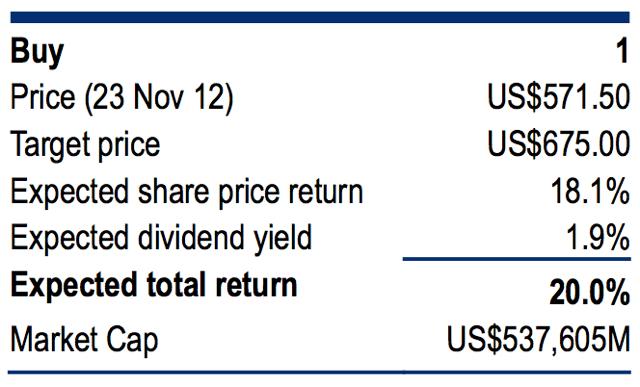

Citi Research began covering Apple stock on Monday, and kicked things off with a note to investors projecting a $675 target price with a recommendation to buy.

Citi's price target implies an expected return of about 20 percent from AAPL stock. The firm noted that shares of Apple slid 28 percent on a "correction" that began on Sept. 21, which put it in line with past corrections in its own history, as well as those of its peers.

Year-over-year growth at Apple is expected to stabilize in the first half of 2013, which Citi believes would set the company's stock on course for the $675 price target.

But that price is also 11 percent below the consensus price target for Apple on Wall Street. That's because Citi believes that the risks for Apple "are increasingly coming into focus."

"We assert that Apple's share of the smartphone market is at risk from low-end smartphones and competition from other ecosystems," they wrote. "We see upside from tablets, but this negatively impacts (gross margins)."

Rather than have a lead analyst assigned to Apple, as most other investment firms currently do, Citi has opted to take a "unique team approach" in its Apple coverage. That strategy involves semiconductor analyst Glen Yeung, software analyst Walter Pritchard, and hardware analyst Jim Suva.

"This reflects Apple's broad impact to the technology supply chain and allows us to uniquely follow the company from several industry angles," Citi explained in a note to investors on Monday.

Neil Hughes

Neil Hughes

Andrew Orr

Andrew Orr

Wesley Hilliard

Wesley Hilliard

Oliver Haslam

Oliver Haslam

Christine McKee

Christine McKee

Amber Neely

Amber Neely

22 Comments

Nope. Apple is doomed.

Analysts seemed to go slightly negative just because apple adjusted their device release schedule. This seems pretty shallow for people who study company financials for a living.

[quote name="ifij775" url="/t/154609/citi-initiates-coverage-of-apple-stock-with-buy-rating-675-target#post_2236993"]Analysts seemed to go slightly negative just because apple adjusted their device release schedule. This seems pretty shallow for people who study company financials for a living.[/quote] You think they study anything ... really? ;)

[quote name="AppleInsider" url="/t/154609/citi-initiates-coverage-of-apple-stock-with-buy-rating-675-target#post_2236979"] "We assert that Apple's share of the smartphone market is at risk from low-end smartphones and competition from other ecosystems," they wrote. "We see upside from tablets, but this negatively impacts (gross margins)." Rather than have a lead analyst assigned to Apple, as most other investment firms currently do, Citi has opted to take a "unique team approach" in its Apple coverage. That strategy involves semiconductor analyst Glen Yeung, software analyst Walter Pritchard, and hardware analyst Jim Suva. "This reflects Apple's broad impact to the technology supply chain and allows us to uniquely follow the company from several industry angles," Citi explained in a note to investors on Monday.[/quote] They should consider adding a customer-satisfaction-and-brand-loyalty analyst to their team, if they hope to ever understand and predict the success of Apple's products.

I care more that the stock price is correct, both on the homepage as well as in the forums on AI than what City has to say.