Apple has begun to prepare investors for the possibility that the European Commission's ongoing investigation into Ireland's corporate tax arrangements, which the commission argues amount to illegal state aid, could force the company to suffer a significant financial loss.

"If the European Commission were to conclude against Ireland, it could require Ireland to recover from the company past taxes covering a period of up to 10 years reflective of the disallowed state aid, and such amount could be material," Apple wrote in its latest quarterly report. The warning was first noted by the Financial Times.

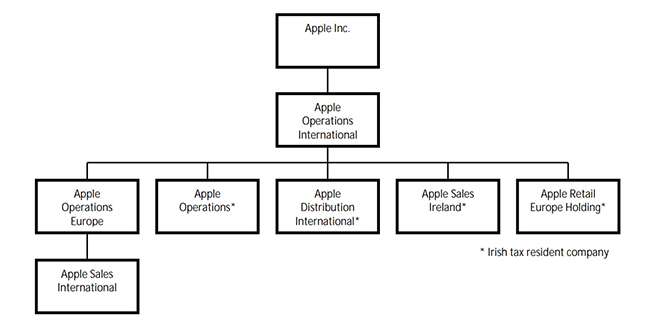

The investigation stems from accusations that Ireland — Â alongside Luxembourg and the Netherlands — Â offered sweetheart tax arrangements to large companies in exchange for setting up operations there. A preliminary report issued by the commission last year found that Ireland's 1991 and 2007 tax accords with Apple represented illegal state aid, designed to skirt market forces.

Apple is thought to have saved as much as $9 billion per year as a result of these agreements, meaning that any penalty which includes retroactive tax recovery could run into the tens of billions of dollars.

Ireland has vowed to fight any EU ruling against its tax policies, and Apple has repeatedly defended its arrangement.

"Apple is proud of its long history in Ireland and the 4,000 people we employ in Cork," the company said in a statement last year. "They serve our customers through manufacturing, tech support and other important functions. Our success in Europe and around the world is the result of hard work and innovation by our employees, not any special arrangements with the government."

"Apple has received no selective treatment from Irish officials over the years. We're subject to the same tax laws as the countless other companies who do business in Ireland."

Sam Oliver

Sam Oliver

Malcolm Owen

Malcolm Owen

Marko Zivkovic

Marko Zivkovic

Christine McKee

Christine McKee

Andrew Orr

Andrew Orr

Andrew O'Hara

Andrew O'Hara

William Gallagher

William Gallagher

Mike Wuerthele

Mike Wuerthele

-m.jpg)

52 Comments

Sam, where does the '$9B' projection come from? And, where is the backup to "tens of billions of dollars" come from?

Is that your assumption or is confirmed from any other sources?

I think the moral of this story is, do not invest in Europe, do not put money in Europe, keep your capital elsewhere in the world.

Because in Europe, the commission comes along and nails you for ten years of back taxes.

Dude, if you allow it, then allow it. If you want to change the rules going forward, change the rules.

But if you retroactively tax companies, they are not gonna keep their dough on your shores.

Tax away, but say goodbye to the lucre in the future.

That's my opinion anyway...

$9B per year is total BS.

Totally. I think these numbers are completely pulled out of the air. Unless someone shows me some analysis or proof

So perhaps this is why the stock is down again today?

This report from this past September indicated that Apple could owe about $8 billion in total, not per year.

http://www.ibtimes.com/apple-inc-could-owe-8-billion-back-taxes-eu-1697030