After reaching a record high in September, Apple stock has suffered nearly eight straight weeks of losses as investors bail out ahead of potential capital gains tax hikes that could hit as early as next year.

Editor's Note:This article has been modified to reflect the expected 2013 reversion to the 20 percent U.S. capital gains tax of 2003. This article incorrectly stated that the rate would increase to 35 percent.

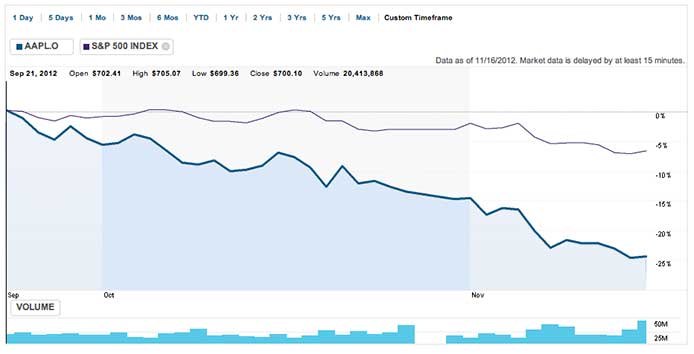

As noted by Reuters, AAPL stock has lost a quarter of its value, underperforming the S&P 500 average which saw a 7 percent decline over the same period.

Since its mid-September high of $705.07, the stock dropped precipitously and closed Friday at $527.68, losing some $170 billion in market capitalization. The publication pointed out that the market cap dropped is worth more than the entirety of Coca-Cola.

With a market value of around $493 billion, Apple still stands as the most valuable company in the world and leads second-place U.S. stock Exxon by about $100 billion.

The stock's fall may be attributed to a dumping of assets as investors prepare for a likely rise in capital gains and dividends taxes as part of a program to cut the U.S. deficit. Also part of the supposed deal is a round of government spending cuts, however high-income taxpayers are expected to take the brunt of the increases.

Because of Apple's meteoric rise, investors could be looking to sell the stock now to protect against the feared capital gains tax bumps by locking in earnings to offset the higher rates next year. The current 15 percent tax on dividends and capital gains is scheduled to reset by the end of the year, and will change to the 35 percent rate levied on normal income.

It appears that uncertainty over how the government will handle the so-called fiscal cliff is dissuading investors from picking up Apple stock at its current relatively undervalued price.

Once legislators decide on a future plan and the U.S. fiscal outlook is solidified, Apple shares are likely to start gaining traction once again, as many analysts still see the stock as being worth between $700 to $850.