Buying in on hype for an anticipated 10th anniversary "iPhone 8" super-cycle, investment firm J.P. Morgan has raised its price target on shares of Apple to $165.

Analyst Rod Hall believes that Apple will sell 260 million iPhones in fiscal year 2018, up from his previous projection of 245 million. The new $165 price target is also up from a former 12-month forecast of $142 per share.

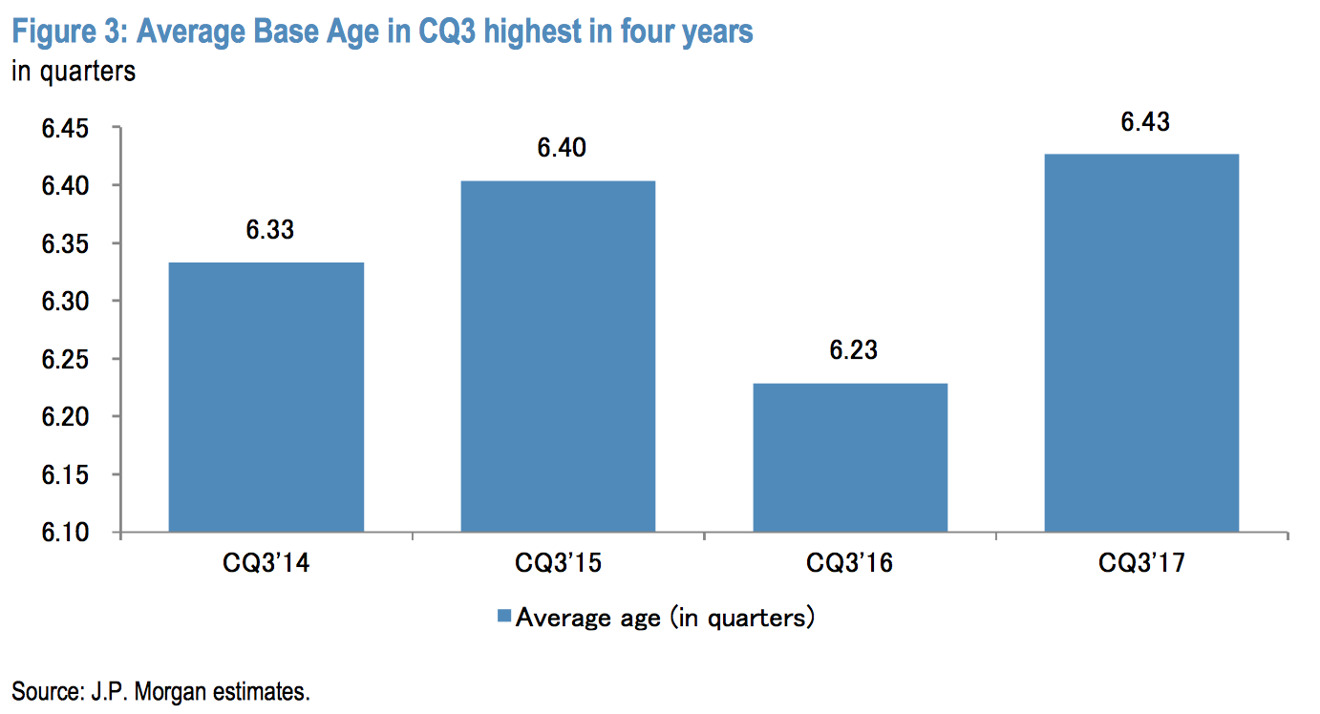

According to a proprietary replacement model developed by J.P. Morgan, the average relevant base age for an iPhone by this September will be around 6.4 quarters.

"This is the highest we have seen in four years, driven by two years of relatively weak replacement behavior on our calculations," Hall wrote.

As a result, Apple could be primed to draw in massive new upgrades with an anticipated "iPhone 8" redesign. The company is expected to introduce three new iPhone models this year, with a high-end anniversary model featuring an edge-to-edge OLED display, glass chassis, and new 3D forward facing camera system that could add biometric facial recognition and augmented reality applications.

Hall's expectations for the "iPhone 8" are largely in line with rumors, including the suggestion that the device could be priced starting at more than $1,000, making it the most expensive iPhone to date.

To him, the real challenge for Apple later this year will be whether the company can produce enough to meet consumer demand. Specifically, the new technology said to be adopted by Apple — Â OLED in particular — Â is expected to limit the company's ability to produce hardware.

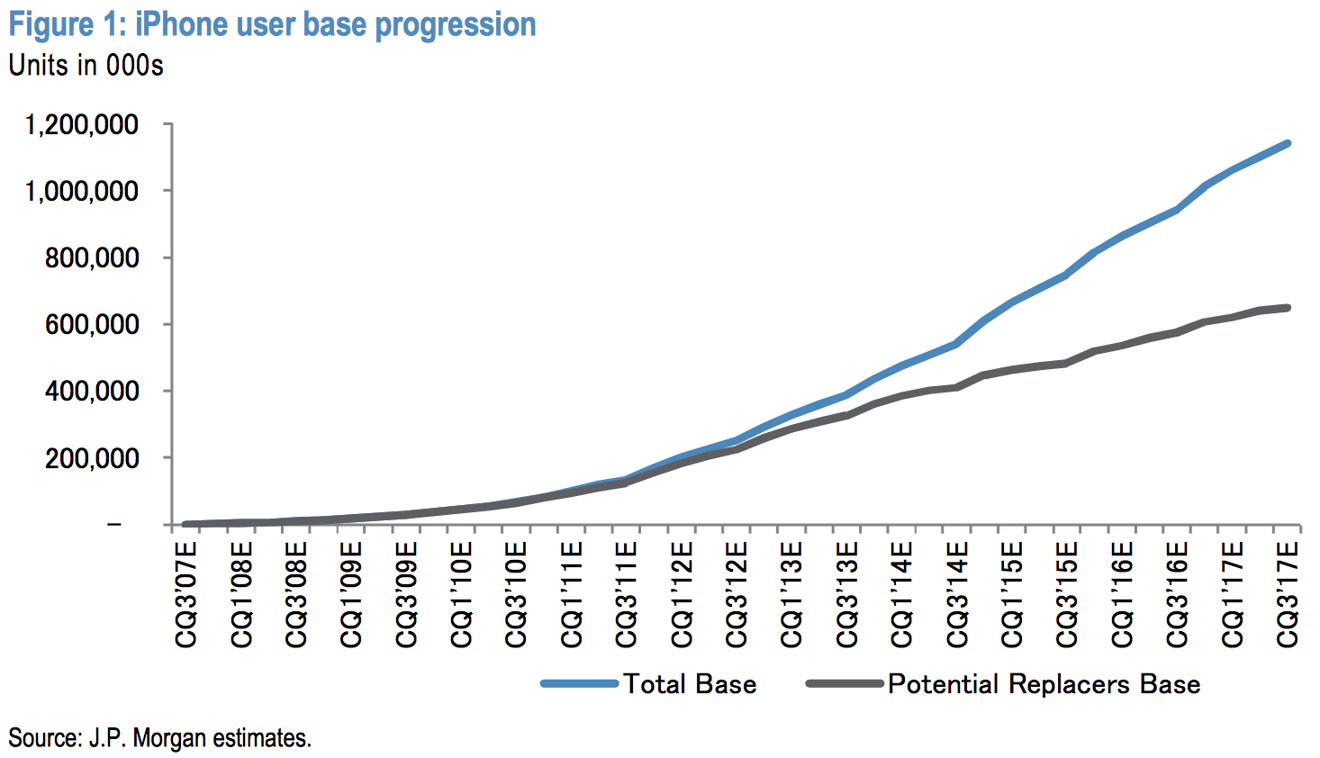

J.P. Morgan estimates suggest the iPhone user base will be 1.14 billion total handsets in use by the end of the September 2017 quarter, up from 542 million heading into the iPhone 6 cycle in late 2014. Hall estimates that first-time iPhone owners will make up 57 percent of the total base by September heading into the "iPhone 8" and "iPhone 7s" product cycle.

Neil Hughes

Neil Hughes

-m.jpg)

Amber Neely

Amber Neely

Mike Wuerthele

Mike Wuerthele

William Gallagher

William Gallagher

Andrew Orr

Andrew Orr

Wesley Hilliard

Wesley Hilliard

7 Comments

Unfortunately like all "super-cycles" it will be followed by years of "these phones all look the same as the last one" and the inevitable downturn in sales. Maybe Apple will bring out something in the Augmented reality realm by then to fill the breach?

The stock market never looks backwards. And it seldom looks ahead long term (more than one year).

I upgrade every very two years no matter what. Since I can upgrade now without too much penalty (stupid activation fees) I may go from a 7+ to an 8, I'll have to see what it offers. I'm very happy with my 7+.

260 Million? What a joke.

On top of an expanding user base (a significant portion of which is more than 2 years old), with compelling new functionality, screens and cameras, iPhone (FY2018 model) should sell at least inline with average (3 year) bi-annual growth rates.

Doing so puts iPhone unit sales during FY2018 at 279 million units.

These analysts really seem to be pushing iPhone sales expectations for Apple fairly high. What's the point? Any long-term investor will continue to hold onto Apple even if iPhone sales don't even come close to that number. That's the difference between Tesla and Apple. For Apple it takes huge numbers of units to be sold to move the stock even a little bit. With Tesla, nothing even has to be sold for the stock to climb a huge amount. Tesla has the Musk effect while Apple has the Cook effect. Completely opposite effects on the stock. Honestly, for Apple to move 260M iPhone units is almost unbelievable to me.

The thing that worries me the most is if Apple does move a humongous number of iPhones in 2017, Wall Street will claim that 2018 will be a bust year for Apple because everyone who wanted an iPhone will have already bought one. That's pretty scary. Apple had better find some new product or service for 2018. AR glasses? New streaming video services? Some refreshed desktop Macs? Apple is going to need something to build investor confidence in 2018. Every year Apple is going to have to outdo itself or Wall Street is going to start mouthing off about how Apple is losing its mojo or something just as stupid. Can any company keep growth going year after year at the revenue level Apple is at? If Apple ever does reach a $1T market cap will Wall Street start yawning the following year. Jeez. Such immense greed.