Moody’s Investors Services noted in a report today that Apple's cash pile could reach $170 billion this year if the company doesn't change its policies regarding dividends and stock buybacks.

A report by Marketwatch cited the research note, which alarmingly warned, "unless Apple changes its philosophy towards liquidity/shareholder returns by increasing its $10 billion annual common dividend, or if Apple increases it stock buyback program, we estimate Apple’s cash balances could increase by another $35 billion in 2013 and exceed $170 billion."

Moody's profiled cash stockpiles among non-financial US corporations as amounting to $1.45 trillion at the end of 2012, more than a third of which ($556 billion) is held by tech companies.

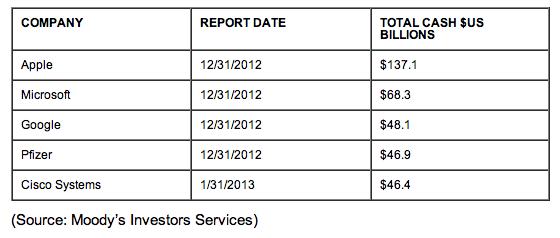

Nearly a quarter of the total ($347 billion) is being held by five companies, with Apple at the top of the list with over $137 billion. Microsoft, Google, Pfizer and Cisco round out the top five.

Apple announced plans last year to distribute $2.5 billion each quarter to shareholders as a dividend, and said it would earmark another $10 billion in stock buybacks to offset stock-based compensation. In total, this would amount to around $45 billion over the next three years.

The company has also outlined plans to invest $10 billion in 2013, including nearly $1 billion to enhance and expand its retail stores worldwide, and $9 billion in facilities and infrastructure, including data centers, new office buildings, and manufacturing equipment it will install at its partners' facilities to help guarantee a smooth supply of components.

Despite having articulated plans to put $55 billion of its cash pile to work, Apple continues to generate so much new cash flow that its assets continue to expand. Last quarter, the company added another $16 billion.

While commonly depicted as a cash "hoard," Apple's "cash" is actually conservatively invested in corporate securities (over $46 billion), US Treasury and US agency securities (over $39 billion), and other money market funds, mutual funds, municipal securities and mortgage and asset backed securities, according to the company's most recent 10-K filing.

Daniel Eran Dilger

Daniel Eran Dilger

Brian Patterson

Brian Patterson

Charles Martin

Charles Martin

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

Christine McKee

Christine McKee

Marko Zivkovic

Marko Zivkovic

34 Comments

So Apple will shortly have 1/10 of the entire cash reserves of all of corporate America (not counting finance firms). Pretty amazing - especially to those who lived through the bleak years in the late 90s.

The horrors! Warning: Apple earns more money than they can spend!

They should pay North Korea to start nuking Samsung's HQ. :D

Isn't it funny how the tone of all Apple news and blogs have changed in last few days! What was "cash" hoarding few days is now "conservatively invested"! Apple faithful! Hang in there! I think you know your company better than all these Wall Street analysts!

So basically, Apple is just barely hanging on by a thread... Or something.