Apple's share of U.S. PC market rises to nearly 11% on strong growth

Preliminary results released by market research firm IDC indicates that Apple shipped 1.917 million Macs stateside during the three-month period ended June, representing a 14.7 percent increase over the year ago quarter. The performance was strong enough to solidify the Cupertino-based company as the nation's No. 3 PC maker with a 10.7 percent share, up from 9.0 percent during the year ago quarter.

Although PC sales in the United States marked a substantial growth from the first quarter of 2011 with total shipments topping 17.8 million, the segment contracted 4.2 percent on a yearly basis. IDC contributed the decline to three primary factors: the ongoing contraction in the Mini Notebook (Netbook) market as consumers continue to shift towards tablets like the iPad; the second quarter of 2010's difficult-to-sustain 12 percent growth rate; and softened demand from corporate buyers who continue to focus on increasing share of their IT budget in new IT solutions such as cloud and virtualization.

"Given the weakness of [the second half of 2010], we expect a better market environment in [the second half of 2011] with mid-single digit growth rates in the third quarter's back to school and fourth quarter's holiday season," said Rajani Singh, research analyst, United States Quarterly PC Tracker.

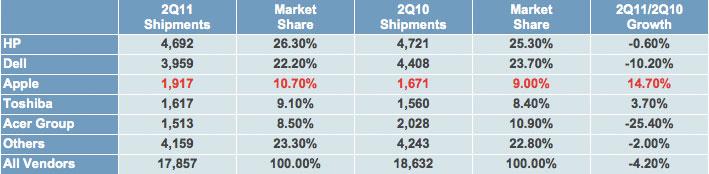

IDC's preliminary U.S. PC market share estimates (in thousands) for the second quarter of 2011.

Aside from Apple, Toshiba was the only other major PC maker to report second quarter growth, which came in at just 3.7 percent from the local sale of 1.617 million units. That placed the Windows PC maker in 4th place with a 9.1 percent share of the U.S. market. Behind them was Acer, who saw growth decline more than 25 percent as consumers stopped buying its low-cost and cumbersome notebooks in favor of multimedia tablets like Apple's iPad.

Overall, HP topped the list of U.S. PC makers for the second quarter, shipping 4.692 million units (-0.6 percent growth) for a 2.63 percent share. It was followed by Dell, whose growth declined by a little more than 10 percent to 3.959 million units and a 22.2 percent share.

Meanwhile, rival market research firm Gartner reported for the first time in recent memory the same U.S. market share figure for Apple of 10.7 percent, but offered different figures to support the claim. In particular, Gartner said Apple shipped only 1.814 million systems stateside during the second quarter, representing just 8.5 percent growth compared to its 1.671 million actual shipments during the year ago quarter.

Both sets of figures are preliminary estimates and neither factor iPad sales into the mix.

Worldwide, both IDC and Gartner's numbers suggest that Apple could crack the global top 5 soon. Both estimates show Asus with between 4.4 million and 4.5 million total units shipped. Last quarter, Apple reported total Mac shipments of 3.76 million, and sales continue to grow consistently.

In the worldwide market, Gartner's estimates show HP to retain its crown as the market share leader, accounting for 17.4 percent of total global PC shipments in the second quarter of 2011. HP performed better than average in most regions, but was pulled down by a poor showing in the Asia/Pacific region. It shipped an estimated 14.9 million units in the quarter.

Dell took second place with 12.5 percent worldwide on estimated shipments of 10.6 million units, followed by Lenovo (12 percent, 10.2 million), Acer (10.9 percent, 9.3 million), Asus (5.2 percent, 4.5 million), and Toshiba (5.2 percent, 4.4 million).

Gartner found that the global PC market grew 2.3 percent in the quarter, and everyone except Acer and Toshiba saw market gains. Acer continued to drop precipitously as netbook sales wane, sliding 20.4 percent year over year.

"After strong growth in shipments of consumer PCs for four years, driven by strong demand for mini-notebooks and low-priced consumer notebooks, the market is shifting to modest, but steady growth," said Mikako Kitagawa, principal analyst at Gartner. "The slow overall growth indicates that the PC market is still in a period of adjustment, which began in the second half of 2010."

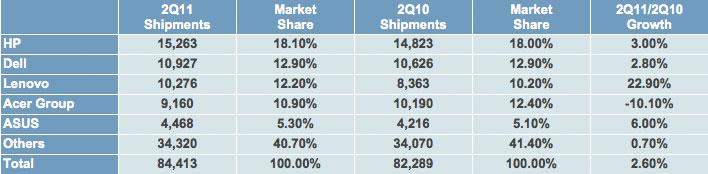

IDC's estimates paint a similar picture, with HP atop the market taking an 18.1 percent total share. The Windows PC maker is estimated to have shipped 15.2 million units in the second quarter of 2011.

Again in second was Dell, with a 12.9 percent share and 10.9 million units estimated shipped. Lenovo took third with 12.2 percent and 10.3 million, followed by Acer with 10.9 percent on 9.2 million units, and Asus with 5.3 percent on 4.5 million units.

IDC found that the global PC market grew an estimated 2.6 percent year over year in the second quarter of 2011. The greatest market share gainer in the top 5 was Lenovo, which saw a sales increase of 22.9 percent from 2010. Acer again saw the greatest losses in the three-month frame, sliding 10.1 percent.

"These preliminary results continue to reflect pressure from competing consumer and business products as well as cautious spending," said Jay Chou, senior research analyst with IDC's Worldwide Quarterly PC Tracker. "Nevertheless, product refreshes and promotions in the second half of the year as well as easier year-ago data should boost growth in the second half of the year."

AppleInsider Staff

AppleInsider Staff

Malcolm Owen

Malcolm Owen

William Gallagher and Mike Wuerthele

William Gallagher and Mike Wuerthele

Christine McKee

Christine McKee

William Gallagher

William Gallagher

Marko Zivkovic

Marko Zivkovic