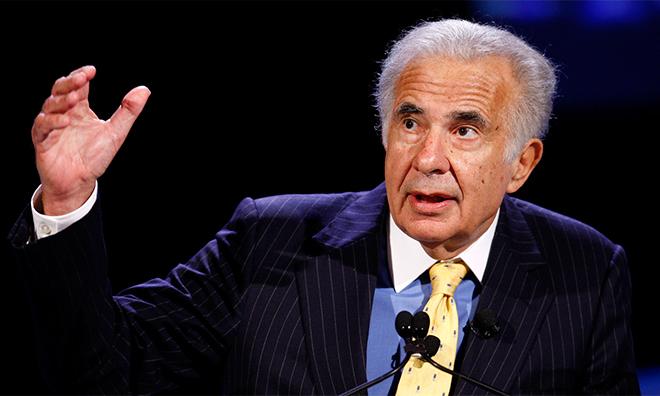

Billionaire activist investor Carl Icahn on Monday dropped efforts push for Apple to spend the bulk of its considerable sum of cash on its own shares, citing recent stock repurchases by the company as "so close" to fulfilling his original goals.

Icahn announced the repeal of his efforts in an open letter to shareholders. The backing off comes after Apple bought some $14 billion worth of its own shares in the last few weeks, marking the largest repurchase on record for such a short period.

"We see no reason to persist with our non-binding proposal, especially when the company is already so close to fulfilling our requested repurchase target," Icahn said.

Apple Chief Executive Tim Cook was "surprised" when shares in his company dropped 8 percent immediately following its quarterly earnings results. The pullback in shares of AAPL prompted the company to pounce on the opportunity in an "aggressive" fashion.

News of Apple's $14 billion investment in itself sent shares of Apple surging last week, and even earned positive comments from Icahn, who said the company's current trading price set by investors is "ridiculous." In a post to Twitter, he offered the advice, "Keep buying Tim!"

Icahn's efforts were also hurt by proxy advisory firm Institutional Shareholder Services, which issued a note On Sunday recommending that AAPL shareholders vote against his proposal. Icahn had asked shareholders to approve a $50 billion repurchase in the company's stock. Apple has spend $40 billion on shares in the past year alone.

ISS was also the second of the three major proxy advisors to recommend against Icahn's proposal, as Egan-Jones also advised investors to vote "no" last week.

Icahn's letter is republished in its entirety below:

CARL C. ICAHN767 Fifth Avenue, 47th Floor

New York, New York 10153

February 10, 2014

Dear Fellow Apple Shareholders,

While we are disappointed that last night ISS recommended against our proposal, we do not altogether disagree with their assessment and recommendation in light of recent actions taken by the company to aggressively repurchase shares in the market.

In their recommendation, ISS points out, and we agree, that "on the spectrum of options for allocating capital, the board appears to have been sluggish only in returning excess cash to shareholders," and even though the company has in place "one of the largest buybacks in history" we agree with ISS that this effort seems "like bailing with a leaky bucket" when "given the scale of the company's cash reserves."

That being said, we also agree with ISS's observation, taking into account that the company recently repurchased in "two weeks alone" $14 billion worth in shares, that "for fiscal 2014, it appears on track to repurchase at least $32 billion in shares." Our proposal, as ISS points out, "thus effectively only asks the board to spend another $18 billion on repurchases in the current year."

As Tim Cook describes them, these recent actions taken by the company to repurchase shares have been both "opportunistic" and "aggressive" and we are supportive. In light of these actions, and ISS's recommendation, we see no reason to persist with our non-binding proposal, especially when the company is already so close to fulfilling our requested repurchase target.

Furthermore, in light of Tim Cook's confirmed plan to launch new products in new categories this year (in addition to an exciting product roadmap with respect to new products in existing categories), we are extremely excited about Apple's future. Additionally, we are pleased that Tim and the board have exhibited the "opportunistic" and "aggressive" approach to share repurchases that we hoped to instill with our proposal. It is our expectation that Tim and the board continue to exhibit this behavior as fiduciaries to the shareholders since they clearly seem to agree that our company continues to be extremely undervalued, and we all share a common optimism with respect to the company's bright long term future.

Sincerely yours,

Carl C. Icahn

For more information on this and other topics, follow me on Twitter at: @Carl_C_Icahn

https://twitter.com/Carl_C_Icahn

Neil Hughes

Neil Hughes

-m.jpg)

Andrew Orr

Andrew Orr

Wesley Hilliard

Wesley Hilliard

Oliver Haslam

Oliver Haslam

Christine McKee

Christine McKee

Amber Neely

Amber Neely

101 Comments

Because yesterday's investment report said he was wrong.

So when does he start selling his stock. Its obvious now that he's not able to push his weight around in money (and stock amounts) like he's done with other companies.

Cue CNBC studio camera 1 - Icahn PR fluff "

Don't all of your posts make you look like an idiot?