A report by Strategy Analytics is getting lots of attention, but its core implication that Samsung Electronics is now leading Apple, Inc. in profits is simply not accurate.

Estimating figures Apple and Samsung don't actually provide

On Friday, Strategy Analytics issued a press release stating that "Samsung has finally succeeded in becoming the handset industry's largest and most profitable vendor," according to its "latest research."

Samsung has been making the most phones since the first quarter of 2012, when it passed Nokia to take the global handset crown. That means the only thing actually new in Strategy Analytics's statement is the claim that Samsung is actually making more profit than Apple, a long time leader in profitability across both mobile devices and desktop PCs.

Strategy Analytics has to employ "research" to come up with this claim because Samsung doesn't actually report how many phones, smartphones, tablets, cameras or set top boxes it sells (or even the inventory numbers it ships) and doesn't report the profit share of any of these products segments.

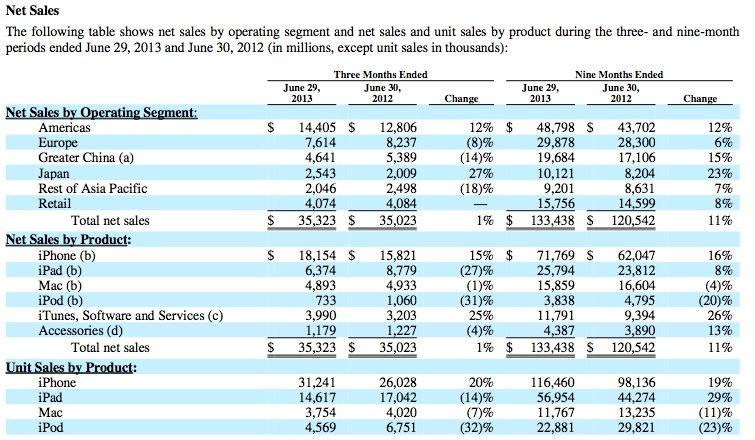

Apple does report specific unit sales of product segments, and often provides additional detail on inventory shipments (clarifying how many devices actually sold compared to how much inventory it shipped into the channel). But Apple doesn't break down profit share by product segments either.

Strategy Analytics is attempting to estimate mobile handset profit shares for both companies. While it generated a lot of coverage for its report, the numbers not only don't reflect reality, but they were further mangled by sloppy reporting from a variety of major tech websites.

The straight facts on profits

Before looking at analyst estimates, look at the actual figures reported by Apple and Samsung for the quarter ending in June (Samsung's Q2 and Apple's Fiscal Q3 both relate to the same quarter).

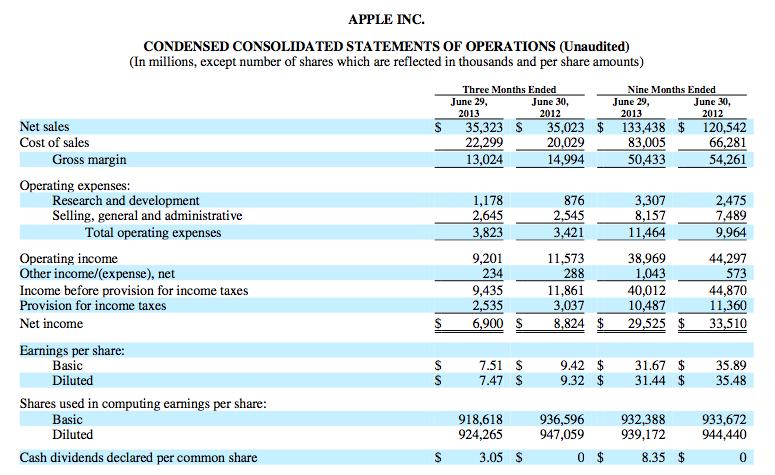

Apple in its 10Q filing reported $9.2 billion in total operating income. After $2.5 billion set aside for taxes, that leaves $6.9 billion in net income.

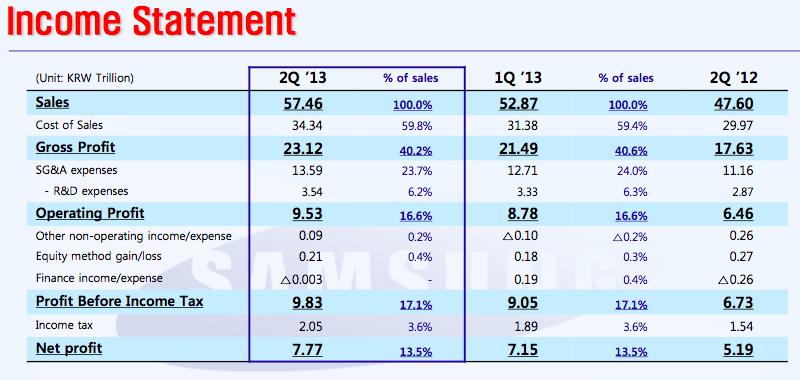

Samsung Electronics reported (PDF) $9.53 trillion Korean Republic Won ($8.56 billion) in total operating income. After $2.05 T KRW ($1.84 billion) set aside for taxes, that leaves $7.77 T KRW ($6.98 billion) in net income.

(All currency translations here were performed today using data from Google, which is slightly more flattering, but not significantly different, than the currency exchange at the time the results were stated).

Comparing Apple's to Samsung's

Apple is earning greater operating profits than all of Samsung Electronics, despite the fact that Samsung operates across a lot of other businesses. Apple sets aside more for taxes, so its reported net profit is slightly but not significantly lower, at least in the current currency exchange.

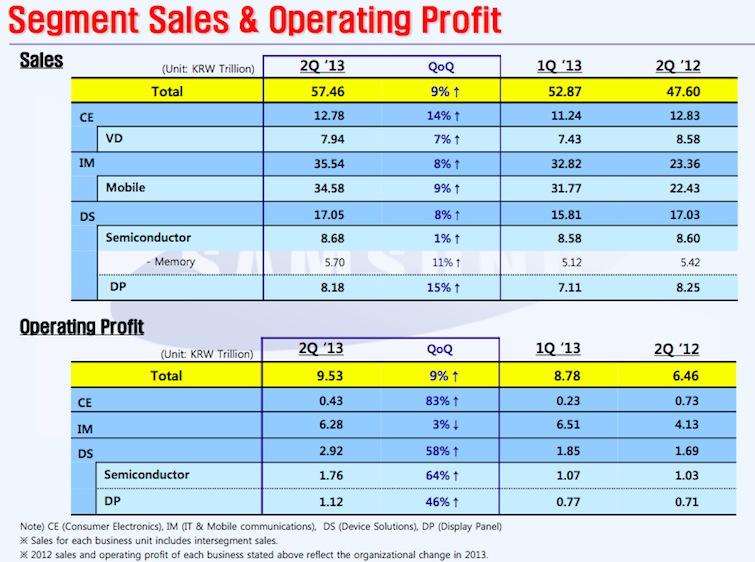

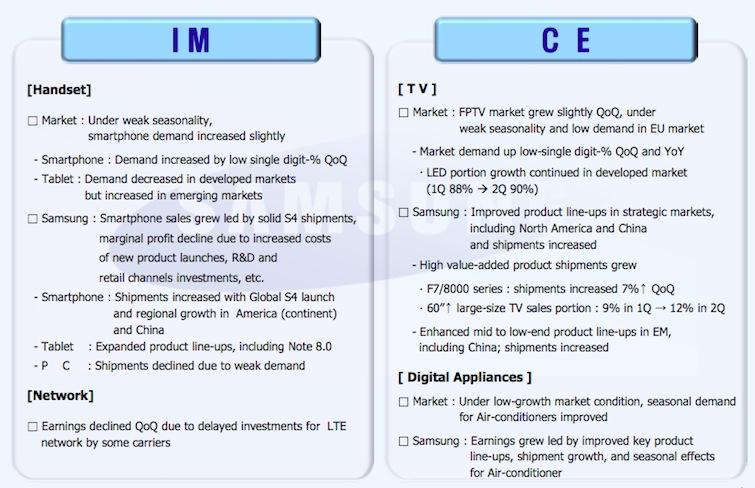

Samsung further breaks its overall earnings into three market segments: Consumer Electronics (TVs and appliances), IT & Mobile communications (which includes handsets, smartphones, tablets, PCs and network equipment) and Device Solutions (which includes LCD and OLED screens, memory, and System LSI, the fab that builds Apple's A-series chips for iOS devices).

If you only compare the IM segment of Samsung that directly compares to Apple's business (iPhones, iPads, iPods and Macs), you get $6.28 T KRW ($5.64 billion) in operating profit (Samsung doesn't detail its taxes or net income for IM). That amounts to just 61 percent of Apple's total earnings.

Tech media mangles the data

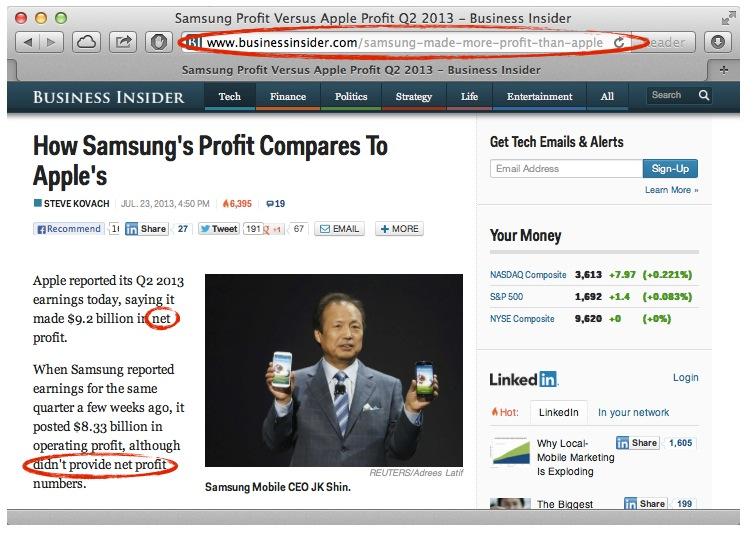

Reporters had a hard time presenting this information. An initial report by Steve Kovach of BusinessInsider proclaimed "Samsung Made $1.43 Billion More In Profit Than Apple Last Quarter, " before the site realized that it was comparing Apple's after tax net income to Samsung Electronics pre-tax operational income.

The site subsequently corrected its story with a new, less racy headline "How Samsung's Profit Compares To Apple's," but the incorrect "news" was widely syndicated by others, and still appears, uncorrected, on the site's Australian edition.

A Google search for the original, incorrect headline "Samsung Made $1.43 Billion More In Profit Than Apple Last Quarter " returns 6,650 results. Some of those syndicated reports have been corrected, including those by the San Francisco Chronicle and Yahoo Finance. Many other blog entires have not, such as this one by Cult of Android.

Even the corrected version still mixes up "net profit" for "operational profit," and says that Samsung doesn't report net profit (the company does, as shown above).

A report by CNET described Samsung's IM earnings as its "mobile business," obscuring the reality that this group, even its "mobile" subgroup that excludes networking sales, also sells all of Samsung's PCs and tablets.

That report noted that IM accounts for about two thirds of Samsung Electronics' revenue, and had declined by 3.5 percent over the previous quarter. That decline occured despite the fact that Samsung had launched its new flagship Galaxy S4 smartphone in April. In contrast, Apple's sales for the quarter represented the third quarter of its iPhone 5 flagship.

Strategy Analytics compares all of Samsung's IM to just the iPhone

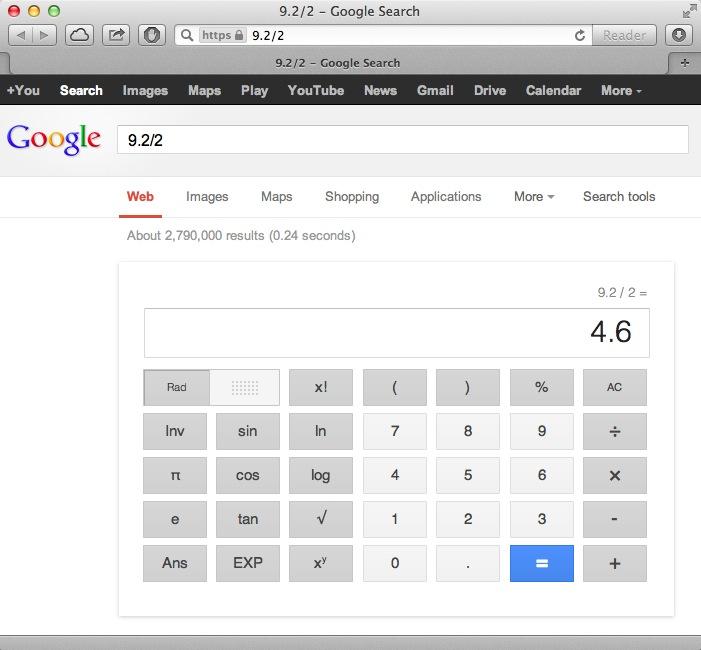

Three days after BusinessInsider corrected its report, Strategy Analytics introduced its own that compared its "estimated" $5.2 billion for Samsung's "operating profit for its handset division" with "an estimated iPhone operating profit of $4.6 billion."

Samsung's "handset division" doesn't just sell handsets, as the company itself outlines in its breakdown of the IM division (below). It doesn't even refer to its IM Mobile segment as a "handset division." So at Samsung, IM Mobile includes tablets and PCs, everything other than its networking gear.

Strategy Analytics estimates that $5.2 billion of the $5.64 billion in operating profits Samsung reported for IM is non-network related, but this "mobile" figure also includes all of Samsung's Windows PC sales, Chromebooks and Galaxy tablets.

Apple doesn't report profits for iPhone. It does report net sales by regional/retail operating segment and by product category: iPhone, iPad, Mac, iPod, iTunes Software & Services, and Accessories. In overall revenue generation, iPhone accounts for 51 percent of Apple's business.

Where did Strategy Analytics get its "estimated iPhone operating profit of $4.6 billion"? Some reverse engineering (below) exposes an algorithm of division by two.

In other words, in order to report that "Samsung has finally succeeded in becoming the handset industry's largest and most profitable vendor," Strategy Analytics had to compare Samsung's entire PC and device business with only half of Apple's.Strategy Analytics had to compare Samsung's entire PC and device business with only half of Apple's.

That's based on the faulty assumption that Apple earns the same profits on iPhone as it does across the rest of its business. Apple doesn't report margins for each business segment, but it is well known that Apple earns more from iPhone sales than from other product segments.

Apple has publicly stated that its overall profit margins in 2013 were significantly lower due to "a higher mix of new and innovative products with flat or reduced pricing that have higher cost structures and deliver greater value to customers and anticipated component cost and other cost increases." Sales of the iPad mini, for example, helped drive Apple's industry leading margins down.

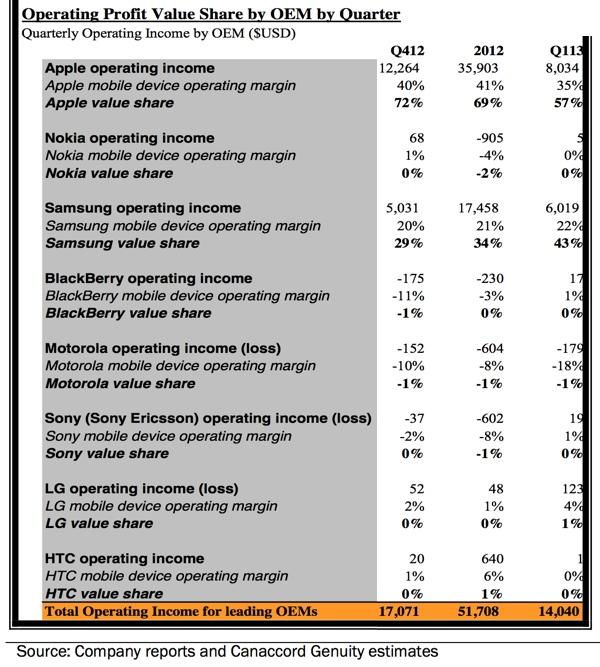

Canaccord Genuity contrasted Apple's 35-40 percent mobile device margins with those of the rest of the industry. Samsung is in second place with margins of 20-22 percent. Every other company on its list reported profit margins in the single digits, with most of them actually losing money.

By simply cutting Apple's reported profits in half to estimate the profits it earns on the iPhone, Strategy Analytics paints a false picture of Apple's profitability, quite obviously just to fuel a sensationalist headline.

A racy headline to draw attention to Strategy Analytics' report

Essentially, Strategy Analytics is suggesting that Samsung has no real PC or tablet business at all and that its entire range of handset sales (from feature phones to phablets) should be compared to revenue-based estimates of just one of Apple's products. Looked at honestly, Apple and the entirety of Samsung Electronics are both making nearly equal amounts of money, but Samsung is relying on much larger volumes of lower quality products to keep up.

Even with this logic, the "lead" Strategy Analytics gives all of Samsung's PC and mobile devices over just the iPhone is mere $600 million, less than the impact of currency fluctuations.

As BusinessInsider realized, it's not nearly as exciting to just report the fact that Apple reported profits of $9.2 billion and Samsung $8.56 billion, overall figures that are similarly just $600 million apart.

Samsung has consistently sold around twice as many total handsets as Apple has over the past year, but the devices Samsung sells are mainly low end models that contribute to very low profits.

Looked at honestly, Apple and the entirety of Samsung Electronics are both making nearly equal amounts of money, but Samsung is relying on much larger volumes of lower quality products to keep up.

More interesting information comes directly from Apple and Samsung

Strategy Analytics's "division by two" profit "estimates" press release was picked up and uncritically published by a variety of sources, including Juliette Garside of the Guardian UK, David Murphy of PC Mag, Tim Worstall of Forbes, Christopher Harress of London's International Business Times, Don Reisinger of CNET, Ryan Knutson of the Wall Street Journal, Kevin C. Tofel of Gigaom, Zach Epstein of Boy Genius Report, Matt Clinch of CNBC, and a report by BBC News.

[Update: Murphy has called attention to the issue in a promptly updated article for PC Mag

Matt Clinch of CNBC addressed the discrepancy on Monday, disparaging AppleInsider as an "Apple fan website" that only claimed an opinion "that Apple and Samsung Electronics were likely to be making similar profits."

Samsung most profitable in phones? Harrumph! pic.twitter.com/KpjLKLgG40

— Horace Dediu (@asymco) July 30, 2013

]

Google lists 833,000 search results for "Strategy Analytics profits Apple Samsung," more than 3 times the results it returns for the "Samsung pays Apple in nickels" hoax.

Strategy Analytics' "news" overshadowed more interesting information from the companies themselves. Samsung's executives reiterated the warnings they began sounding in January, seeking to explain why the company's high end smartphones aren't selling better.

A report by Aaron Back of the Wall Street Journal described Samsung executives as being "in defensive mode."

It noted that "Samsung's shares have fallen 15% since the end of May on concerns about sales of the company's flagship Galaxy S4 phone," and that "operating profit for the [IM] segment fell by 3% from the previous quarter, partly due to higher marketing costs to push sales of the S4."

Profits for Samsung's other divisions fared better; earnings from its component business, which supply Apple, were up 73 percent. But Samsung is at risk of losing a significant chunk of Apple's business.

At the same time, chips and displays only account for 31 percent of Samsung's overall profits, most of which come from its mobile sales.

Samsung leads Apple in worrying about future sales

Apple's executives, on the other hand, noted that despite being in the cyclically slow third quarter of iPhone 5, the company set a record for iPhone sales in the June quarter.I don’t subscribe to the common view that […] the smartphone market has hit its peak. I don’t believe that" - Tim Cook

Asked about fears of "increasing concerns that the high end of the smartphone market is reaching saturation point and that growth may be harder to come by," Apple's chief executive Tim Cook replied:

"I don’t subscribe to the common view that the higher-end, if you will, the smartphone market has hit its peak. I don’t believe that, but we’ll see and we’ll report our results as we go along."

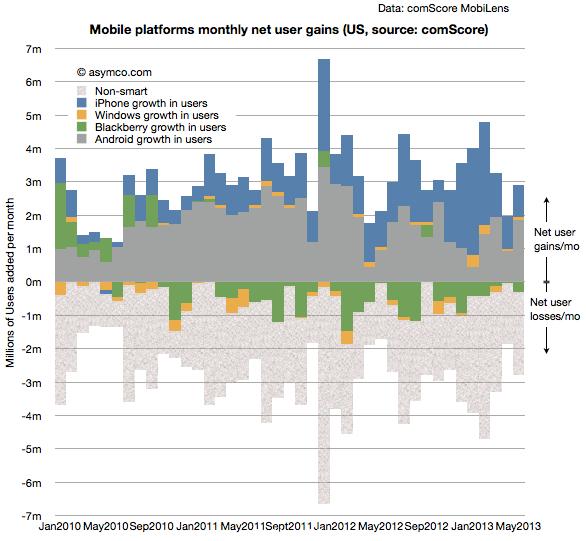

Analyst Horace Dediu of Asymco addressed the "Peak Smartphone" fears in detail, concluding, "to summarize, with penetration now at about 60% in the US, the rate of adoption of smartphones is not slowing in any perceptible way."

With Samsung sending out distress signals about the sustainability of its high volume, low quality business model for phones in a market where Apple continues to grow, Strategy Analytics' creative accounting designed to award Samsung with an contrived achievement appears to be a distraction from reality, rather than real information.

Daniel Eran Dilger

Daniel Eran Dilger

-m.jpg)

Marko Zivkovic

Marko Zivkovic

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

Amber Neely

Amber Neely

Sponsored Content

Sponsored Content

-m.jpg)

140 Comments

We don't even know if samsung makes more phones than Apple does, even. They don't release sales numbers... something even Apple Insider doesn't seem to get.

Samsung does not release sales numbers, because the sales are anemic.

Very good article! Although not directly within the scope of this article, we may note that Apple sold 100 millions iPads in less than two years, that is huge!

We don't even know if samsung makes more phones than Apple does, even. They don't release sales numbers... something even Apple Insider doesn't seem to get.

Samsung does not release sales numbers, because the sales are anemic.

It's true we don't know exactly how many phones Samsung sells (or tablets, or the feature/smartphone split, or how many are Android/WP). But we can estimate ballparks, and can look at usage data, surveys and other information to make reasonably intelligent conclusions and predictions.

The "analysis" that went into comparing all of Samsung's profits against half of Apple is not very astute though. It's also shameful that nobody from bloggers to journalists investigated the claim with even the most delicate finger scratching of sanity checks.

It is pretty interesting that Samsung's entire chip fab/LCD/memory, TV & appliances AND mobile/PC businesses combined are still earning less than Apple.

There seems to be a lack of morality, credibility, and integrity in the majority of those Apple bashing articles. It's my understanding that Samsung does not break out number of tablets or smart phones shipped/sold each quarter but we get these negative articles daily of apple's demise. Of course they are always followed by Apple spokesman declined to comment, and Samsung's spokensman could not be immediately reached. Is it really that serious to put out such misinformation. If coke and pepsi can coexist without all of this drama, surely apple and samsung can.....

Both Apple and Samsung make more money than I do.

I have no facts or evidence to support this.