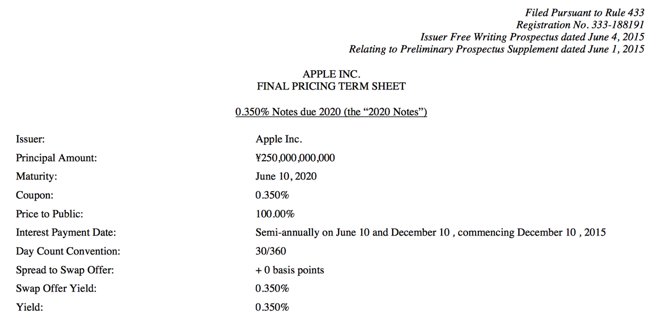

In a filing with the U.S. Securities and Exchange Commission on Thursday, Apple revealed that it has raised 250 billion yen through its first-ever Japanese bond offering, which is the equivalent of $2 billion U.S.

The bonds mature on June 10, 2020, and are managed by Goldman Sachs International and Mitsubishi UFJ Securities International. Apple's bonds are rated AA1 by Moody's Investors Service and AA+ by Standard & Poor's Ratings Services.

Bond offerings from Apple are always a hot item for investors, as the company is the most valuable in the world, and as of the end of last quarter it had a massive $194 billion in cash.

Apple's first yen-denominated bond will take advantage of Japan's extremely low interest rates. The company borrows to fund its capital return program for investors, which includes share buybacks and a quarterly dividend.

Apple's current plan calls for it to return $200 billion to shareholders by the end of March 2017.

The $2 billion Japanese bond is one of the largest in the nation's history, but Apple's offering fell short of the $2.2 billion U.S. bond issued by Citigroup in 2007.

Last November, Apple also offered its first-ever euro-denominated bond, also taking advantage of extremely low interest rates. The iPhone maker raised $3.5 billion from that bond offering.