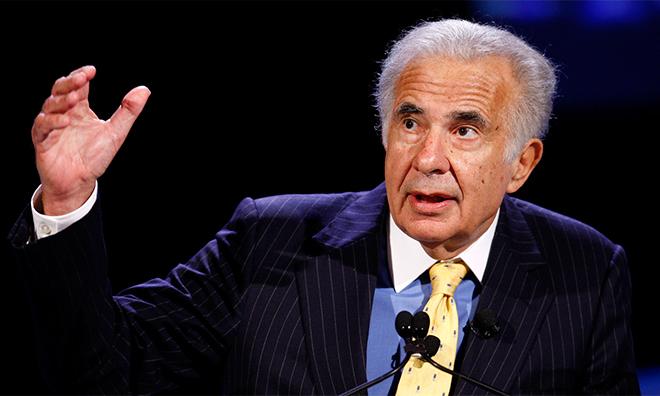

Billionaire investor Carl Icahn, who is known to use his substantial clout to steer public companies' financial policies, recently boosted his stake in Apple by 2.8 million shares worth nearly $1.65 billion.

Icahn's latest position was revealed in a Securities and Exchange Commission filing on Thursday and shows the activist investor now has more than 7.5 million AAPL shares, reports The Wall Street Journal.

At the end of trading today Apple's stock dipped to $588.82, meaning Icahn's stake in the company is worth over $4.4 billion.

The bullish buy was recorded for the March period, which came just before Apple announced a 7-to-1 stock split and share repurchase program. The board increased buyback authorization to $90 billion from a previous $60 billion, while the stock split will take place on June 2 with split-adjusted trading to commence on June 9.

In addition to the split and share buyback initiatives, Apple's board also approved an 8 percent bump to its quarterly cash dividend, bringing the figure up to $3.29 per share. That's up from the previous $3.05 per share, per quarter.

Icahn's move can be seen as a stamp of approval for the decisions made by Apple's board. The investor first revealed his "large position" in Apple last August in a tweet saying he met with CEO Tim Cook to push for a larger stock buyback to boost earnings. It was later reported that Icahn owned about $1.5 billion worth of AAPL stock at the time.

In the months following, Icahn turned up the heat on a prospective stock buyback, going so far as to file a shareholder proxy vote regarding the matter.

Following a series of additional share purchases — and an increase in Apple's repurchase program — Icahn dropped his aggressive effort, saying at the time that further actions were unnecessary given the company was "so close" to reaching his proposed target.

Mikey Campbell

Mikey Campbell

Andrew Orr

Andrew Orr

Amber Neely

Amber Neely

Marko Zivkovic

Marko Zivkovic

William Gallagher and Mike Wuerthele

William Gallagher and Mike Wuerthele

Mike Wuerthele

Mike Wuerthele

55 Comments

I was thinking he is dead. Here comes again.

As long as he's buying, I am cool with that.

Imagine that guy with his 7.5 million shares and the daily swings that he sees.

Small time investors or traders like me don't like to hold any stock and see that they're hundreds or thousands of dollars down on any given day, but if there's a typical day where AAPL is down $10, then Icahn's account would have 75 million dollars less in it than it did at the beginning of the day.

It must be nice to have that much money.

And after the split, the guy is going to own more than 50 million shares of AAPL.

[quote name="Apple ][" url="/t/179717/investor-carl-icahn-buys-another-1-65b-in-apple-stock-as-shares-head-toward-7-for-1-split#post_2534706"]Imagine that guy with his 7.5 million shares and the daily swings that he sees.[/quote] Today that is 7.5 MM x ($5.05) = ($37,875,000.00). That's a pretty big loss for [I]most[/I] people.

For guy worth 25 Billion, 75 million is a not much! It's like 30k in wealth and having $75 volatility!