In a rare blog posting, Apple listed a series of inaccuracies in the "Paradise Papers" tax story reported by the International Consortium of Investigative Journalists, while outlining its business in Cork, Ireland; emphasizing that the company is the "largest taxpayer in the world" and repeating that it "pays every dollar it owes in every country around the world."

Apple's 6,000 employees in Cork, Ireland include customer support, sales, finance, logistics and manufacturing

'Nothing illegal,' but 'raises fresh questions' Apple is 'forced to defend'

Earlier today, AppleInsider reported, based on an article by the Guardian citing the ICIJ's Paradise Papers investigation, that Apple has "shifted a holding firm to Jersey [in the UK Channel Islands] to protect $252B from taxation."

The Guardian report specifically noted that "Apple has done nothing illegal," but in an homage to 2016 election reporting said the story is "likely to raise fresh questions for the technology company, which has been forced to defend its tax affairs."

The report also stated that Apple had "defended the new arrangements and said they had not decreased the company's tax payment anywhere in the world," adding a company statement that "the debate over Apple's taxes is not about how much we owe but where we owe it."

Irish subsidiaries moving to Jersey did not reduce tax payments

In a rebuttal titled "The facts about Apple's tax payments," the iPhone maker flatly outlined that "the changes Apple made to its corporate structure in 2015 were specially designed to preserve its tax payments to the United States, not to reduce its taxes anywhere else. No operations or investments were moved from Ireland."

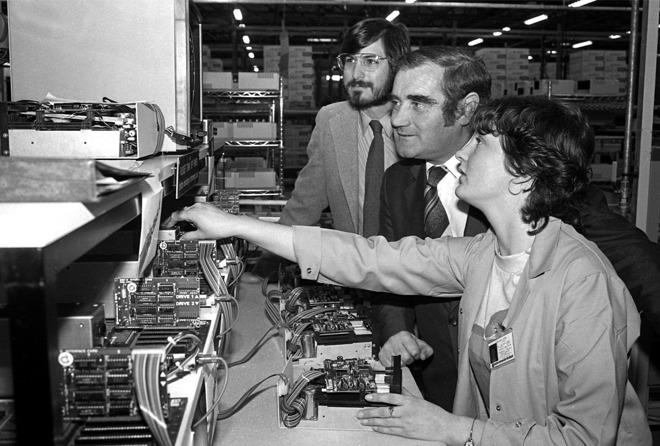

Steve Jobs' 1980 visit to Apple's new facility in Cork, Ireland

The company noted that its presence in Ireland dates back to 1980, when "Steve Jobs looked for a base to expand outside the US. The facility in Cork, Ireland started with 60 employees and now has over 6,000. Apple's innovation and investment supports a further 12,000 jobs across Ireland. And across Europe, Apple supports more than 1.5 million jobs."

It then expand upon the situation, explaining that "when Ireland changed its tax laws in 2015, we complied by changing the residency of our Irish subsidiaries and we informed Ireland, the European Commission and the United States."

Apple's statement added, "Since then, all of Apple's Irish operations have been conducted through Irish resident companies. Apple pays tax at Ireland's statutory 12.5 percent."

The changes made "did not reduce our tax payments in any country," Apple said. "In fact, our payments to Ireland increased significantly and over the last three years we've paid $1.5 billion in tax there -- 7 percent of all corporate income taxes paid in that country. Our changes also ensured that our tax obligation to the United States was not reduced."

"Apple is the largest taxpayer in the world"

The company also emphasized that rather than evading taxation anywhere, "Apple is the largest taxpayer in the world, paying over $35 billion in corporate income taxes in the last three years. Apple pays taxes in every country where we sell our products."Apple's worldwide effective tax rate is 24.6 percent, higher than average for US multinationals

It stated, "when a customer buys an Apple product outside the United States, the profit is first taxed in the country where the sale takes place," which would include local sales taxes or VAT, as well as the property taxes and payroll taxes Apple pays as part of its retail business in various countries.

"Then Apple pays taxes to Ireland, where Apple sales and distribution activity is executed by some of the 6,000 employees working there," the company stated. "Additional tax is then also due in the US when the earnings are repatriated. Apple's worldwide effective tax rate is 24.6 percent, higher than average for US multinationals."

Dispute is over who gets Apple's tax payments

Apple's statement took issue with the idea that it is "untouched by the United States," noting that it "pays billions of dollars in taxes to the US at the statutory 35 percent rate on investment income from its overseas cash." It also added that "Apple's effective tax rate on foreign earnings is 21 percent -- a figure easily calculated from public filings. This rate has been consistent for many years."

It explained that "under the current international tax system, profits are taxed based on where the value is created. The taxes Apple pays to countries around the world are based on that principle. The vast majority of the value in our products is indisputably created in the United States -- where we do our design, development, engineering work and much more -- so the majority of our taxes are owed to the US."

The European Union sought to impose higher taxes on Apple in Ireland, claiming that Irish tax law constituted "illegal state aid." However, that effort was an attempt by the EU to tax holdings that are reserved for paying taxes to the US, and the dispute was with the EU and Ireland, not a legal issue with Apple.

That effort triggered the Obama Administration's Department fo the Treasury to issue a statement of concern regarding the possibility that "any repayments ordered by the [EU] Commission will be considered foreign income taxes that are creditable against U.S. taxes owed by the companies in the United States.

"If so, the companies' U.S. tax liability would be reduced dollar for dollar by these recoveries when their offshore earnings are repatriated or treated as repatriated as part of possible U.S. tax reform. To the extent that such foreign taxes are imposed on income that should not have been attributable to the relevant Member State, that outcome is deeply troubling, as it would effectively constitute a transfer of revenue to the EU from the U.S. government and its taxpayers."

Tax reform should "ensure certainty of law for taxpayers"

Apple added, "we understand that some would like to change the tax system so multinationals' taxes are spread differently across the countries where they operate, and we know that reasonable people can have different views about how this should work in the future.

"At Apple we follow the laws, and if the system changes we will comply. We strongly support efforts from the global community toward comprehensive international tax reform and a far simpler system, and we will continue to advocate for that."

It concluded, "Apple believes comprehensive international tax reform is essential, and for many years has been advocating for simplification of the tax code. Reform that allows a free flow of capital will accelerate economic growth and support job creation. A coordinated legislative effort internationally will remove the current tug of war between countries over tax payments and ensure certainty of law for taxpayers."