Apple's new iPod Nano introduced last week is virtually a completely new design of the player, using a fresh array of components and sporting the fattest profit margins of any other iPod of recent past, according to a new tear-down analysis.

As has been the case with all of iSuppli's recent tear-downs, the estimated BOMs are strictly limited to costs for components and other materials used to construct the product, but do not include costs for manufacturing, software, intellectual property, accessories and packaging. The firm's BOM figures also do not include research and development costs, since such data cannot be derived from a tear-down and component analysis.

In achieving the Nano's more cost-effective design, Apple has reportedly turned to a fresh array of component suppliers that include Micron Technology Inc., Dialog Semiconductor GmbH and Intersil Corp. Synaptics Inc., once a fixture in click-wheel-based iPods, has also returns to the platform after an absence.

"The changes in components have resulted in significant cost reductions in the Nano design, allowing Apple to offer a product that is less expensive to build and that has enhanced features compared to its predecessor," said Andrew Rassweiler, senior analyst and teardown services manager for iSuppli.

Fat margins are nothing new for Apple, whose products traditionally have been sold at retail pricing that is about twice the level of their hardware BOM costs, based on earlier tear-downs of the iPhone, the iPod Shuffle and previous members of the iPod Nano line (2005 Nano, 2006 Nano). However, Rassweiler notes that with the new Nanos, "Apple has exceeded even its usual lofty standards."

The arrival of new Nano semiconductor suppliers, Micron, Dialog and Intersil — and the return of Synaptics — has been accompanied by the departure of previous part providers, NXP Semiconductors and Cypress Semiconductor Corp. Such wholesale supplier swaps are also not unusual for Apple, which frequently switches its component partners.

"With Apple, it seems, no supplier is safe, and no slot is a given," Rassweiler added.

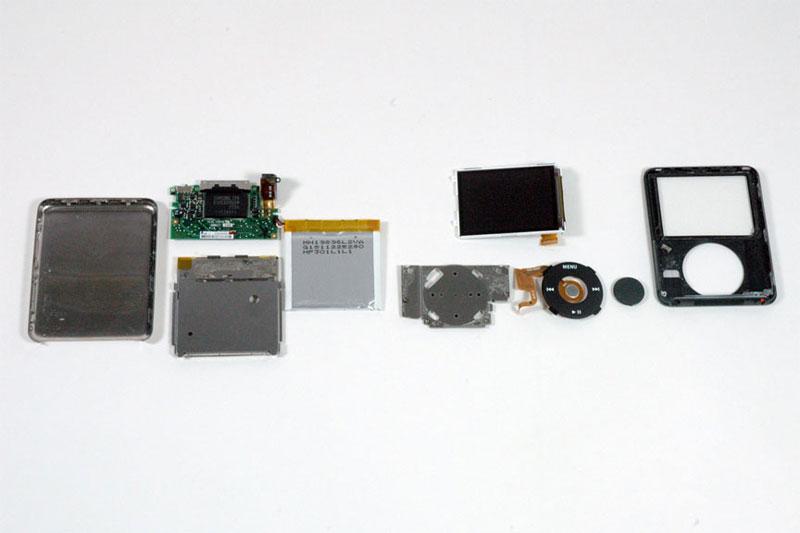

Third-gen iPod Nano tear-down photo compliments of iFixIt

Of all the Nano's new component suppliers, Micron stands out as the most notable addition because it's the first time that iSuppli's Teardown Analysis Service has identified a Micron part in an iPod. In the Nano torn down by the firm, Micron was the maker of the high-density NAND flash memory that serves as media storage, worth $24 in the 4Gbyte version of the product and $48 in the 8Gbyte version.

"This gave Micron the largest single portion of value in the Nano of any supplier at 40.8 percent for the 4Gbyte version and 57.9 percent for the 8Gbyte," the firm said.

Apple's primary suppliers of NAND flash historically have been Korea's Samsung Electronics Co. Ltd. (which has been the dominant seller), Japan's Toshiba Corp. and Korea's Hynix Semiconductor Inc.

Micron is last in share position as a supplier to Apple for NAND flash, and only began shipping small quantities during the last year. While the new Nano slot is a major win for the U.S. semiconductor supplier, iSuppli believes Samsung remains the world's largest maker of NAND-type flash and is likely to continue to be used as a supplier by Apple.

Another one of the biggest and most important slots on the new Nano is the combined core video processor/microprocessor chip in the system, according to the firm. Costing $8.60, the Samsung-supplied core IC processor accounts for 14.6 percent of the 4Gbyte version's BOM, and 10.4 percent of the 8Gbyte's BOM.

This is the second time around for Samsung's core processing IC in the Nano line; in the version of the Nano released in late 2006, Samsung supplied the core processing IC as well. Samsung also contributes 32Mbytes of Mobile SDRAM, worth $2.72, or 4.6 percent of the 4Gbyte BOM and 3.3 percent of the 8Gbyte BOM.

iSuppli tentatively forecasts that total iPod Nano shipments will reach about 23 million units in 2007 and 27.9 million during 2008.

Prince McLean

Prince McLean

-m.jpg)

Malcolm Owen

Malcolm Owen

Andrew Orr

Andrew Orr

William Gallagher and Mike Wuerthele

William Gallagher and Mike Wuerthele

Christine McKee

Christine McKee

William Gallagher

William Gallagher

-m.jpg)

27 Comments

Sorry, but ur 'rithmatic is wrong:Nano (1st Gen) (2GB)

BOM Cost: $89.97

Price: $199

Margin: 54.8%Nano (2nd Gen) (4GB)

BOM Cost: $72.24

Price: $199

Margin: 63.7%Nano (3rd Gen) (4GB)

BOM Cost: $58.85

Price: $149

Margin: 60.5%Nano (3rd Gen) (8GB)

BOM Cost: $82.85

Price: $199

Margin: 58.4%So the new Nanos have a slightly worse margin than last years nanos.

(although they're still good, and still better than the 2005 Nano 1st Gen)

When I see these tear-down cost analyses, I just have to ask myself,

"Does Apple really pay those prices? Who can know?"

iSuppli can research the cost of the microprocessor, and find that it's $8.60, but

who's to say Apple hasn't negotiated some high-volume deal, so maybe they

get them for $8.04? Or $7.56? Or who knows?

Therefore, I think whatever profit margin we can glean from such numbers,

(after totally guessing at labor costs, packaging costs, etc.) is going to be

substantially off.

Only Steve knows.

I think the nanos are a great deal for the price, regardless of what they cost EXCEPT for the storage capacity. Other companies have similar players with double the memory at the same price points.

It's great that apple added features and upped the capacity with this update, but it's been so long since the last update, they're lagging in capacity from day one this time around.

And don't get me started on the shuffle, they must be making a ton of profit on that now. A year later and no price drop or capacity boost? Another great unit, but apple is coasting on their market dominance instead of staying competitive.

I agree with Lafe that they're probably getting a better deal. That said, you can't calculate profit based on parts costs alone. What about Marketing? Packaging doesnt cost apple anything meaningful. Intelectual property and software are sure to be a major contributing cost. What about accessories as stated above?

I've often wondered why people who post these figures DON'T factor in such things as:

- R&D (Apple spends enormous amount of money developing these things)

- Cost of manufacturing

- Cost of shipping some components to Taiwan

- Cost of shipping the finished products to the US and elsewhere.

- etc. (and there are many of them)They create the impression Apple is reaping so much profits, which is not true.