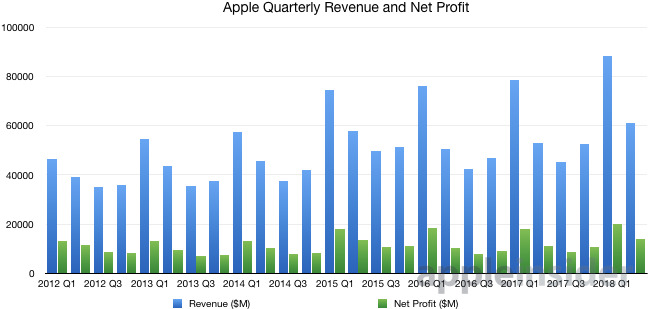

The continued impact of the iPhone X has expectedly reverberated into Apple's second financial quarter of 2017 an interesting one -- but not quite how analysts thought they would. The changes over time are best illustrated graphically, showing the magnitude of the quarter, as compared to the same quarter from of years past.

As usual, the high revenue of the first quarter buoyed by holiday sales makes the second quarter results look slightly disappointing, but it is better to compare it against the results of year-ago quarters. There is a considerable jump of $8.5 billion compared to Q2 2017, an increase of 15.6 percent.

Apple's continued growth has led to the second quarter exceeding the revenue earned in the first quarter spanning the holiday season of 2014. Apple earned more in the last quarter, which didn't see a major iPhone launch, than one that enjoyed the benefits of the flagship iPhone launches four years previously.

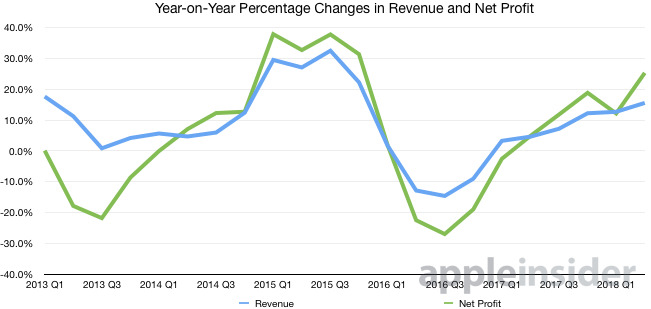

While the year-on-year revenue growth is an important part of the story, net profit growth has also spiked far higher, up 25.3 percent compared to a year ago. As the graph shows, the net profit changes tend to magnify alterations in revenue growth, with this quarter showing a considerable upward shift.

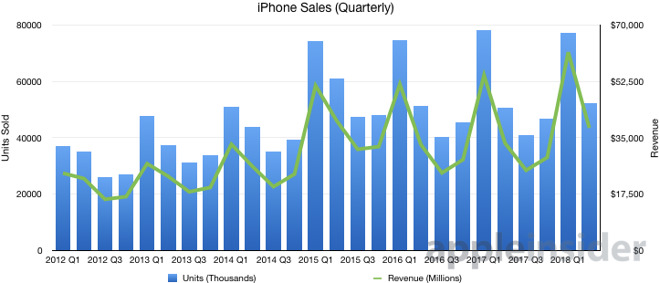

A large contributor to Apple's revenue, iPhone continues to see growth in both unit sales and earnings. Again, the unit sales of 52.2 million iPhones is higher than the 51 million achieved in Q1 2017.

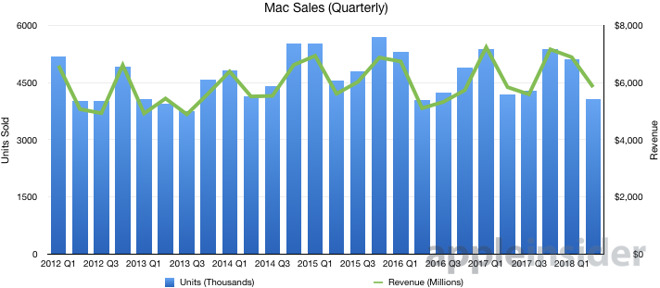

Apple's Mac business is relatively stagnant, with unit sales down 2.9 percent year-on-year. The revenue earned in the quarter of $5.8 billion is in fact up from last year by just $4 million, representing a year-on-year improvement of a mere 0.1 percent. While this isn't great news, the silver lining is that Apple is earning more per Mac sold than last year, in order to keep revenue practically the same while reducing sales.

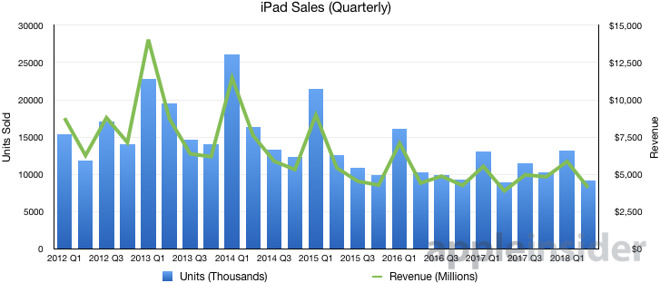

Revenue and shipments of iPads grew by 5.8 percent and 2.1 percent respectively. This does not take into account the new Apple Pencil-equipped iPad, as it launched at the end of the quarter and couldn't make much of an impact.

It will, however, be a factor in the Q3 results.

The average selling price (ASP) of the iPhone has stayed well above $700 this quarter, thanks to the sales of the premium-priced iPhone X keeping it at $728. The ASP is actually down from the $796 seen in the first quarter, which was probably affected by customers buying higher-specification models during the holiday period.

The Mac's ASP is likely to be benefiting from iMac Pro sales, pushing it up to $1434 -- a new record. The ASP for iPad is up year on year by $16, rising to $451.

The main takeaway for operating segment results is the relative closeness of Greater China and Europe as sources of revenue. Apple earned $13.8 billion from Europe in the last quarter, compared to $13.0 billion from Greater China.

Europe makes up 22.6 percent of all Apple's revenue, while Greater China contributes 21.3 percent. Given the closeness of the two segments, it is entirely plausible for China to retake second place on the list in the coming quarters.

Services is continuing to be extremely consistent in terms of its revenue, with steady year-on-year growth resulting in its highest revenue since Apple started including it in reports. The $9.1 billion earned this quarter is more than double the Services revenue reported in its first quarterly appearance in Q1 2014.

The year-on-year growth has also increased higher than normal this quarter, up by 30.5 percent. This is the second highest spike in growth for the Services business, behind the 34.4 percent reported in 2017 Q4's results.