Apple is widely expected to introduce new, larger iPhone 6 models this year, after ignoring the "phablet" market for years. Somewhat ironically, it was Apple that initiated and perpetuated the trend toward larger smartphones phones while its competitors, including Samsung, worked to popularize small devices in order to "exploit" consumer preferences for phones that weren't as "monstrously large" as the iPhone, as revealed in confidential documents from the patent infringement trial.

The "Monstrously Large" iPhone 3G

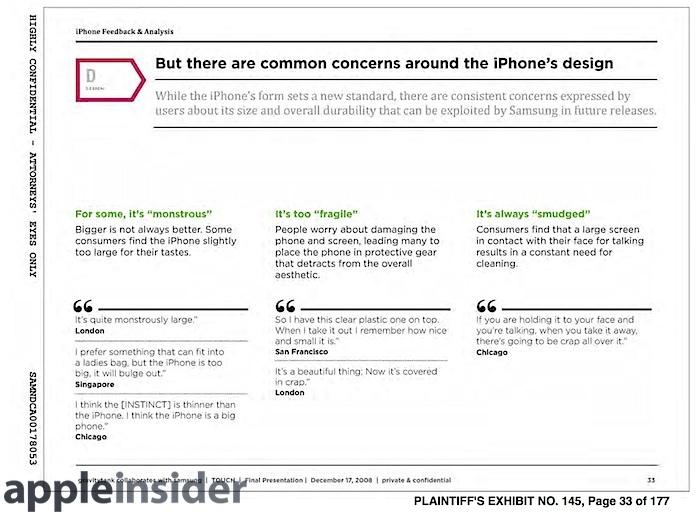

In an internal Samsung document from December 2008 (above), the company acknowledged that the form factor of Apple's 3.5 inch iPhone 3G "sets a new standard," but it referenced "concerns expressed by users about its size and overall durability," which it identified as issues "that can be exploited by Samsung in future releases."

The document cited a user in London who remarked that the original iPhone design was "quite monstrously large," and a user in Singapore who said, "I prefer something that can fit into a ladies bag, but the iPhone is too big, it will bulge out."

Today, the original 3.5 inch iPhone looks small compared to the modern 4 inch iPhone 5s, and almost tiny compared to mainstream Android flagships like Samsung's 5.1 inch Galaxy S5 and the 5.7 inch Galaxy Note 3. However, the original iPhone not only started off larger than any other mainstream phone, but also maintained a leading screen size across its first three years.

Tiny screens before iPhone: 2002-2006

In 2005, prior to any rumors of Apple's iPhone, the industry sold an estimated 825 million phones, of which IDC estimated that 57 million (fewer than 7 percent) were smartphones. Figures from Strategy Analytics and Canalys reported closer to 45 million smartphones, but everyone was in agreement that the smartphone segment of mobiles was poised for growth.

At the time, most "smartphones" featured tiny screens, due to the cost and technical issues (including battery life) associated with bigger displays. The size of phone displays was also cramped by the virtual necessity of a physical keypad.

Apple shared the same engineering challenges in developing its iPod line, which featured 2 inch screens between 2001 and 2005, when the 5th generation iPod classic grew to incorporate a 2.5 inch display. Like smartphones of the day, Apple reserved a significant portion of the face of its iPods for physical navigation buttons. Unlike the smartphone makers, Apple resolved to change this, and decisively shifted to an entirely new design for iPhone and the iPod touch in 2007.

In 2005, smartphone market leader Nokia introduced its N70 flagship with a 2.1 inch screen. Just prior to Apple's iPhone launch, Nokia unveiled the N95, with a 2.6 inch display, which like the iPod, was complemented by physical controls positioned below the screen.

Between 2002 and 2006, HTC, the primary maker of Microsoft's Windows Mobile devices, sold "Windows Smartphones" with 2.2 inch non-touchscreen displays (like the Motorola Q or Samsung BlackJack), outside of a few expensive ($999 list, $750 online) "Pocket PC" PDA-phones with 3.5 inch displays similar to the late 1990s Palm Pilots with 3.2 inch screens.

Palm sold a line of Treo phones with 2.5 to 2.7 inch screens that were actually smaller than the company's original 3.2 inch Pilot PDAs, in order to make room for a BlackBerry-like keyboard. The original Palm Pilots were effectively scaled down versions of Apple's original 6.1 inch Newton Message Pad, introduced in 1994 without a built-in, physical keyboard but at a price (like Microsoft's PocketPCs from a decade later) that could not attract a mainstream audience.

Both Palm and Windows Mobile smartphones appeared to be copying BlackBerry, which had introduced the chicklet keyboard design on its early pagers and phones, a differentiating but widely-copied feature that the company had originally derived its "berry" product name from. The popular BlackBerry Curve had a similar 2.5 inch display.

iPhone goes big as critics and competitors second-guess: 2007-2008

When Steve Jobs first unveiled Apple's iPhone at the beginning of 2007, its most shocking feature was its full-faced 3.5 inch display, which lacked any physical keypad or click-wheel. Jobs explained that the multitouch display would provide a reconfigurable interface with much more flexibility than the "lower third" keyboards that everyone else was using.

Many critics weren't convinced, including John Dvorak, who pointed to the apparent popularity of the little keyboards everyone else was using and publicly encouraged Apple to give up on the iPhone as a grave mistake before the company further embarrassed itself.

Even Google--which reacted to the iPhone's introduction by stopping its Android reference design work on a BlackBerry-like Java-based button phone in order to instead copy Apple's touchscreen design--didn't have full confidence in Apple's vision.

Initial Android phones relied on physical, slide-out keyboards and Google's own invention of an LED-backlit trackball controller for navigating the user interface, along with five other physical buttons. The first Android phone to ship, HTC's Dream (aka G1, above) in October 2008, used a smaller 3.2 inch display than Apple's iPhone in order to squeeze in Google's trackball (a differentiating feature Android has since abandoned as a mistake).

It was in this context that Samsung was asking focus groups what it should do at the end of 2008. "We tested a number of Samsung touch phones with different segments and value propositions," the company's internal research reported (below). "While people like the phones, they don't exhibit the same kind of passion and loyalty as they do with the iPhone."

Samsung's study highlighted in particular "a consumer need for size diversity," featuring (below) the compact Samsung ROXY (aka Behold), featuring a 3 inch display. "Customers especially love the compact form factor, indicating that there is consumer pushback to Apple's one-size-fits-all offering," the company's research stated.

In the document, users from around the world were cited as making comments like, "I prefer the small one [ROXY] because I can use it with one hand while walking," and "that's a real nice screen size. Being compact is important."

A Samsung study of various screen sizes evaluated by buckets of different types of users (such as "hip and trendy" or "feature maximizers") found that, across the board, users preferred larger screen sizes. Curiously, the largest screen size in the study was the 3.5 inch display of Apple's iPhone. Samsung was evaluating that against designs using 3.2 and 2.8 inch screens.

Comparing users by region, Samsung determined that the majority of Americans preferred larger (coincidentally iPhone-sized) screens, while users in some countries, particularly France and the U.K., were "more open to a smaller, slimmer phone." In the U.K., the largest number of users said they preferred a smaller 3.2 inch display over the size of the iPhone.

iPhone competitors try going smaller: 2009-2010

Samsung wasn't the only company trying to compete against Apple's iPhone with smaller screen alternatives. Palm first reacted to the iPhone in early 2009 by increasing the display of its new webOS-based Palm Pre to 3.1 inches, a display larger than the 2.7 inch Treo it replaced, but still significantly smaller than the 3.5 inch iPhone.

By the end of 2009, Palm wagered a bet on even smaller phones, introducing its compact Palm Pixi with a 2.63 inch display. After Palm was acquired by HP, its new parent company released another subcompact phone, the HP Veer, with a 2.6 inch screen in early 2011. That's only slightly larger than the 2.5 inch screen of the fifth generation iPod from 2005.

Nokia doubled down on its strategy of small screens paired with keypads in 2009 with the N86 featuring a high quality, albeit 2.6 inch screen. The company's N97 slider phone featured a 3.5 inch display, but hedged its bets with a "mini" version that used a 3.2 inch screen. Still, that model was larger than its N96 predecessor from 2008, which used a 2.8 inch display.Over its first three years, Apple's iPhone remained at the very top of the largest-screened smartphones available, despite selling in volume as a mainstream phone

In 2009, HTC released one Pocket PC phone with a 3.6 inch display, but the majority of even its niche PDA-phone offerings remained at 3.2 inches or smaller, while its mainstream Windows Smartphone products refused to grow larger than 2.4 to 2.8 inches. HTC's Android 1.x offerings throughout 2009 remained at 3.2 inches.

So over its first three years, Apple's iPhone remained at the very top of the largest-screened smartphones available, despite selling in volume as a mainstream phone. Over this period of time, Apple was working on a device with a much larger screen, but it wasn't a new iPhone: it was the iPad, released at the beginning of 2010.

Google goes big with Android 2.0: 2010

At the end of 2009, Google partnered with Motorola and Verizon Wireless in a new "Droid" branded effort to counter Apple's iPhone, which had been attracting valuable data plan customers to AT&T in a way Verizon's current BlackBerry-centric product line couldn't compete against.

Verizon launched the Motorola Droid as the first Android 2.0 phone, boasting a screen both slightly larger than iPhone, at 3.7 inches, and with a much higher resolution: 854×480 vs the original iPhone's 320x480 display.

In January 2010, Google launched its self-branded, HTC-built Nexus One, with the Droid's same 3.7 inch display but with a slightly different, 800x480 resolution. A few months later in April, HTC launched its own 3.7 inch Droid Incredible, the first HTC-branded Android phone larger than iPhone. It too had a higher resolution screen, albeit also slightly different than Motorola's at 800x480.

In June, Samsung released its Galaxy S, the first product of its intense "Crisis of Design" session (documented in the company's exhaustive 132 page CopyCat document) launched with the goal of duplicating every significant feature of iPhone 3GS, from its physical appearance to its bundled apps, even its accessories and the box it shipped in. The primary distinguishing feature of the product was a larger display, at 4.0 inches with a PenTile resolution of 800×480.

While Samsung chose to sell a larger-screened phone than Apple, it introduced a much smaller tablet: the Galaxy Tab was 7 inches, compared to Apple's iPad at 9.7 inches. Samsung, as a major vendor of displays, wasn't copying Apple's screen sizes because those sizes were in demand by its largest client: Apple. Samsung was using what was left over.

In the first half of 2010, Verizon's apparently successful initiative to abandon BlackBerry and partner with Android kicked off an ecstatic new enthusiasm around Google's platform just as all remaining hope drained away from the beleaguered iPhone alternatives from BlackBerry, Nokia, Palm and Windows Mobile, all of which had pursued strategies oriented around devices with displays smaller than Apple's iPhone because unlike Samsung, they didn't have low cost access to displays between 3.5 inches and 9.7 inches that Apple wasn't using.

Instead of releasing a phone with a bigger screen like HTC, Motorola and Samsung, Apple launched iPhone 4 that summer with the same 3.5 inch display size but equipped with a Retina Display resolution of 960×640, exactly doubling the resolution of previous iPhones for a pixel-perfect transition for existing iOS apps.

Rather than being impressed with bigger Android phone screens (and fragmented resolutions that left existing apps looking wonky), buyers overwhelmingly flocked to iPhone 4, causing Android's hype vehicle to veer off the tracks and crash before the end of 2010.

iPhone 4's impact was so tremendous that within a year, Verizon dropped its Droid campaign targeting Apple and picked up iPhone 4 in a partnership that required the development of a new CDMA version of iPhone 4 by Apple. As it had on AT&T, iPhone 4 immediately outsold all of the other smartphones Verizon had been selling, despite their larger screens.

iPad & economies of scale

One factor that appears to have helped Apple retain its lead in premium smartphones in 2010 was the parallel launch of iPad, which delivered a familiar but differentiated iOS experience as a tablet. While Google and its Android licensees pursued smartphones with moderately bigger screens, Apple developed an entirely new mobile PC form factor leveraging the same iOS, development tools and chip architecture as its iPhone.

Critics initially mocked iPad as being "just a big iPod touch" including Nintendo president Satoru Iwata who, ironically, two years later delivered a XL version of the Nintendo 3DS, differing only in screen size. Just as it had with the original iPhone, Apple's iPad selected a carefully chosen display size and resolution that enabled it to remain in the lead

However, just as it had with the original iPhone, Apple's iPad selected a carefully chosen display size and resolution that enabled it to remain in the lead, despite a flurry of size experiments performed by its competitors using their paying customers as guinea pigs.

The A4 chip Apple developed to power iPad was reused in iPhone 4, leveraging an economy of scale that helped Apple drive down its costs for both products in parallel. Even Samsung, Apple's A4 chip fabricator, continues to use a variety of different Application Processors across its product line, including Snapdragon chips designed by its direct competitor Qualcomm.

iPad also appeared to nudge Verizon away from mocking Apple with its Droid campaign to instead partner with the company to sell mobile service for the new tablet in October 2010.

The next year, Google attempted to deliver an answer to Apple's iPad in the form of Android 3.0 Honeycomb, but just as it had in smartphones, the effort was plagued by shoddy hardware, the "unstable performance" of Google's unfinished software, platform fragmentation and non-competitive pricing. Further, rather than help Android smartphones via economies of scale, Honeycomb only distracted Google's attention away from polishing either product category.

This year, Google appears set to repeat its Honeycomb mistake by jumping head-first into Android Wear on the cusp of losing over $700 million on Motorola phone experiments in just six months as its Nexus 7 tablet shipments implode. And at the same time, it's also rumored to be taking another shot at Android TV while continuing its year-old beta testing of Glass, while experimenting with robots and self driving cars. All of these hobbies are being underwritten by a collapsing ad empire rooted in the Pre-Mobile Era PC web browser.

First generation LTE drives Android phones even larger: 2011

After failing to encroach upon Apple in the high end of smartphones with larger screen sizes, Android licensees jumped to support the newly emerging 4G LTE, which promised radically faster data service. However, the initial chipsets supporting LTE technology were large and inefficient, necessitating bigger devices with larger batteries.

The upside was that such models could be sold as having even larger displays, a feature that began differentiating Android flagships from Apple's iPhone, even among models that didn't actually support LTE. Apple's Tim Cook wasn't unaware of the advantages or disadvantages of LTE. In April 2011, he told analysts, "The first generation of LTE chipsets force a lot of design compromises with the handset, and some of those we are just not willing to make." "The first generation of LTE chipsets force a lot of design compromises with the handset, and some of those we are just not willing to make" - Tim Cook

In January 2011, Motorola launched its Atrix 4G with a 4 inch screen, which would turn out to be one of the smallest premium Android devices of the year. Samsung's "smaller" Ace, a lower end 3G phone, was one of the rare new Android introductions released with a 3.5 inch screen the size of Apple's mainsteam iPhone 4.

In the other direction, HTC's Sensation boasted a 4.3 inch display, followed by an XL version with a 4.7 inch screen, although neither actually supported LTE. Samsung's Galaxy S II sequel only supported LTE on Rodger's in Canada, but it was delivered as a big phone around the world, in both 4.3 and 4.5 inch versions.

In October, Samsung launched an even larger 5.3 inch Galaxy Note device, which it bundled with a stylus and marketed as having the features of a tablet and a phone in one product. Samsung also partnered with Google to deliver the 4.65 inch Galaxy Nexus, with support for LTE on Verizon and Sprint.

Rather than following the industry to roll out a large screen iPhone with early support for LTE, Apple launched iPhone 4S, focusing attention on its new Siri assistant and its speedy new A5 chip, borrowed from iPad 2 launched at the beginning of 2011. A5 gave iPhone 4S the graphics performance to run a new class of apps and games like Infinity Blade II, which launched alongside it.

Over the next year, iPhone 4S continued to outsell Android flagships featuring both significantly larger screens and tremendously faster LTE data service. By waiting for the next generation of LTE chips, Apple could claim significant advantages in battery life in the meantime. Early Android LTE phones drew so much power that they would frequently run their batteries dead while being used as an automotive GPS, even when plugged into a car charger.

Android goes full phablet: 2012

By 2012, virtually every premium Android model had pushed toward 5 inches. In April, HTC launched its 4.7 inch One X, followed in May by Samsung's Galaxy S III at 4.8 inches to help accommodate its new six band LTE. In October the Note II grew to 5.5 inches.

That September, Apple launched iPhone 5 with a distinctively tall 4 inch display and a resolution of 1136×640, making it relatively simple for app developers to adapt their apps. Apple marketed the tall screen as being easy to navigate with one hand, an ability that Samsung's research from just four years earlier linked to the much smaller 3 inch ROXY.

Apple also differentiated iPhone 5 with a precision metal case featuring a chamfered edge design, and for the first time, support for LTE mobile service on every major carrier worldwide. Like iPhone 4 & 4S before it, iPhone 5 wildly outsold every other flagship competitor, despite being almost two years late to the LTE party and quite noticeably smaller than every other higher-end smartphone on the market.

Samsung delivered a Galaxy S III "mini" version with a 4 inch screen at the end of 2012, but that device was 3G-only and sold as a discount model. The era of anyone experimenting with modern new higher-end phones smaller than Apple's iPhone had ended quickly; even phones with screens comparable to iPhone 5 were sold only as budget models lacking the latest features.

Android Phablet find a niche, but still outsold by middle-tier iPhone 5c: 2013

Last year, Samsung ramped up its Galaxy S4 flagship to a full 5 inches, and even its "mini" version grew to 4.3 inches. The Note 3 weighed in last fall with a 5.7 inch screen.

HTC followed suit with its own One Max sporting a 5.9 inch display, while the company's One "mini" model is also now a rather large 4.3 inches.

Android licensees weren't alone in tipping the scales; last October Nokia launched its Lumia 1520 phablet with a 6.4 inch screen, a bit larger than even Apple's Newton MessagePad from twenty years earlier.

All three companies are seeing very limited sales for their big products; the majority of the phones those vendors are selling are low end models with more pedestrian features and much smaller displays, with an Average Selling Price now below $300. IDC predicts that over the next five years, both Android and Windows Phone ASPs will plummet by one third to $200, while the firm expects Apple's iPhone ASP to remain above $600.

Samsung's S5 and Note 3 are both priced at or above Apple's latest iPhone 5s, so if the company were selling similar numbers of premium phones, it would also be reporting comparable ASPs, revenues and profits, rather than announcing having sold a total batch of premium phones in 2013 that reached just two-thirds of the volume of Apple's iPhone sales and, as Android's largest licensee by far, contributed to ASP's for the platform that are half that of Apple's.

While market research companies are cheering that Samsung sold around twice as many phones as Apple, the fact that Samsung also earned half as much (despite also shipping millions of extra tablets bundled for free with many of those phones) indicates some serious problems for Apple's primary competitor.

Samsung's shipments aren't coming from big screen phones, but rather devices like the outdated, 2008-era Galaxy Y with a 3 inch, 240x320 screen, a device that Strategy Analytics Executive Director Neil Mawston cited by name as an example of the "mass-market models" he said were helping to "lift" Samsung's volumes.

Even Apple's middle-tier, 4 inch iPhone 5c, which repackaged 2012's top selling iPhone 5 in new "unapologetically plastic" case at a $100 discount, continued to outsell every other Android flagship this winter regardless of price or screen size.

In turn, Apple's top of the line iPhone 5s, which is embellished with a 64-bit A7 Application Processor and an integrated Touch ID Secure Enclave coprocessor (again sharing economies of scale with iPad Air and new iPad mini), wildly outsold the 5c in the winter quarter.

Larger iPhone 6 threatens to claim remaining premium market for iOS

This makes it extremely difficult to view screen size as a strong competitive edge for Android for very long, even if a growing proportion of Android users are attracted to larger displays. In 2012, it was impossible to argue that LTE wasn't a compelling feature; it delivered speeds easily ten times as fast as basic 3G networks (particularly before the popularity of LTE brought its effective speeds down through user saturation).

However, in both screen sizes and with LTE, Apple has been able to incrementally eat up more and more of the lucrative high end of the smartphone market. So much so, in fact, that everyone trying to make a case for Android must rely on the volumes of low end, unprofitable devices that are not used like smartphones, do not attract similar data plan subscribers and do not support the kind of demand for app development that is supporting the iOS App Store. Apple is now reported to have taken 58.7 percent of China Mobile's homegrown TD-LTE market

After having swooped up key market share among premium LTE handsets in the U.S. and Japan, Apple is now reported to have taken 58.7 percent of China Mobile's homegrown TD-LTE market.

When Apple launches larger iPhone 6 models this fall, further leveraging economies of scale with new iPads, Android and Microsoft will be pressed even harder to identify differentiating features, or forced to move even further down market, as IDC predicts.

Apple's next move might likely involve flexing its economies of scale to deliver lower priced alternatives of its own, as it did a decade ago with the iPod mini.

At that point, the iPhone market will look a lot like the iPod: game over.