Rumors of automotive product entries from Apple and Google are prompting carmakers to look beyond traditional toward revenue streams fueled by data, the first being a reported joint overture for Nokia's HERE mapping service worth billions of dollars.

According to sources, luxury marques BMW, Audi and Mercedes-Benz are eyeing a joint bid for Nokia's HERE maps business in an attempt to thwart advanced telematics domination from software companies like Apple and Google, Bloomberg reported on Monday.

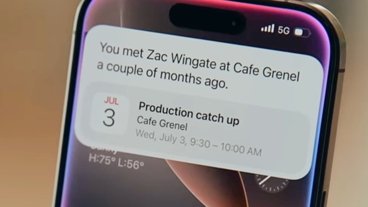

The move is supposedly in response to tech companies' work in areas of geolocation services — Apple Maps and Google Maps — thought to feature heavily in initiatives that might soon turn the car into a content discovery device. Like today's smartphones, autos with built-in location data acquisition hardware and software could one day leverage location and user preferences to offer personalized suggestions on places to eat and nearby points of interest, while at the same time making commutes safer by relaying real-time road hazard alerts from other cars.

Thanks to the double-edged sword of data harvesting, driver information is of course ripe for commoditization.

From integrated service solutions to targeted ads, there are numerous ways in which customer data can be harnessed for profit, and many of those techniques fit into the car world quite nicely. A study by McKinsey & Co. estimates revenue from data services and associated hardware could generate $200 billion by 2020, the report said.

Exploration into self-driving vehicles yields even greater opportunities for data harvesting. McKinsey estimates automated cars could free up 50 minutes per day for drivers around the world, meaning more time spent on the Internet, more eyes on data services and billions in digital media revenue.

"The transportation industry is ripe for disruption," Tony Douglas, an executive at BMW AG's mobility services unit said at an industry conference recently. "Either we kind of drive that disruption and gain from the new business models that will emerge, or we let someone else do it."

For now, Apple's automotive ambitions officially end at CarPlay, an iOS-based integrated infotainment system already being adopted by major manufacturers, though rumors persist of research and development into electric car batteries, advanced onboard computers and even a branded vehicle. Most recently, a report claimed Apple's secret car project has grown so large that it's taking a toll on other departments as Apple reassigns key talent.

For its part, Apple is expectedly tight-lipped about its plans for the car, but executives seem to be having a bit of fun playing off rumors. During a recent interview, for example, Apple operations chief Jeff Williams referred to the automobile as the "ultimate mobile device," later alluding to ongoing work in the space.

In March, AppleInsider uncovered a top-secret Apple complex dedicated to what appears to be an ongoing automotive initiative.

Mikey Campbell

Mikey Campbell

-m.jpg)

Malcolm Owen

Malcolm Owen

Amber Neely

Amber Neely

William Gallagher

William Gallagher

Oliver Haslam

Oliver Haslam

-m.jpg)

11 Comments

funny...Apple is already disrupting the automobile industry all on rumor. What other company can do that...Samdung? I think not.

Not all on rumor... CarPlay is enough to scare them.

The user and all related content has been deleted.

I doubt Google appreciates the concept of 'driving dynamics', especially since they're determined to take the steering wheel out of people's hands. Apple might do better but I want no part of any autonomous vehicle. Some of us enjoy driving.

My fear is that the car manufactures "product entries" perpetuate the mish-mash of UIs for every different dashboard

layoutscreen. That is part of the appeal of CarPlay--a consistent, familiar UI component to interact with. If they want to create their own apps, fine (although the data harvesting aspect of that is worrisome). I suppose one could get used to anything if it is your own car, but I rent cars fairly often, and it is just getting to be such a bother figuring out every manufacturers take on UI design/layout every time I get behind the wheel.And speaking of smartphones...

Integrated CarPlay or even Android Auto may make this moot, but I wonder why, in this day and age, no car manufacturer (that I am aware of) has yet to include a built-in dashboard mount to put a smartphone in view of the driver. Third party mounts are OK, but they can't necessarily be placed in an optimum location without getting in the way of something else. Plus there are often cable management issues no matter what.

Of course, it took them decades to figure out that cup holders were a good idea, so I won't hold my breath.