Apple is paying its shareholders another quarterly dividend on Thursday, but spending about $110 million less because it has bought back and retired 36 million shares over the June quarter.

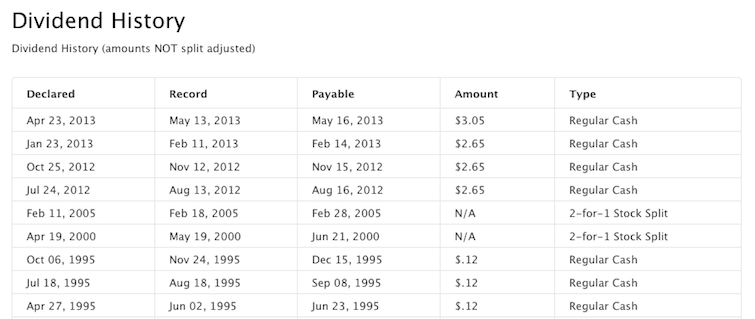

Source: Apple

There are now 908.44 million outstanding shares in the company, meaning Apple will be distributing a total of $2.77 billion. Shareholders "of record" by the ex-dividend date last week will be paid $3.05 per share.

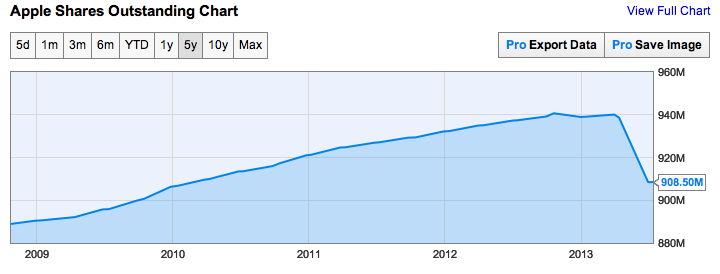

Apple's stock buyback program spent $16 billion over the last quarter buying 36 million shares off the market at an average price of $444.44. As of the end of June, Apple still had $44 billion left to invest in itself under the current program over the next two and a half years.

Source: Ycharts.com

Flush with billions in cash it simply can't spend fast enough, Apple first announced plans for a dividend program a year ago last March, alongside a $10 billion share buyback program. It was the first time the company had paid a dividend in 17 years. Each quarter, the company initially stated it would pay its shareholders a $2.65 per share dividend.

In an earnings conference call earlier this year, the company's chief executive Tim Cook announced that, after paying out more than $10 billion over the previous year in dividends, the company would launch "an aggressive plan that more than doubles the size of the [existing] capital return program."

Cook said "the vast majority of our incremental cash return will be in the form of share repurchases," explaining that "as the Board and management team deliberated among the various alternatives to returning cash, we concluded that investing in Apple was the best. In addition to share repurchases, we are increasing our current dividend by 15% to further appeal to investors seeking yield."

He added, "while we continue to generate cash in excess of our needs to operate the business, invest in our future and maintain flexibility to take advantage of strategic opportunities, we remain firmly committed to our objective of delivering attractive returns to shareholders through both our business performance and the return of capital."

A report by the Dividend Daily stated that Apple's dividend program has attracted new retail investors, noting that "retailer investors are pouring money into tech giant Apple Inc. than ever before."

The report cited consumer-oriented brokerage firm TD Ameritrade as saying that "more of its clients own Apple shares now than at any other point," making Apple shares the second most widely held stock by its clients after General Electric in share count, and by far the most widely held in terms of dollar value.

Can't spend fast enough to make a dent

Over the next three years, Cook outlined that Apple's newly expanded buyback and dividend plans will distribute $100 billion from its cash pile, leveraging debt markets to borrow at very low interest against the company's vast holdings that are mostly held overseas. That allows the company to make use of its stellar credit rating and avoid massive taxes that would be triggered if it were to simply shift cash earned internationally into the U.S.

While this has triggered reports vilifying Apple for "avoiding" taxes, the company is actually "one of the top corporate income tax payers in the country, if not the largest," notes Steve Dowling, Apple's head of public relations.

In 2012, Apple paid $6 billion in federal corporate income taxes, which amounts to 1 out of every 40 dollars in corporate income taxes collected by the U.S. government Dowling told Bloomberg.

In 2012, "Apple paid $6B in federal corporate income taxes: 1/40th of all corporate income taxes collected by the US" bloomberg.com/news/2013-05-0…

— Daniel Eran Dilger (@DanielEran) May 3, 2013

Apple continues to earn new cash faster than it is paying out in dividends and stock buybacks; even with its $10 billion in quarterly dividend payments over the past year and $10 billion in buybacks, Apple's cash hoard has grown to more than $146.6 billion by the end of June, the company's third fiscal quarter. Apple will continue paying the now slightly higher quarterly dividends about a month and a half after the end of each subsequent quarter, and reevaluate its dividend payments on an annual basis.

A dividend equivalent will also be paid to holders of Apple's restricted shares, although Cook declined to collect dividend payments for the 1.125 million shares of restricted stock he has been granted, which would otherwise be worth over $75 million.

The company's current dividend payment rate is quite modest when compared to its current and future cash position. At the same time, Apple's nearly $3 billion in quarterly dividend payments makes it one of the highest dividend payers in the world.