Apple's March-quarter financial results are set to be released on Tuesday, and all eyes are on what Apple will say — or won't say — about iPhone sales volumes. Here's what observers of the iPhone maker anticipate Apple will reveal.

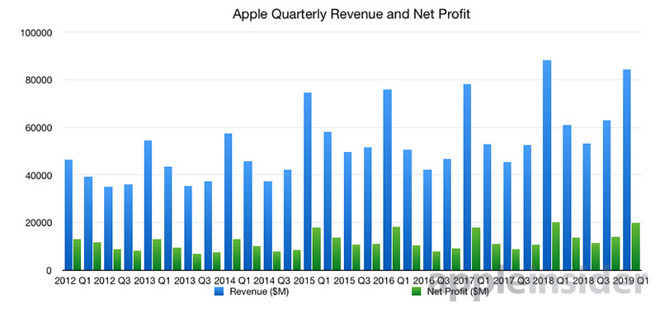

In January's results, Apple forecast revenue of between $55 billion and $59 billion for the latest quarter, with a gross margin somewhere between 37% and 38%. Operating expenses are expected to be between $8.5 billion and $8.6 billion, along with an anticipated tax rate of approximately 17% for the period.

Apple will be revealing its second quarter 2019 earnings on April 30 at the end of the business day, and will be holding a financial results conference call with analysts at 2 p.m. Pacific, 5 p.m. Eastern. AppleInsider will be reporting on the results as they are announced.

Rosenblatt Securities

Earnings are expected to reveal an "in-line F2Q quarter," according to a note from Rosenblatt Securities provided to AppleInsider, as it anticipates risks to the company will be "mainly in the second half of this calendar year." This is apparently due to a market share loss in key markets including China and Europe, which could affect matters.

The expectation that Apple will wait until 2020 for a 5G iPhone launch is also thought to weaken the shipment prospects for the 2019 models, as this may "delay the smartphone upgrade cycle in the second half of this year." Rosenblat expects total iPhone shipments to be "about 37 million in Q2.

Apple will most likely "maintain their gross margin," even with a decline in memory prices affecting production costs. "We think memory price declines in the first half will be able to offset the gross margin impacts form iPhone XR price cuts."

Loup Ventures

Expecting Apple to be the "best performing FAANG stock in 2019," Loup Ventures expects revenue to be better than the consensus of $57.6 billion with an earnings per share (EPS) of $2.37. It is expected that there will be an overall 4% revenue decline, versus the consensus belief of it being 5%, with iPhone revenue down 16% overall.

Services continues to be a big story for Loup Ventures with it anticipated to be up by at least 15% in the results. Tipped to make up 18% of revenue, the 16% decline in sales will apparently be some comfort to investors, bridging the gap into the next iPhone cycle, but only if Apple exceeds the Street's growth estimates of 15%.

"Investors are slowly shifting their focus away from the iPhone cycle and valuing the company more based on the ecosystem of hardware, software, and services," writes the firm, but warns "it will take several years for this to become consensus."

Apple is also expected to expand its share buyback scheme by $100 billion, and to increase the dividend payment by 16%, "in line with last year's changes to the program."

JP Morgan

Anticipating a mixed quarter, JP Morgan thinks Apple will have regained its groove following its January miss, with results "roughly in line" for earnings, but with a modestly softer-than-expected revenue due to a "higher mix of previous generation iPhones sold in the quarter." Revenue is tipped to be around $56.8 billion for the quarter, with an EPS of $2.35.

Shipments of iPhones could be around 41 million units in the quarter, with promising signs from supply chain sources prompting JP Morgan to raise its second quarter shipments estimate to 39 million units.

The shift to Services will face "continued scrutiny" for growth by investors, as it attempts to offset "double digit volume declines in iPhone shipments." Services is forecast for 17% growth, but with margins dipping to 59% caused by Apple's investments in soon-to-launch services like Apple TV+ and Apple Card.

A return to revenue growth in the next quarter will "demonstrate to investors the momentum in Services, Wearables, and Accessories to successfully offset declines in iPhone revenues and improve visibility along long-term growth," JP Morgan suggests.

UBS

Current expectations are for Apple to achieve $56.5 billion in overall revenue, with earnings and guidance likely to be fine overall despite the prospect of iPhone product mix issues. Along with an EPS of $2.33, UBS is pessimistic compared to the Street, with iPhone revenue down due to an anticipated lower average selling price of $687, rather than street estimates of $745.

UBS claims that the lower average selling price is supported by data that indicates a general shift in product mix to "older models." Apple won't report average selling price or iPhone sales volumes, however.

Bank of America

Gross margins will be important for Apple in the results, suggests Bank of America. "If Apple can report a quarter of 37%-38% gross margins (within guidance range), despite the price cuts and quarter-on-quarter gross margins higher in the range of 37.5-38.5%, we would argue that the story has an upward bias to gross margins, which would be a major positive," the bank advises.

Currently Bank of America anticipates an EPS of $2.33, marginally down on Street estimates.

Raymond James

Apple is likely to see a drop in iPhone shipments by a considerable amount from the same quarter last year, suggests Raymond James. Unit sales for iPhones are thought to hit 42 million, representing a decline of 19.6%.

At the same time as lower iPhone shipments, and in turn revenue, the firm suggests investors should look at the average selling price and general product mix of iPhone sales. "Our current model assumes blended ASP could drop 15% y/y by the December quarter, with the mix-shift towards the low-end likely to negatively impact sales, margins, and related AppleCare revenue," the note advises.

Wedbush

Apple's China issues may be returning to form, mostly due to its program of price reductions in the country, according to Wedbush. "It has been Apple's pricing hubris on iPhone XR that was the major factor in the company's December earnings debacle in China," the firm advises.

Taking the price cuts into account, "demand trends are slowly turning around in this all-important region for Cupertino as we expect the Street will see when the company reports on Tuesday after the bell."

Malcolm Owen

Malcolm Owen

-m.jpg)

Amber Neely

Amber Neely

Christine McKee

Christine McKee

William Gallagher

William Gallagher

-m.jpg)

29 Comments

Maybe a wobble but also a major pivot. Even if there's measurable impact on services earnings, it's early days for that story. I hope we get a glimpse, even if just some baseline to understand future reports. How much are they investing in it? How much do they anticipate it'll drive future earnings? There's little reason not to continue to have confidence in Apple as a stock to own.

A few reports of double digit YoY iPhone unit drops in there. One touching 20%. I think that one is doubtful as a 20% drop would more likely have seen Apple react even stronger on its pricing adjustments.

Also a few reports of older models taking a higher slice of the mix. If that's the case, my bet is on prices simply being out of reach of too many users.

A 5% revenue drop and 15% decrease in iPhone unit sales isn't really "back to normal" when Apple had uninterrupted revenue growth for years. If anything it indicates Apple has settled into a "new normal" of stagnant hardware sales with services being the only segment with measurable revenue growth. This is reflected in Apple's push into providing content with Apple Music, Apple TV, and Apple News+.

The big question is whether Apple's investment into consumer entertainment content will drive revenue and profit growth to the same extent the iPod and iPhone have done for almost the last two decades, and I don't think we'll have the answer to that question for at least another two years when the subscriber growth in these new services starts to level out.

Can't say for sure but I expect the same reactions from the same people from every other quarter in the past 10 years.