Historically, October has been the strongest month for Apple stock, and one analyst believes that trend will continue in 2012.

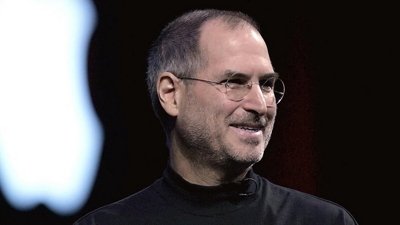

Brian White with Topeka Capital Markets likened Apple to hall of fame baseball player Reggie Jackson with the nickname "Mr. October." He noted that over the past 9 years, October has been the best month of the year to own Apple stock.

Since 2003, AAPL stock has risen by an average of 10 percent month over month. The company only saw one October where its shares slid, in 2008.

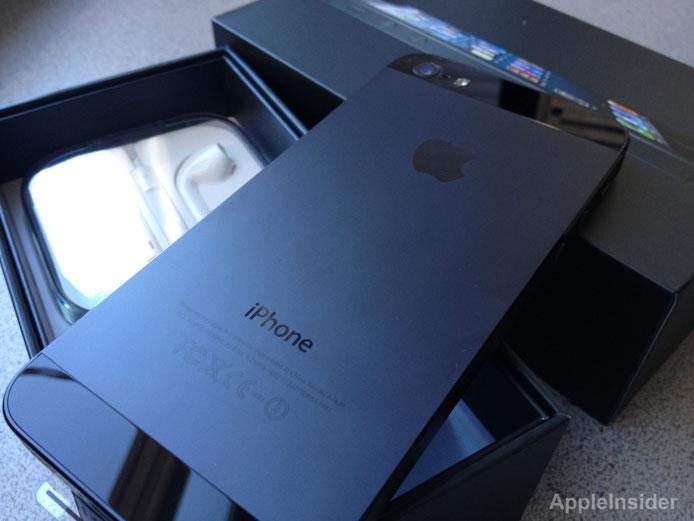

White believes this October could be even better, with strong sales of the iPhone 5 and expected new opportunities, like the rumored "iPad mini."

"In our view, the recent pullback in the stock and rising chorus of investors and/or market pundits trying to call the top in Apple is another positive indicator that sentiment has shifted and the stock is preparing to make another big leg up," he wrote in a note to investors.

White is particularly bullish on the new iPhone 5, which he said is seeing "overwhelming demand." He said that a typical iPhone launch has five phases, and Apple is only in phase two, which gives the company plenty more room to grow.

But beyond Apple's latest handset, he sees even more coming in what he called an "exciting period for Apple." That's expected to include the debut of an iPad mini this month, a new larger iPad model on the horizon in early 2013, and the likelihood of an iPhone 5 debuting with China Mobile, the largest carrier in the world.

Topeka Capital Markets has maintained a 12-month price target of $1,111 with a rating of "buy."

Neil Hughes

Neil Hughes

Christine McKee

Christine McKee

Charles Martin

Charles Martin

Mike Wuerthele

Mike Wuerthele

Marko Zivkovic

Marko Zivkovic

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

-m.jpg)

14 Comments

My analysis results in a forecast of $1,112. Why is Topeka low-balling their numbers?

My analysis results in a forecast of $1,112. Why is Topeka low-balling their numbers?

I think he's being sober, while you're in pump-and-dump territory......

I was thinking $1,112.43

It's easier to have a good October given it's had a 5% pullback since the high in late September. I'm going to guess that it ends the month (after the Oct 24 conference call) in $720 range, which would be 8% up from the 667 close on Sept 28. Of course, if the conference call disappoints then we could be back at $650.

70% of Apple profits and 50 % of its revenues come from the iPhone. The iPhone5 is selling is higher volumes than iPhone 4s, etc. However, the market probably feels with that the surge is not sustainable over time. Sales will peak on the Dec Q and sustain for another Q as foreign markets like China get the iPhone5. China Mobile could extend this surge, but Apple would have make the effort of deploying their version of LTE/TD-SCDMA. Apple played prima donna and waited too long. Even without an agreement with China Mobile they could have sold TD-SCDMA phones at full price. Now there are a bunch competitors like Lenovo, Samsung, etc. The iPad Mini could become hybrid phone/tablet and sold via carriers with a BlueTooth headset. Most people use smartphones for data with little use of voice. Sell it via carriers with a plan and subsidy. $199 anyone? Add the concerns of the fiscal cliff and investors are dumping AAPL along with the rest of the market, even at low PEs.