Apple's domination in the smartphone market compelled Canaccord Genuity to raise its price target on Apple stock to $145 on Monday, advising investors to buy in on the continued strength of the new iPhone 6, which decimated profits for competitors last quarter.

Analyst Michael Walkley of Canaccord issued a note to investors on Monday, a copy of which was provided to AppleInsider, in which he said the growing iPhone user base should help drive steady long-term sales for the company.

Apple is estimated to have dominated with 93 percent of industry profits last quarter, led by strong sales of the iPhone 6 and iPhone 6 Plus.

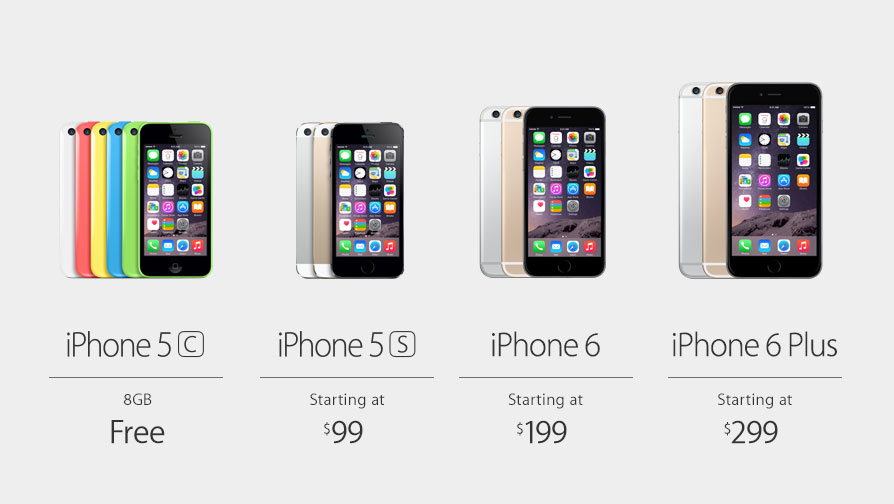

In particular, surveys conducted by Canaccord suggest that the larger displays of the iPhone 6 and iPhone 6 Plus have attracted more Android smartphone users than the iPhone 5 and iPhone 5s before them.

A larger iPhone installed base bodes well for future sales, Walkley said, as Apple has a history of retaining customers and selling upgrades. Walkley estimates that there is currently an iPhone installed base of 404 million people, of which he believes only 15 percent have upgraded to the latest-generation iPhone 6 lineup.

Beyond unit sales, Apple is also dominating the smartphone industry in profits, Walkley said. His estimates show Apple having captured 93 percent of industry profits in the December quarter — Â an accomplishment he called "remarkable."

Apple sold so many smartphones last quarter — Â 74.5 million iPhones in a record smashing holiday — that it edged past rival Samsung in terms of unit sales. But as noted by Walkley, Apple achieved this with an average selling price of $698 per handset, compared to just $206 per Samsung phone.

With Apple estimated to have taken 93 percent of industry profits, Samsung's share was at just 9 percent. The two companies once again combined for more than 100 percent profit share as all other competitors either broke even or lost money.

Canaccord's new $145 price target is an increase from its previous projection of $135. The investment firm has maintained its "buy" rating on shares of AAPL.

Neil Hughes

Neil Hughes

Andrew Orr

Andrew Orr

Amber Neely

Amber Neely

Marko Zivkovic

Marko Zivkovic

William Gallagher and Mike Wuerthele

William Gallagher and Mike Wuerthele

Mike Wuerthele

Mike Wuerthele

37 Comments

"As you can see, we currently control 93% of profits. The other 9% is currently controlled by our competitors, who we are in the process of eliminating." Or something like that. :)

Hang on... these guys aren't analysts are they? Something wrong with this picture!

Apple had better let someone start competing or there could be trouble.

These is ridiclous way of counting. If you want to know the market share of profits, you only take the ones that make profits into account. And because Samsung, LG, Lenovo and Huawei all reported profits and have together much more than 7 %, the 93% is just bulls..t

That would take us over the $1,000 per share pre split if my fuzzy math is correct. Nice :)