The Chinese government on Thursday officially suspended rules on bank technology that have sparked the ire of the U.S. government and international businesses, and could have produced a barrier to the arrival of Apple Pay in the country.

Chinese regulators were set to implement rules that would, for instance, require companies to hand over source code and encryption keys, and undergo strict testing. In a notice obtained by the Wall Street Journal however, two groups -- the China Banking Regulatory Commission and the Ministry of Industry and Information Technology -- jointly stated that "the guidelines will be revised and perfected, after which they will be reissued for implementation."

The Chinese government has become more concerned about controlling its data infrastructure in the wake of leaks by former NSA contractor Edward Snowden, which revealed that US intellgence agencies were exploiting American-made technology to spy on China. Foreign businesses though have been worried that the new rules could let the Chinese goverment steal corporate secrets, as has been alleged in the past, and for the US government, the terms might have produced a thorn in trade relations.

Hints that the rules would be suspended emerged last month, but the change wasn't made official until today.

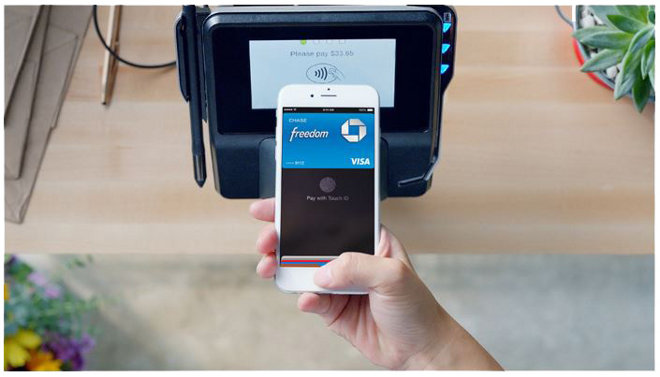

Apple is believed to be working on bringing Apple Pay to China, but might balk if it were asked to turn over code and encryption keys. In general the company has refused to expose critical areas to third parties, one exception being its participation in the National Security Agency's bulk data surveillance programs.

Even without regulatory issues, negotiations between Apple and China's state-owned card processing company UnionPay appear to have stalled. The company has moreover encountered opposition from local banks, which are reportedly hesitant to accept the relatively high fees Apple has been charging in the US. The company takes 0.15 percent of a 2 percent per-payment merchant fee, plus another half-cent per transaction.