In his latest note to investors Monday, Robert Cihra, analyst with Caris & Company, noted that Apple's most recent Form 10-K filing with the U.S. Securities and Exchange Commission has called for a major $1.9 billion in capital expenditures during the 2010 fiscal year. That's well up from the $1.1 billion the company spent in 2009.

While the number could be an example of Apple's traditionally conservative guidance given to investors, Cihra said it's also possible that the increased expenses could mean that Apple is planning for something big in the coming year.

"This year's 10K added wording for purchases of 'product tooling and manufacturing process equipment,' which could imply Apple reversing course to actually build certain products/components in-house," Cihra said. "Beyond that are signals of Apple investing in massive new data center capacity (e.g., North Carolina) that could support anything from iTunes/iPhone Apps through new 'cloud computing.'"

Earlier this year, Apple selected Maiden, N.C., as the location for its $1 billion server farm. The exact purpose of that data center has not been stated.

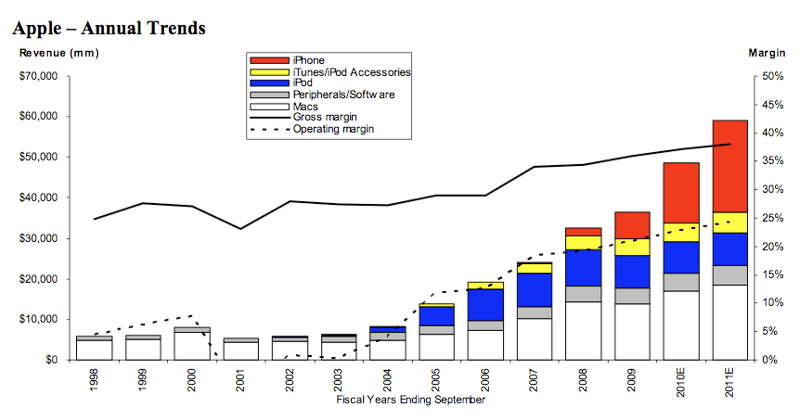

Cihra expects Apple to have a huge December quarter, with sales of iPhones and Macs boosted higher during the holiday season. He has upped his forecast of Mac sales for the first financial quarter of 2010 to 3.4 million. If accurate, that would exceed the record 3 million Macs sold in the September quarter. Those sales will be propelled by the new 13-inch unibody Macbook and redesigned desktop iMac.

He also expects a new record in iPhone sales at 10 million units shipped, well beyond the 7.4 million sold last quarter. After the company faced supply constraints last quarter, Apple has increased orders for iPhones by 20 percent for the holiday. In addition, the handset's recent launch in China is expected to drive sales even higher.

Caris & Company has reiterated its buy recommendation for AAPL stock with a price target of $260.

Neil Hughes

Neil Hughes

-m.jpg)

Amber Neely

Amber Neely

Malcolm Owen

Malcolm Owen

Andrew Orr

Andrew Orr

William Gallagher

William Gallagher

Bon Adamson

Bon Adamson

-m.jpg)

85 Comments

This can only be good news for the economy. Apple is investing heavily rather than just banking its income. If Apple are going to manufacture their own products again, it is because the volumes they sell now make it worthwhile. Back in the mid nineties, the volumes did not justify having in house manufacturing.

I also suspect that this will be more for early development of new products, to prevent the recent leaks that have occurred. I'm sure the volume manufacturing will remain with existing suppliers.

Phil

With 30+ billion in cash, it's about time they start spending it!

'product tooling and manufacturing process equipment,' which could imply Apple reversing course to actually build certain products/components in-house,"

That would be amazing news in this era of deindustrialization in the US. You cannot have a vibrant middle class in an economy without a strong manufacturing sector. And you cannot have a strong manufacturing sector if you stop investing in the continuous development of highly efficient manufacturing systems and just surrender without a fight to the low-wage countries. Germany and Japan fought (and continue fighting) to keep their manufacturing sectors. We did not. This is the 'gift' given to us by generations of MBAs who were taught to treat technology and know-how as just another cost item that you can keep cutting down whenever short term profits are threatened.

With 30+ billion in cash, it's about time they start spending it!

They could start by inventing and releasing a portable consumer device in the $500-$7000 range. I don't care if it's a Netbook, Tablet, Apple-on-a-stick, whatever. The price differential between Macs and PCs is ridiculous. Look at yesterday's Best Buy Sunday flier . Blu ray is included on Sony and Toshiba laptops for $700!!!!!! And 500 Gb of storage!

They could start by inventing and releasing a portable consumer device in the $500-$7000 range. I don't care if it's a Netbook, Tablet, Apple-on-a-stick, whatever.

Pretty big range there!!! Must be all the add-ons....