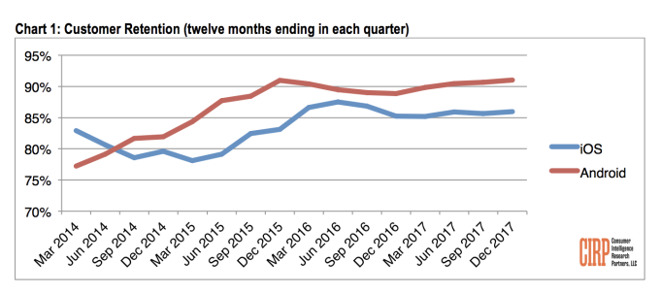

A survey by Consumer Intelligence Research Partners created headlines that Android was "beating iOS in smartphone loyalty," but the data actually shows that more Android users choose to upgrade to iOS than flow the other way and that most users tend to stick with what they've used before.

Lines on a chart

The group charted "loyalty" by platform, based on the number of people surveyed each quarter who said they'd bought a new phone, and had either stuck with the same platform or switched.

Paraphrasing the study data for TechCrunch, Sarah Perez jumped to the conclusion that "Android users just aren't switching to iPhone anymore."

That's not what CIRP reported, however. By the end of her article, Perez chose to include a citation from the group's news release by Josh Lowitz, a Partner and Co-Founder of CIRP, that contradicted her claim. The absolute number of users that switch to iOS from Android is as large or larger than the absolute number of users that switch to Android from iOS

Lowitz stated, "the absolute number of users that switch to iOS from Android is as large or larger than the absolute number of users that switch to Android from iOS," adding that "looking at absolute number of users in this way tends to support claims that iOS gains more former Android users, than Android does former iOS users."

Loyalty figures by brand indicate that the number of iPhone users who return to buy another phone from Apple is commonly far higher than the loyalty numbers among Android brands.

Data from Counterpoint Research last fall stated that in China, more than half (53.4 percent) of all iPhone buyers chose to get another iPhone while only a quarter of Oppo and Vivo buyers chose to repurchase the same brand again, and only 7.2 percent of Samsung buyers opted to get another Samsung phone.

The Loyalty of Stockholm Syndrome

The study didn't seem to make any comparisons of how often users had upgraded their phones, only asking if they'd upgraded within the quarter of a given survey. That would cause all Android users who frequently replace phones to show up more often, causing the platform to appear to be more "loyal" just because an overrepresented group keeps getting Android phones because they are available for free or are deeply discounted.

Google's Android is not loyal to its users

Most Android makers fail to provide software updates for much longer than the first year, making it common for Android buyers to keep rebuying new phones. Even Google has pulled support for its last Nexus phones with the upcoming release of Android P, and those devices were supposed to be Pure Android with the openness to allow end users to supposedly download a new Android kernel and compile it on their own, at least in the words of Google executives. Android devices had a failure rate worldwide of 25 percent - that is more than double the failure rate of iOS devices (12 percent)

Android phones also have a high hardware failure rate that would necessitate more frequent repurchasing. According to a study reported last fall by Blancco Technology Group, during the second quarter of 2017, "Android devices had a failure rate worldwide of 25 percent - that is more than double the failure rate of iOS devices (12 percent)."

Phones from Samsung were particularly bad. The group noted that the "failure rate for Samsung devices overall was 61 percent." However, Samsung buyers tend to keep buying more devices from the company, even after Galaxy Note 7 fires that were caused by rushed engineering and poor quality control.

Samsung heavily promotes its phones with steep discounts and frequent buy one, get one offers that would tend to skew loyalty statistics performed by calling a group of users and only asking if they'd bought a new phone, and if so was it the same platform as their previous one.

Surveys can provide useless data

Surveys also are not an infallible source of data from which to draw broad conclusions. In January, CIRP claimed that based on its survey of hundreds of users, iPhone 8 had outsold iPhone X over the holiday quarter.

Counterpoint Research later reported that "since its launch on Nov. 3, the iPhone X outsold the iPhone 8 and iPhone 8 Plus by a 2:1 margin. What this means is the super-premium segment (above $800) has grown from almost 0 percent in previous years to 25 percent share of the total smartphones sold in USA during Q4 2017, which speaks volumes for the potential of USA market and the U.S. consumers' buying power."

The next day Apple's chief executive Tim Cook reported in its earnings call that iPhone X was indeed the "top-selling iPhone every week since it shipped in November."

-xl-s.jpg)