A new study from investment bank Piper Jaffray suggests app quality on Apple's iOS and Google's Android mobile operating systems has equalized, pushing the two tech giants toward a race for better built-in services.

In a note issued to investors on Monday, Piper Jaffray analyst Gene Munster said his checks of the top 200 paid and free apps on the iOS App Store and Google Play revealed comparable app quality and consumer experience between the two rival operating systems. As such, apps are no longer a "point of differentiation," having become an expected feature for modern smartphones.

"The app ecosystem has transitioned to where it no longer matters how many apps each OS has, but rather the satisfaction the user gets out of them," Munster writes. "Going forward we can compare where the apps were and where they currently stand from a user's perspective."

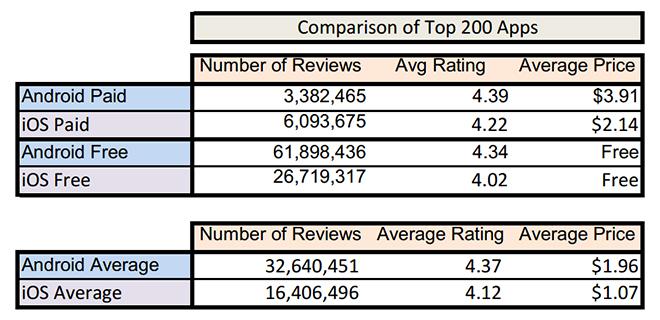

In the test, Munster compared star ratings for the top 200 apps on the iOS and Android app stores. The study found a a huge discrepancy in number of reviews for paid and free apps for each platform. Users of paid iOS apps returned 6.1 million reviews or ratings compared to 3.4 million for Android. For free apps, Android led with 61.9 million reviews, while iOS users put in 26.7 million.

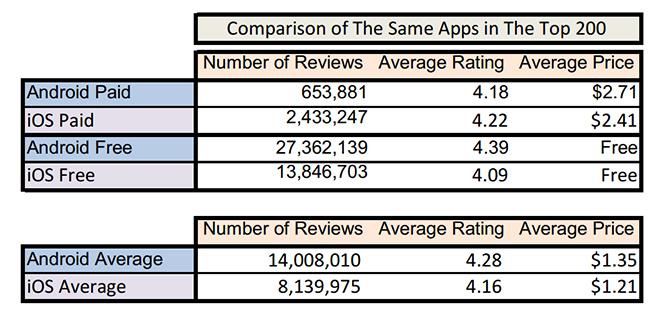

Looking at the crossover from the top 200 apps, 38 paid and 74 free titles were found on both platforms. Aggregating scores from these common apps, Android averaged a 4.28 rating, while iOS netted a similar 4.16 average.

Munster believes the data to be a result of high iOS user engagement for paid content, which suggests better returns for developers. Even so, the analyst thinks developers are creating apps for both platforms regardless of monetization opportunities. The bigger point is that customers appear to be happy with each store's content, Munster notes.

It is unclear if the study took into account the types of users who leave ratings as such feedback is an opt-in feature for both platforms.

With app parity, the new battleground, says Munster, is in value-added services like Siri and Google Now, both of which are deeply integrated into their respective platforms. Here, too, the analyst found a nearly identical experience, meaning the competition will likely extend beyond virtual digital assistants. The iPhone 5s' TouchID and Google's voice-activation feature are examples of this new front.

Munster sees 2014 as an opportunity for Apple to launch a "game changing" service in a payments platform unique to iOS, but stops short in detailing possible plans.

While mere speculation, Apple could aggressively roll out iBeacons and extend Passbook support to include credit cards. Apple executives have so far taken a "go slow" approach to so-called "e-wallets," though key hardware and software pieces are falling into place that may foreshadow a more concerted effort in the mobile payments space.