An analyst with historically off-target guesses about Apple's hardware intentions and supply chain machinations is claiming that the "iPhone 8" will not only ship later than expected because of Touch ID supply problems, but also claims that full manufacturing won't fully ramp up until the first calendar quarter of 2018.

Jun Zhang from Rosenblatt Securities issued a note to investors on Friday, alleging that the fingerprint sensor behind the screen of the "iPhone 8" has so many problems, that there won't be enough component inventory until late in the holiday quarter to produce the device in any quantity. Correspondingly, Zhang believes that production orders have been trimmed down from between 100 million and 110 million to around 85 million iPhones for shortly after launch.

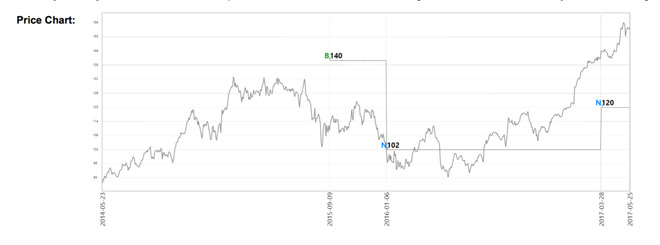

Notably, Rosenblatt Securities has maintained a $120 price target for shares of AAPL since September 6, 2016, despite the fact that the company has been trading above the $120 mark since January, and currently sits north of $150.

As a result of the supposed "delay" for the "iPhone 8," the analyst believes devices like the Huawei Mate 9 and smartphones by other unspecified Chinese manufacturers will take advantage of the situation. Zhang suggested that will lead to a situation where Apple's phone could "lose its competitiveness when the market fills up with high screen-to-body ratio smartphones and 3D glasses."

In the analyst's note, seen by AppleInsider, there appears to be little awareness of differentiation between the "iPhone 8" and the also-rumored "iPhone 7s" family device. That, or the analyst is assuming that the latter will have OLED screens and Touch ID embedded behind the glass as well -- which hasn't been said to be the case so far.

Historically, in April 2016, the same analyst said that if the iPhone 7 didn't have a "panel upgrade," then there was no other feature upgrade possible to drive demand, even though it acknowledged "camera upgrades, speaker upgrades, a home-button upgrade, and some software upgrades" were probable for the device. At the time, it had a $105 Apple stock price target, and the stock was actually priced at $104.35.

Apple saw sales of 78.3 million units in the holiday quarter -- the company's first quarter of fiscal 2017. That was an increase from the previous record, 74.8 million iPhones the company sold in the same quarter a year prior, and not a decline as predicted by Rosenblatt.

Rosenblatt continues to retain its "neutral" rating on the stock, which means that it believes the stock will be in line with the average return of others in its industry over the next 12 months.

In actuality, Apple stock has out-performed the rest of the NASDAQ. In the last year, the NASDAQ has climbed 22 percent to Friday's mid-day value of 5,787, while Apple has climbed over 50 percent in the same timeframe.