Apple's nascent advertising business is in a good place to take advantage of the booming mobile advertising market, though the opportunity is limited because of its privacy focus, JP Morgan says.

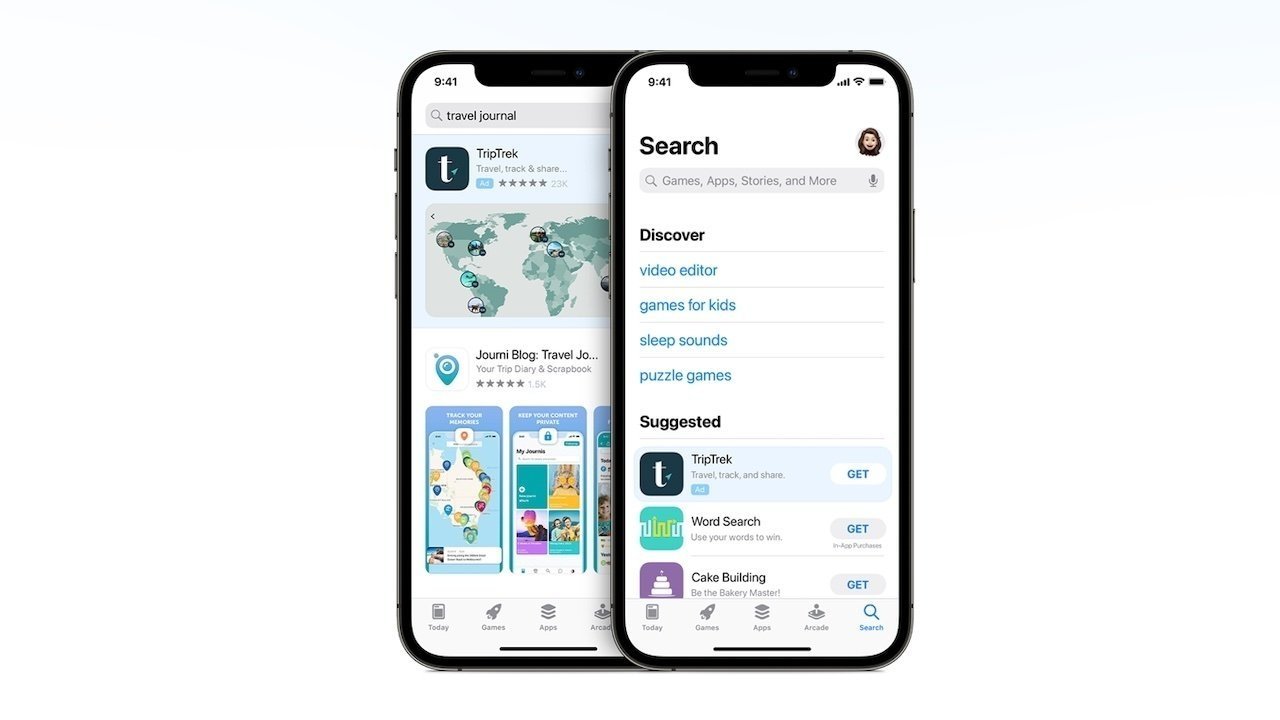

Apple Search Ads

In a note to investors seen by AppleInsider, JP Morgan lead analyst Samik Chatterjee writes that, because of Apple's installed base of 1 billion iPhone users, the company is better positioned to take advantage of the "secular trend" than other companies.

According to Chatterjee's forecast, the mobile advertising market is booming too. The total market is expected to eclipse $400 billion by 2024. Up from $288 billion in 2021. The analyst believes Apple could rake in $6 billion in revenue from mobile advertising in 2025.

The Cupertino tech giant is not an advertising company, however. Chatterjee notes that Apple's decision to only show a single Search Ad in its App Store could limit the revenue opportunity relative to his prior expectations.

Chatterjee also touches on changes to iPhone advertising made through App Tracking Transparency, which blocked cross-site and -app tracking if users enabled it. He highlights the supposed $10 billion in lost revenue that Meta cited was a result of iOS changes.

The analyst says that the change drove headwinds for incumbent advertising platforms, even though Apple has denied claims that it implemented ATT to boost its own ad business.

On the other hand, Chatterjee expects those headwinds to lead to a reallocation of advertising dollars. While not all of it will be spent on Apple Search Ads, JP Morgan believes that some of the money will end up benefitting Apple's own advertising business.

Apple has a large network to leverage for advertising purposes too. The company has 825 million paid subscriptions and an installed base of more than 1 billion.

If Apple were to implement some type of audience network allowing it to manage the logistics of ad targeting, Chatterjee believes that it could lead to a ramp up in advertising -- and Services -- revenue for the iPhone maker.

"We forecast revenues amounting to $1.7 bn by FY25, if Apple were to be willing to build an audience network of third-party applications which allow Apple to manage the logistics of ad targeting and delivering to these applications, matching demand from digital advertising customers with supply of an audience," he wrote.

Still, the largest share of advertising revenue for Apple will still come from Apple Search Ads. By 2025, Chatterjee believes the ad type will reach $4.1 billion in revenue. That number is actually limited by what he says is Apple prioritizing "consumer experience," which likely amounts the company's focus on privacy and design.

Chatterjee is maintaining his 12-month Apple of $200, based based on a price-to-earnings multiple of 30x on his 2023 earnings estimate of $6.73.