While some investors are concerned about Apple's reduced margins in the face of multiple new product launches, one analyst has noted that Apple's margins previously took a hit following the iPhone 4 launch, and subsequently rebounded to new heights.

Chris Whitmore of Deutsche Bank issued a note to investors on Monday calling concern over Apple's near-term margins "overblown." He believes recent hits to the company's stock price have created a "very attractive entry point" for those looking to buy.

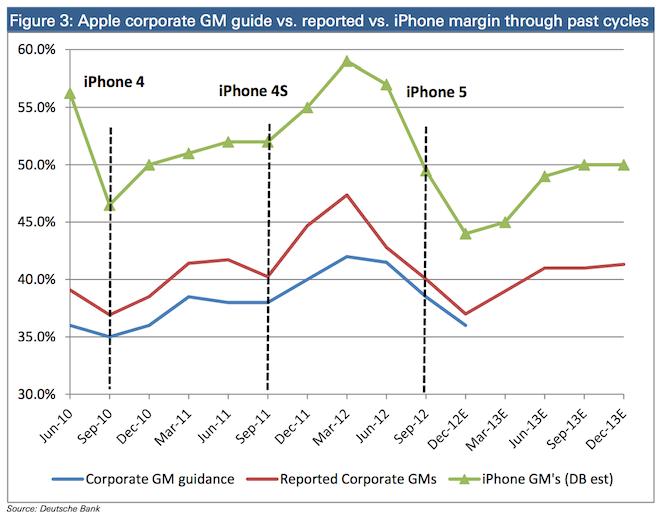

"We believe this step down in margins is nearly entirely cyclical and not structural," Whitmore wrote. "In fact, this margin step down is not without precedence. There is a striking parallel between Apple's margin outlook for the iPhone 5 ramp and the prior iPhone 4 cycle — which was the last complete iPhone overhaul."

Following the launch of the iPhone 4 in 2010, Apple's gross margins took a significant hit. Apple advised investors accordingly, guiding margins to about 35 percent, citing "higher cost structures" of the newly launched iPhone 4 and iPad.

But Apple's margins also began to rebound almost immediately in the following quarter as production of the iPhone 4 began to ramp up.

Like with the launch of the iPhone 4 in 2010, Whitmore believes Apple's gross margins will only dip for a single quarter. He also noted that the company typically beats its own margin guidance by between 2 and 4 percentage points. As such, he believes there is "a healthy amount of conservatism" in Apple's margin guidance for the first quarter of fiscal 2013.

Whitmore joins a long list of analysts who have advised investors to stand by Apple in the face of shrinking margins. Apple officials have said they expect the company's margins to improve once production of its new products, namely the iPhone 5 and iPad mini, is streamlined.