After recovering to $100 per share earlier this month, Apple's stock again came under downward pressure last week when the company announced that next month's Macworld Expo would be its last and that Jobs would not delivering his traditional keynote presentation.

Apple attributed the decision to end its near 25-year commitment to the annual Mac conference to a move away from trade shows in general, saying the increasing popularity of its retail stores and website enable the company to "directly reach more than a hundred million customers around the world in innovative new ways."

Some industry watchers poked fun at the decision, mocking the company in a parody press release titled "Apple Announces Last Year of Christmas," joking that while the Cupertino-based firm has been honored to work with the North Pole for the last several years, it has decided "that this is the last year for Christmas."

"Apple has been steadily scaling back on holidays in recent years, including Valentine's Day, Columbus Day, President's Day and Grandparents Day in Japan," the mock release said.

Others didn't take the announcement so lightly, like those within the Apple community who feel an exit from Macworld serves as a slap in the face to an industry that has supported the Mac maker for more than two decades, arguing that the decision could ultimately prove detrimental to the Apple ecosystem going forward.

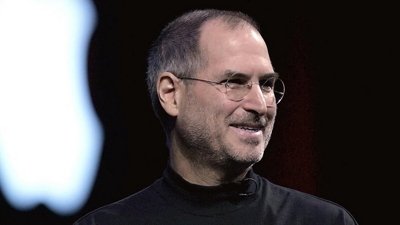

The biggest concerns came from Apple investors, however, some of which couldn't help but wonder if the move had anything to do with the health of Jobs, which has been a topic of public scrutiny ever since the cancer surviver appeared overly gaunt at this year's Apple Worldwide Developers Conference. They also question why the company waited until just three weeks before the conference to make its plans known.

In a note to clients, Kaufman Bros. analyst Shaw Wu offered his own thoughts and perspective on the situation, arguing against the notion that Apple is one man show but rather a vast family of enthusiastic professionals who share Jobs' leadership skills and penchant for innovation.

"While CEO Steve Jobs deserves a lot of credit for the revival and success of Apple and, as one of the founding fathers of technology, helping revolutionize the world with the Apple I, Apple II, Lisa, Macintosh, NeXT, Pixar, Mac OS X, the Apple Store, iTunes, iPod, and iPhone, we believe Apple today has a deep bench and its culture of innovation and execution or 'spirit' has more or less been institutionalized," he wrote.

Wu said that, in his view, Apple has an uncanny ability to attract and hire "fanatics" who are "entrepreneurial, work hard, and are looking to change the world." He believes that unlike years past, the Apple of today is not only innovative but a company with world-class operations and execution, driven by many people other than Jobs, from its senior management team down to its 32,000 individual employees.

"We believe Apple has always been an innovative company and we would like to note that most overlook that the company actually had some hit products while Mr. Jobs was not there that defined the computer industry, including the Macintosh Quadra, QuickTime, PowerMac and PowerBook, and Apple IIgs," the analyst added.

Wu maintained his Buy rating and $120 price target on shares of Apple, saying the most recent pull back in shares makes the risk-to-reward more favorable for long term investors.

Sam Oliver

Sam Oliver

-m.jpg)

Christine McKee

Christine McKee

Charles Martin

Charles Martin

Mike Wuerthele

Mike Wuerthele

Marko Zivkovic

Marko Zivkovic

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

-m.jpg)

37 Comments

While CEO Steve Jobs deserves a lot of credit..... 'spirit' has more or less been institutionalized"

Warning.... clown alert.

I think some analysts need to be institutionalized...

I think some analysts need to be institutionalized...

I agree. The Press is all about the headlines and skinny or deceptive on the facts

In a press release today, AppleInsider announced that rumor readers' favourite analyst - Shaw Wu - has taken up a position at a different firm. When asked about his move, Wu muttered something about having being institutionalized, followed by what AppleInsider thinks was a reference to the ghost of Steve Jobs.

Whether the analyst was making a forward looking statement or is privy to inside information on the Apple, Inc. CEO is not currently known.

I wonder if some of these changes are just designed to remove some of the rabid instability from Apple's stock price. It must drive the shareholders mad to see the price drop on the crazy speculation from the press, analysts and bloggers. Less Steve in the news, less events to speculate about and more products released in their own time have got to help a little.