The survey, performed by Royal Bank of Canada Capital Markets analyst Mike Abramsky earlier this month after the Consumer Electronics Show in Las Vegas, indicates that buyers aren't simply attracted to tablet hardware specifications alone.

RIM's strongest card with its new PlayBook is the promise to deliver dual core CPU performance via its newly acquired QNX real time operating system. However, a major factor of the iPad's success wasn't hardware features but rather its familiarity with iPhone and iPod touch users and the third party developers building apps for it.

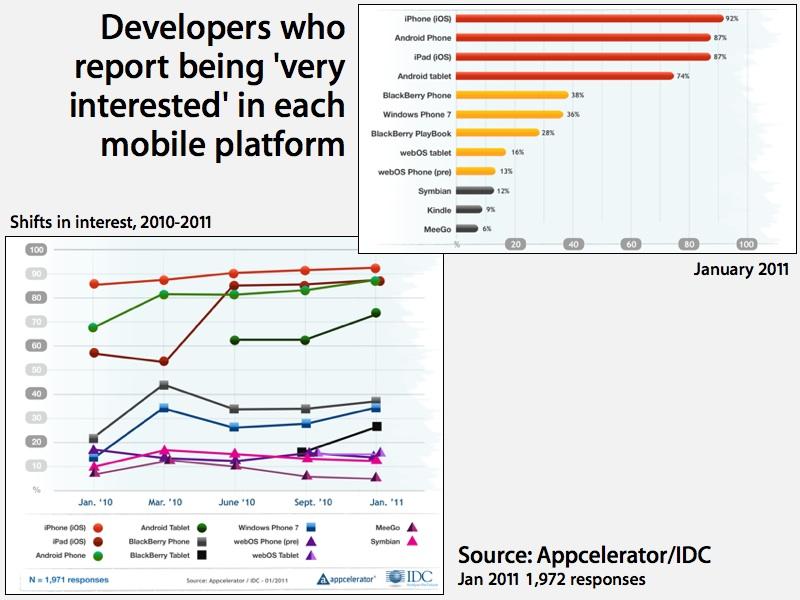

Developer interest in mobile platforms

Abramsky noted that "developer interest in PlayBook nearly doubled to 28% in January from 16% in September," citing figures compiled by Appcelerator and IDC of 2,235 mobile developers.

However, RIM's 28 percent interest figure is well behind the 74 percent who reported interest in coding for Android tablets and the 87 percent who said they were very interested in iPad.

Developer interest in iPad is equal to Android smartphones, with only the larger iPhone market reflecting greater interest among developers. Interest in the PlayBook came in below even the 38 percent who said they were very interested in the existing (and incompatible) BlackBerry OS and the 36 percent who expressed interest in Windows Phone 7.

Of all of the features that developers reported as being critical success factors for new Android tablets, 57 percent noted price of the hardware. However, RIM will be debuting its 7 inch PlayBook for the same price as Apple's full sized iPad, offering no advantage in that regard.

RBC's enthusiastic outlook for RIM

Abramsky noted that Appcelerator's developers were more likely consumer-oriented, saying, "we believe BlackBerry's popularity among enterprise developers is significantly higher." The firm expects RIM to sell 6 million PlayBooks in its first full year on the market and 4 million through the end of 2011; that's well ahead of the street consensus of 2-3 million sold in 2011.

RBC is a major investor in RIM, and the two partnered in 2008 with other Canadian investors to set up the BlackBerry Partners Fund to help foster the development new mobile applications. RBC's chief operating officer Barbaras Stymiest also sits on the RIM board of directors. The investment bank's analyst has historically taken an exuberant outlook on RIM's future prospects.

Daniel Eran Dilger

Daniel Eran Dilger

-m.jpg)

Andrew O'Hara

Andrew O'Hara

William Gallagher

William Gallagher

Andrew Orr

Andrew Orr

Mike Wuerthele

Mike Wuerthele

Bon Adamson

Bon Adamson

Marko Zivkovic

Marko Zivkovic

Wesley Hilliard

Wesley Hilliard

Amber Neely

Amber Neely

-m.jpg)

54 Comments

The PlayBook will only need a few bullets on the box it will ship in:

I think the consumer interest in the Playbook will be even lower when people realize that you have to use a Blackberry to make it useful. Even Blackberry owners aren't going to want to be locked in to RIM's double-play.

DOA, in the words of Mr. Jobs... Too little way too late.

An analyst's survey of 1,100 consumers found just 6 percent reporting they are "likely" to buy RIM's new playbook, less than half the number who said the same of Apple's iPad last February. ...

I've seen this same data trotted out around the web this morning on several sites, but it's complete nonsense if you think clearly about it. The survey purports to gauge "developer interest," with the subtext being that we can tell which platforms the developers think are better or worse or indeed likely to "take off" by examining the data. In fact however, "developer interest" in platforms/devices that aren't even on the market yet, or are so nascent that consumers haven't even had a chance to use them, really tells us nothing at all.

"Developer interest" is indeed a good gauge of what platforms are more likely to succeed, but only after they've been around and fighting it out for a while. The absolutely huge developer interest in Honeycomb tablets for instance reflects nothing more than the hopes of the developers and can't really be used in any analytical way to say anything at all.

Most of this data is essentially meaningless. It's a survey of opinion, and that opinion is just based on all the same advertising we've all seen ourselves. There's nothing to really inform it at this stage.

The PlayBook will only need a few bullets on the box it will ship in:

Please explain what part of Apple's no-flash strategy leads anyone to believe that consumers give a crap? Is it the endless developer support for Apple's platform? Or the 160Million Flash-less iOS devices sold? Or the product launches featuring people wrapped around the block, eager to get their hands on the newest device that doesn't run flash?

Nerds and apple-haters care about flash. Consumers do not.