Struggling Canadian smartphone manufacturer BlackBerry announced on Monday that it has agreed to a $4.7 billion deal that will see it acquired by a group led by Fairfax Financial.

The announcement came early on Monday afternoon, with shares of the company halting trading shortly thereafter. Monday's halt marks the second time in just days that BlackBerry trades have been stopped pending big news. On Friday, BlackBerry shares were halted as the company announced 4,500 new layoffs and an expected net operating loss of more than $950 million for its second quarter.

The deal as described in BlackBerry's Letter of Intent would see Fairfax Financial Holdings paying $9 per share to each BlackBerry shareholder. Fairfax already holds about 10 percent of BlackBerry.

BlackBerry expects that diligence on the deal will be complete by November 4, 2013. During that period, the firm is required to actively solicit, receive, evaluate, and negotiate with potential other suitors in case a better offer arises.

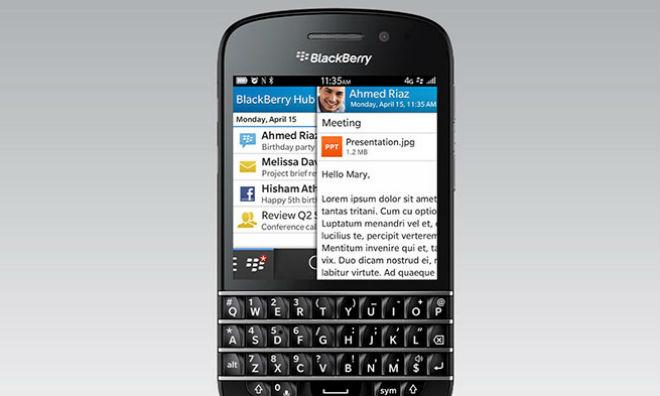

Once virtually synonymous with the idea of mobile productivity, BlackBerry was slow to react to the emergence of competition from Apple's iPhone and other devices running Google's Android operating system. The years since its peak have seen BlackBerry (née Research in Motion) plummeting both in terms of market share and revenue.

BlackBerry announced in August that it was officially putting itself up for sale.

Its most recent operating system update, BlackBerry OS 10, was meant to reverse this trend. The firm released two new high-end models to accompany BBOS 10, one with BlackBerry's signature physical keyboard and the other a touchscreen-only affair. Both are viewed largely as failures, and BlackBerry's share of mobile device sales has fallen below even that of Nokia, which was itself recently bought by Microsoft.