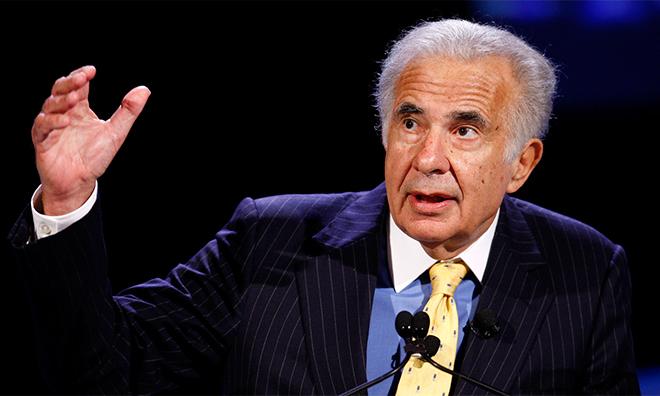

Well-known proxy advisory firm Institutional Shareholder Services on Sunday released a report recommending AAPL shareholders vote against a proposal from activist investor Carl Icahn, who wants Apple to repurchase $50 billion worth of stock.

Ahead of Apple's annual shareholders meeting coming up at the end of February, influential proxy firm ISS has issued a report suggesting against Icahn's proposed $50 billion stock buyback, reports The Wall Street Journal.

From the ISS report:

"Shareholders may wish to support the current proposal, at least in part, to signal to the board their sense of urgency about the lack of resolution on this issue of excess cash. At the same time, however, the board has taken clear and strong measures in the past two years— including establishing (and then increasing) a significant dividend, authorizing (and then increasing) a sizable share buyback, and creating a cadence of annual communication to investors about additional measures it will take."

The statement echoes one from Apple's own board of directors, which recommended against the proposal in a proxy statement issued in December, saying the company is considering its options for returning cash to investors.

Icahn has long taken a strong stance on the AAPL buyback after revealing a "large position" in the company last August. Since then, the billionaire investors has pushed hard for a buyback, going so far as to meet with CEO Tim Cook to discuss the topic. Most recently, Icahn telegraphed his intentions to raise the issue at the upcoming shareholders meeting.

The ISS was not entirely complimentary of Apple's plans, however, as the firm noted Cupertino needs a more comprehensive long-term strategy for its growing cash hoard. At the end of fiscal 2013, Apple's cash pile reached $148.6 billion, $35.5 billion of which was held in the U.S. In the intervening weeks, that number has grown to more than $159 billion.

For its part, Apple has been aggressive with its current repurchase plan. CEO Tim Cook revealed last week that Apple bought back $14 billion of its own stock over the two-week period following the company's latest earnings call. Apple is sticking to a $100 billion buyback scheduled for completion in 2015.

"It means that we are betting on Apple. It means that we are really confident on what we are doing and what we plan to do," Cook said at the time. "We're not just saying that. We're showing that with our actions."

Mikey Campbell

Mikey Campbell

-m.jpg)

Sponsored Content

Sponsored Content

William Gallagher

William Gallagher

Wesley Hilliard

Wesley Hilliard

Thomas Sibilly

Thomas Sibilly

Marko Zivkovic

Marko Zivkovic

Christine McKee

Christine McKee

51 Comments

Support the interest of long term shareholders, not the short-term shareholder, not the day trader. Vote negative and tell iCahn 'iCan't'. By the way, it appears a billion dollars can't buy you a decent haircut. [IMG ALT=""]http://forums.appleinsider.com/content/type/61/id/38266/width/350/height/700[/IMG]

Now others besides Apple and many of us are saying no to Icahn. I wonder what the Carl-acolytes have to say.

And a tear fell from Carl's eye.... aaaaaaand 'scene'.

Questionably morality and the number one question is how this can be avoided by law. Investor finds a company that is affluent in cash, buys a large portion of it (not large in percentage but if we're speaking a few billion it raises eye brows). Of course everyone knows why Icahn is doing this: To drive up the share price and sell when it's there. So what can be done to outlaw this behaviour? Anyone with deep pockets can do this. I'm just happy for now that the originally allocated buyback funds aren't entirely spent yet, so even though Apple bought stock back earlier than anticipated, lets say it was good enough an opportunity to do so. I do hope that they think twice to increase the amount of the buyback program. So far, of course it plays into Icahns hands as people would think he's the one who's steering AAPL now. Not that the buyback plan was announced in 2012 when Icahn (if at all) held little shares.

I know nothing about stocks or investing, but I've long been confused about why this Icahn guy is being treated any more special than the millions of other Apple investors out there. It sounds like he just likes being heard.