The last time AAPL shares traded below $435 was in January of 2012.

AppleInsider Staff

AppleInsider Staff

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

Mike Wuerthele

Mike Wuerthele

Christine McKee

Christine McKee

Andrew Orr

Andrew Orr

Sponsored Content

Sponsored Content