A surprise tweet by Carl Icahn on Tuesday voluntarily disclosed a "large position" in Apple, but this week all institutional investment managers face a deadline for reporting their holdings of securities worth at least $100 million.

Icahn was reported by Bloomberg to now own a stake in Apple worth more than $1 billion, and cited an unnamed "person with knowledge of the purchase" in saying that Icahn had "accumulated the position over the past month."

The U.S. Securities and Exchange Commission requires large investors to report their significant holdings, but only about a month and a half after the quarter ends, as AppleInsider reported in mid-February.

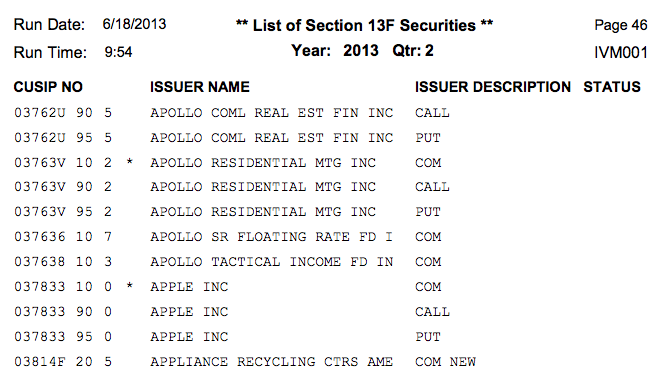

The deadline for other major institutional investment managers and investment advisers to disclose their common stock holdings and put or call options (as of the end of the June quarter), is August 15, submitted as SEC Form 13F.

Disclosures, but only every three months

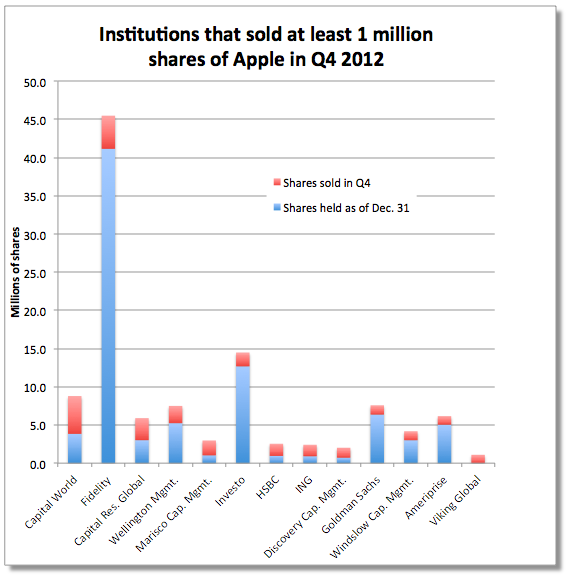

In mid-February, a series of reports (such as one by Aaron Pressman for Reuters) detailed institutional investors that had "dumped" Apple shares, even though many of the largest sellers continued to own vast holdings (below).

Pressman blamed Apple's drop on "investors worried about increasing competition and declining profit margins," and, conversely, explained that "the shares also may have dropped because their price rose too much, too fast."

He also cited an analysts as saying "three months from now, we'll be seeing a lot of the people who sold starting to pick it up again."

Three months later, there was again a steady trickle of reports of institutional investors "dumping" shares in Apple, information culled from 13F regulatory filings. This "news" was presented without context or explanation of any kind by sites such as BusinessInsider, or alternatively, occasionally framed as worthy of dire concern.

Vikas Shukla of ValueWalk wrote that Apple "continues to lose charm among shareholders," based on reports of its shares being "dumped" by several large mutual funds including "Fidenlity Contrafund" [sic].

"These sell-offs by key investors bodes trouble for the iPhone maker," wrote Meghan Foley for Wall St. CheatSheet.

Apple shares have gone up more than 10 percent since those mid-May reports first appeared, reciting as "news" information that at the time of their publication was already six weeks old.

Daniel Eran Dilger

Daniel Eran Dilger

-m.jpg)

Thomas Sibilly

Thomas Sibilly

Wesley Hilliard

Wesley Hilliard

Marko Zivkovic

Marko Zivkovic

Malcolm Owen

Malcolm Owen

Amber Neely

Amber Neely

15 Comments

I'm not surprised there is all this chatter about investing in Apple. All of the big investors with an ounce of sense know that Apple is about to launch a HUGE product rollout starting in a month. All of these big investors bought low a few weeks and months ago without telling anyone and are now ready to ride the wave up to $700+. Funny thing is that it was these same investors that depressed the price down to $400 earlier this year so that they could gobble up stocks cheap. A lot of behind the scene manipulation going on and of course Apple being somewhat predictable makes it easy for them.

There needs to be new laws with regards big stock ownership and announcement. A tweet shouldn't control a company's value when the gy who did it was one of the folks who drove the stock price down in the first place.

ValueWalk and Wall St. CheatSheet are well-known for their shoddy, thinly-researched stock coverage. That they are cited uncritically as Apple stock authorities for the purposes of THIS story tells me everything a person need know about AppleInsider...You guys cannot and should not ever be taken seriously by investors.

Carl Icahn on one side,

Larry Ellison on the other http://finance.yahoo.com/blogs/talking-numbers/ellison-apple-going-down-without-steve-jobs-175209349.html

Now, who knows Apple best?

Carl Icahn on one side,

Larry Ellison on the other http://finance.yahoo.com/blogs/talking-numbers/ellison-apple-going-down-without-steve-jobs-175209349.html

Now, who knows Apple best?

Who says he cares about AAPL? He like the rest care only about the shiny dollar and walking the grey line to get it.