In addition to outselling a broad and combined range of Windows Mobile handsets, Apple's iPhone 3G is being credited this week as the lone force responsible for growth of the smartphone market during the September quarter.

In a report issued Tuesday, Needham & Co. noted that worldwide smartphone shipments increased 28.6% during the three-month period ending September, boosting the multi-function handsets' share of the overall mobile phone market to 13.8%, up from 12.2% in June and 11.2% a year ago.

"Apple’s iPhone 3G, introduced in July, is the only reason smartphone growth did not slow in September," explained analyst Charles Wolf. "Apple shipped almost seven million iPhones in the quarter, accounting for all of the sequential shipment growth in the quarter and then some."

That said, Wolf acknowledged that 2 million of those near 7 million iPhones represented shipped, but unsold, channel inventory. Without this excess inventory fill, "sales growth would undoubtedly have decelerated in September," he said, adding that he believes December quarter smartphone growth may ultimately produce disappointing growth numbers as a result.

Even if iPhone sales decline along with overall smartphone shipments during the December quarter, Wolf said the competitive dynamics of the smartphone market suggests the Apple handset won't be a one-quarter wonder as feared by some industry watchers. That's largely in part because the iPhone, along with Research in Motion's BlackBerry offerings, are winning the battle of business models in the market through their tightly integrated ecosystems of hardware and software.

By contrast, "Windows Mobile, Android and now Symbian are relying on handset manufacturers to integrate these operating systems with smartphones of their own design," he said. "The September shipment numbers indicate that the BlackBerry/Apple model is clearly winning at this stage of the conflict."

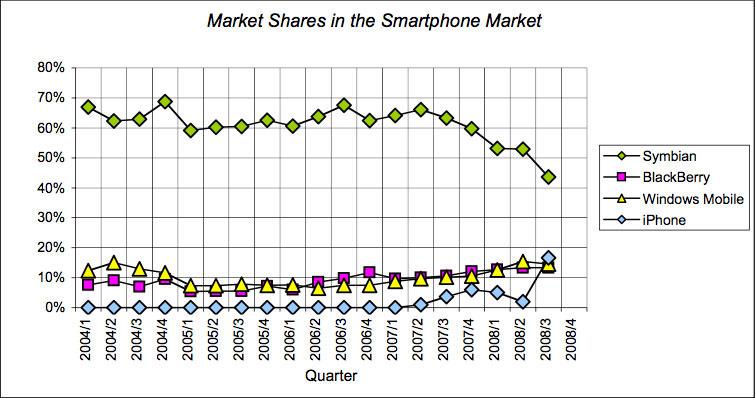

For example, Wolf points out that both Apple and RIM shipped more units than Windows Mobile despite the fact that over 30 handset manufacturers license the Microsoft operating system. Meanwhile, he notes that Symbian’s dominance began to fade during the past year, first with a surge in BlackBerry sales and next with the introduction of the iPhone.

"Together, BlackBerry and the iPhone captured 31.1% of the smartphone market in September, up from 14.3% a year ago," he said. "Symbian is likely to face further competitive pressures going forward when many of the industry’s leaders introduce phones running on Google’s Android platform."

And while it's too early to predict who will emerge victorious in the battle between Apple and RIM, the Needham analyst pointed to one metric that can often prove telling because it translates into a stream of upgrades down the road: new activations.

"On this metric, the iPhone won the activation game hands down," he said.

During its August quarter, RIM sold 6.13 million BlackBerries, of which 3.52 million were upgrade sales while 2.61 million were new activations. On the other hand, Apple's exclusive US wireless carrier activated 2.4 million iPhone 3Gs during a similar time period, in addition to approximately 2.49 million activations internationally. [Editor's note: this logic may be misleading given that many new iPhone 3G activations were the result of upgrades from the original iPhone.]

"Worldwide iPhone activations, then, totaled 4.9 million phones," Wolf said. "This was almost twice the number of phones BlackBerry activated in RIM’s August quarter."

-xl-s.jpg)