With Apple actively exploring potential uses for its $137 billion in cash and investments, bringing all of that money back to the U.S. would be a costly move.

About 70 percent of Apple's cash balance is held overseas, and repatriating that money would have it taxed at America's 35 percent corporate rate. As noted by analyst Amit Daryanani of RBC Capital Markets, that means bringing the money stateside would cost Apple $33 billion.

But Apple also currently has $43 billion in cash domestically, which Daryanani believes, along with another $45 billion in annual free cash flow, provides Apple enough room to return additional cash to investors.

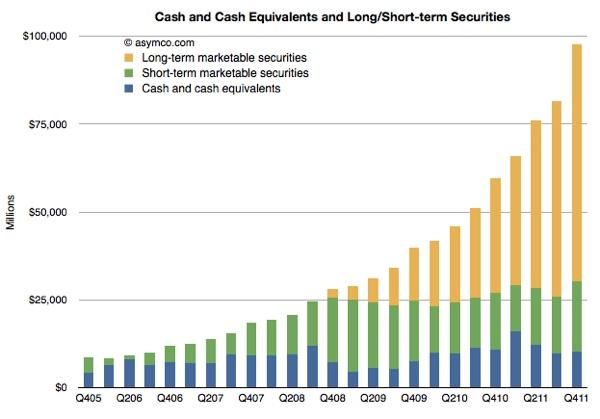

Apple added $38 billion in cash in 2012. Chart by Asymco.

Scrutiny of Apple's $137 billion in cash and investments grew considerably on Thursday after it was announced that David Einhorn, the high-profile hedge fund manager behind Greenlight Capital, has sued Apple over what he believes is a "cash problem" for the company. Einhorn believes Apple should return some of its cash to investors in the form of perpetual preferred stock with a 4 percent yield.

Apple quickly responded and reiterated that the company has been holding "active discussions" on what to do with its massive sum of cash. Apple also promised to "thoroughly evaluate" the proposal from Greenlight Capital.

The discussions suggest Apple's upcoming annual shareholder meeting could be particularly interesting, though Daryanani doesn't expect the Feb. 27 event to bring about any changes to the company's capital allocation policy.

"Given Apple's history of announcing products and changes to capital allocation policy through company specific events, we believe any change to capital allocation policy would likely occur in the March time frame after the annual shareholder meeting," he said, noting that Apple announced their dividend buyback on March 19 of last year.

Daryanani believes Greenlight's proposal would "get the stock moving upwards in the near-term." He also said that Apple has "ample cash" to fund a new, larger dividend.

RBC Capital Markets has an "outperform" rating for AAPL stock with a price target of $600. The firm believes Apple deserves to trade at a slight premium to the S&P 500.

Neil Hughes

Neil Hughes

-xl-m.jpg)

-m.jpg)

William Gallagher

William Gallagher

Malcolm Owen

Malcolm Owen

Mike Wuerthele

Mike Wuerthele

Thomas Sibilly

Thomas Sibilly

Wesley Hilliard

Wesley Hilliard

99 Comments

Here's a question: Could Apple use cash held internationally to buy back AAPL stock on foreign stock exchanges without having to pay US tax? I'm not a lawyer, but it seems like if foreign cash is being used to buy AAPL on a foreign exchange, then that cash would never come under the purview of US taxes. Yet, the benefit to stockholders would be the same as if Apple conducted a stock buy-back on an American exchange using domestic cash (because stock is fungible across borders). Is this the perfect loophole?

One thing that the analyst has missed is that Apple has already reserved cash to cover taxes for much of the money stashed overseas. So bringing it back would not affect their P&L. It would, however, affect their balance sheet. Of course, the flip side of that is that if Apple uses the cash overseas and does not repatriate it, they will get a gain by reversing the reserves.

The "perfect loophole" that would have brought money back to the US, stimulated the economy, and intern created more tax revenue without raising taxes. Didn't get elected last November.

By "costly" to Apple what you actually mean is "paying their fair share of taxes instead of hiding profits offshore." If they can't use the money because they'd have to pay some of it in taxes, they have $137 billion doing nothing and going to waste. If they bring it back to the U.S. they'll have over $100 billion that can be used. Which would you prefer, a bunch of money you can't touch, can't do anything with, and is doing nothing for you, or tons of money that can be used?

[quote name="jragosta" url="/t/155875/overseas-cash-restricts-apples-options-for-reallocating-capital#post_2273759"]One thing that the analyst has missed is that Apple has already reserved cash to cover taxes for much of the money stashed overseas. So bringing it back would not affect their P&L. It would, however, affect their balance sheet. Of course, the flip side of that is that if Apple uses the cash overseas and does not repatriate it, they will get a gain by reversing the reserves.[/quote] Yes, I was going to comment on that. In fact, they put over $14 billion away for that last quarter. This can be a confusing topic.