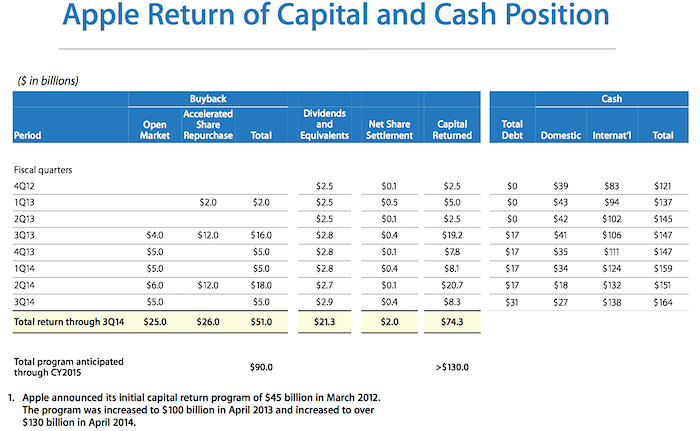

During its fiscal Q3 ending in June, Apple spent $5 billion to buy up its own stock off the market. Since the beginning of fiscal 2014, Apple has spent $28 billion to repurchase stock at average share prices between two-thirds and three-quarters of its current stock price.

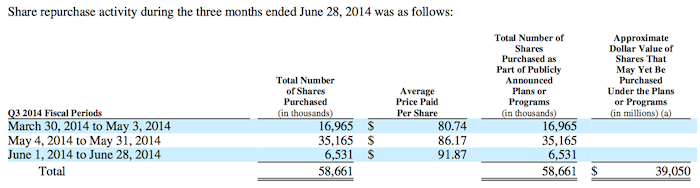

During the June quarter, Apple spent $5 billion buying back 58,661 shares at an average price of $85.23. Apple's investment partners are also continuing to to buy shares as part of the $12 billion Accelerated Share Repurchase program initiated in January, which will continue through 2014.

Apple's buyback program is not only the largest stock buyback program (setting multiple records both per quarter and in trailing twelve-month buyback activity) since the SEC enhanced the transparency of issue repurchases in 2005, but also arguably most successful program ever initiated.

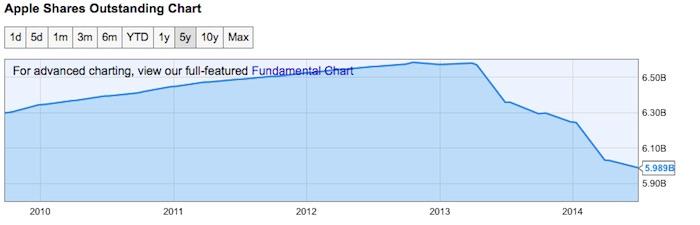

Apple's chief executive Tim Cook first announced Apple's current dividend and share buyback plan in March 2012. At the time, Apple's share price was around $85 (split adjusted).

However, by the time Apple's buyback program began at the start of fiscal 2013 (beginning in September 2012), Apple's share price began to collapse. The company's shares continued to fall and remain low throughout 2013, dipping as low as $55. That provided Apple with the perfect conditions to buy up its own stock.

Given the prevailing conditions, Apple immediately shifted from its originally conservative plan (which spent a total of $2 billion on buybacks in its first quarter) to a liberal outlay of $26 billion in calendar 2013 followed by $23 billion spent on buying up shares over the last six months of 2014.

Capt'n Cook's surreal milking of fleeing investors

Apple's establishment of a third ASR in late January helped the company to rapidly spend an incredible $14 billion on buybacks within a two week period, after industry analysts incited a stock panic that caused Apple's shares to plunge more than 8 percent following the company's Q1 release detailing its highest ever quarterly revenues and operating profits— results that the tech media depicted as "disappointing."

Apple's shares since then have since appreciated almost 25 percent, nearly reaching the company's all time high ($100.01) set in September 2012, just prior to the beginning of the buybacks. Apple shares closed today at $97.67.

The dip and subsequent recovery of Apple's share price over the last two years has enabled the company's buyback plan to effectively generate tremendous returns for its shareholders from the "massive pile of cash" that some investors had expressed concerns about not generating high enough returns.

Despite having spent $51 billion on buybacks and more than $21 billion to distribute dividends since the beginning of fiscal 2013, Apple's cash holdings have grown from $121 billion when Cook first announced the capital return program to $164 billion at the end of June. Apple's buybacks and dividends have been paid from its domestic cash holdings, as well as a $31 billion debt offering that has given the company access to capital at absurdly low interest rates, secured by its reputation anchored by massive cash holdings overseas.

Even subtracting Apple's long term debt from its cash holdings results in a net gain of $12 billion despite the $73 billion spent on capital return programs over the last two years. At the same time, Apple has produced the best selling smartphone and tablet models globally (despite efforts by its competitors to brand it as "lacking in innovation") and has increased its Mac market share as the overall PC market shrinks.

ASR, matey

To leverage the most value from its cash holdings and take full advantage of the market's irrational turn, Apple used Accelerated Share Repurchase (ASR). Under an ASR, a company buys its shares from an investment bank, which essentially shorts the stock by borrowing shares (typically from its clients) which it then delivers to the company for a fixed, upfront price.

Over the term of the ASR agreement, the investment bank then seeks to buy shares to replace those it has borrowed. Buying back shares via an ASR is usually more expensive because the bank wants to profit from the transaction. However, the slight price premium allows the company to spend a fixed amount of money rapidly and immediately reduce its outstanding share count.

While Apple fronted the money right away and retired the initial proceeds of borrowed stock, the company's banking partner continued to buy back shares over the year-long term of the agreements, resulting in windfall of 1.1 million extra shares that were delivered to Apple for retirement in the quarter when the second ASR was settled. The average share price under the second ASR in 2013 was $69.55.

Investors who sold as Apple's stock plunged in paper value overnight from $78.50 to below $72 (and then continued there through the end of January 2014) unwittingly found Apple itself to be a willing buyer of the shares they abandoned. One week into February, the company's chief executive Tim Cook revealed that Apple's executive team had jumped at the rare opportunity and spent $14 billion of its remaining buyback budget to snatch up its shares at a discount.

Following the $14 billion share grab, which included a third $12 billion ASR and an additional $2 billion in open market purchases, Apple spent an additional $4 billion in open market purchases throughout the rest of the spring quarter, resulting in the $18 billion total for fiscal Q2. Following its stock split, Apple now has 5.989 billion shares outstanding.

Apple has since continued its quarterly pace of buying back $5 billion in shares off the open market in the June quarter, and noted in SEC filings that it expects to continue, although it is not obligated to do so. Apple has another $39 billion set aside to buyback shares under its current capital return program, which is currently slated to continue through the end of calendar 2015.

Daniel Eran Dilger

Daniel Eran Dilger

-m.jpg)

Charles Martin

Charles Martin

Wesley Hilliard

Wesley Hilliard

Stephen Silver

Stephen Silver

William Gallagher

William Gallagher

Marko Zivkovic

Marko Zivkovic

47 Comments

I truly wonder if it makes sense to continue with the repurchase program at the current price (= $683.69, pre-split; all-time high is ~$705). It might have made more sense to be a bit more aggressive earlier.

Given the parity in tax rates for qualified dividends versus capital gains, a special dividend with the remaining, planned $39B (~$6.50 per share) may not be such a bad idea...

Analysts: Constant share purchases by AAPL show they have no faith in the general investor. We're downgrading the stock to Overweight from Buy status.

Wall Street is watching Cook conduct a master class in share and cash management.

Echoing anantksundaram, it is now irresponsible to continue with a linear buyback. That's the very thing bad management has historically done with its cash and has looked foolish because of it. Apple can retire all of ~6.5% if it spent the whole buyback at current prices. If it continues buying appreciating stock, the value of the buyback will diminish to something well under 5%. What the company should do instead is basically buy only if the price falls. It can't stop the stock from dropping if the market really wants that, but it can help act as a backstop if the price falls below, for example, $85 "buy this much"... below $80 "buy that much more." From here, even at $5 billion per quarter, Apple won't be able to spend $39 billion. And if it spends it near the end, it looks even more foolish if the stock is at the high end 6 quarters from now.

So is it a master class or irresponsible? :???: