Disclosure documents filed today with the Securities and Exchange Commission clarify that Apple's falling stock price over the winter quarter was tied to the widespread selloff of over a million shares by just seven large hedge funds.

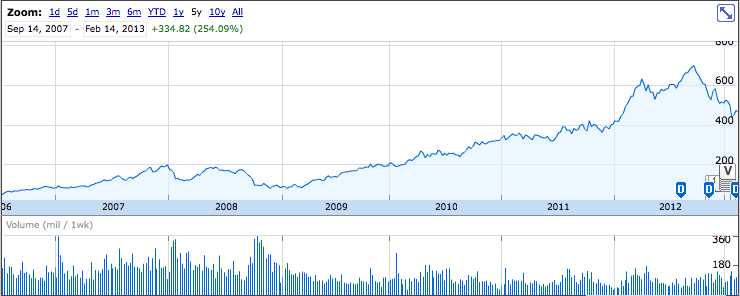

After reaching an all time high of $704 on September 21, shares in Apple tumbled downward more than 24 percent, hitting a low at the end of 2012 at $509. After some recovery in the new year, shares fell again after the company announced record earnings, hitting a 52 week low of $435.

Panic or planned?

While observers like to attribute the dramatic drop to a "loss of faith by investors," the actual catalyst is now known to be a more calculated, rational act by a few hedge fund managers with very large holdings.

A noted in a report by Reuters, hedge funds' quarterly disclosure forms filed with the SEC reveal a series of massive, billion dollar liquidations during the quarter.

Puzzlingly, however, even the report itself described Apple's stock drop as coinciding with voiced "concerns about increasing competition and declining profit margins" and offered the explanation "the shares also may have dropped because their price rose too much, too fast."

"Three months from now, we'll be seeing a lot of the people who sold starting to pick it up again."

An unconnected thought presented later in the report notes that "despite the plunge in Apple's stock price, most of the managers likely exited their positions with substantial profits because they bought years earlier."

It also cited Justin Walters, the co-founder of Wall Street research firm Bespoke Investment Group, as saying, "three months from now, we'll be seeing a lot of the people who sold starting to pick it up again."

Four funds that sold 796,000 shares worth

The report outlined that Leon Cooperman's Omega Advisors fund "dumped its entire stake of more than 266,000 shares during the fourth quarter."

Eric Mindich of Eton Park Capital Management dumped all its shares in Apple in the fourth quarter; it held 250,000 shares at the beginning of that quarter.

Thomas Steyer of Farallon Capital sold 137,000 shares, while Barry Rosenstein's Jana Partners "unloaded its entire Apple stake of more than 143,000 shares."

Next to a stock photo of a rotting Apple, Julia La Roche of Business Insider claimed that the four hedge funds' liquidation of Apple "is significant because the tech giant's stock is normally a hedge fund favorite."

Following the brilliant adage "buy low, sell high," any stock is probably going to be more of a "hedge fund favorite" before pumping the stock up and then liquidating it, compared to the period of decline following said liquidation.

At least two of the hedge funds began accumulating Apple's stock in early 2010, when shares were around $250, providing them with a return approaching 250% or more on those shares, if they were sold near the peak.

Other hedge funds trimmed some shares

The report ends by noting that three other hedge funds trimmed their holdings in Apple in the fourth quarter, but retained 73 to 82 percent of their holdings.

These include Philippe Laffont of Coatue Management, which retained 643,000 shares after selling 18 percent of his firms holdings; Chase Coleman of Tiger Global Management, which sold 19 percent of its holdings but ended the year with a portfolio including over 1 million shares of Apple and Julian Robertson's Tiger Management LLC fund, which cut 28 percent of its Apple stake, ending with 42,000 shares.

These three firms therefore sold off around 390,000 shares, while retaining more than 1,685,000, more than twice as many shares as those liquidated by the four firms that abandoned their entire positions.

In total, these seven firms reported sales of more than million shares, about 1 percent of Apple's total. If sold near Apple's peak, the sales would have resulted in the shift of $7 billion in capital. Those shares are currently priced at around $4.6 billion.

The shockwaves generated by those sales helped deflate Apple's market cap from a high above $650 billion to today's $438 billion.

Correlation is not causation

Last fall, Seth Fiegerman jumped on this massive stock price shift caused by hedge fund profit taking, to suggest that Apple's valuation drop was actually caused by the "cursed" release of iPhone 5.

The phone has since become the most popular model ever, taking top sales records in Japan and helping Apple take the majority of smartphone sales in the US.

With Apple's shares currently hovering around $466, all six of the firms are now free to buy back shares at about two thirds the price they commanded at their peak last September, and won't have to disclose the purchases until a month and a half after the current quarter ends.

Daniel Eran Dilger

Daniel Eran Dilger

-m.jpg)

Marko Zivkovic

Marko Zivkovic

Christine McKee

Christine McKee

Andrew Orr

Andrew Orr

Andrew O'Hara

Andrew O'Hara

William Gallagher

William Gallagher

Mike Wuerthele

Mike Wuerthele

Bon Adamson

Bon Adamson

-m.jpg)

33 Comments

See it not all bad, but selling at the high and forcing the drop and then buying back in when they force it low makes them lots of money, How many of these same funds also shorted the stock the the same time. It becomes a self fulfilling Prophecy.

So the tanking was pure and simple profit taking with these funds reaping huge profits while almost destroying AAPL. Any collusion involved in the sell off or was it purely coincidental? Of course, now that it's at a bargain basement price, these same funds will probably buy it again, pump it up, take profits and destroy the stock a second (and third, and fourth) time. This is not the way to run the financial market and allowing it is not the way to run the country or the world. AAPL was not too high, just look at its pitiful P/E.

The tyranny of the metrics. The funds needed to show overall high returns and how better to juice your averages but by selling the winners? Bummer for small investors who have their emotions tied up in watching the ups and downs but if you're a buy and hold investor you're not going to go wrong by sticking with the winners.

Re rob53: they did not "almost destroy AAPL", selling at a 52-week high is good business practice for any investor. In all likelihood, the trades were executed automatically through previously-set Sell Limit Orders. Plus, many if not all investment funds sell off their best performers at the end of the year to maximize profits, finalize taxes, etc. The only question now is how long it will take the stock to return to its previous level (Intel-Apple iTV, anyone ;)

This is the dumbest thing I've ever read. Apple bought back twice as much as these firms sold and the price still tanked. Plus the stock trades close to 20 million shares a day...every day. Selling 1 million shares over a quarter would barely be noticeable. Idiot reporting for empty heads.