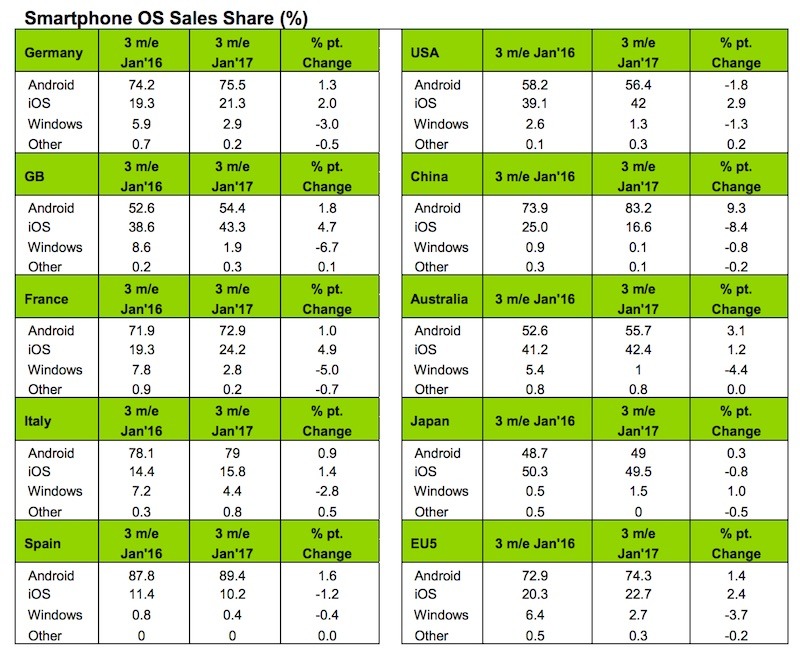

A new report by Kantar Worldpanel examining global smartphone sales data shows Apple's flagship iPhone 7 continues to win new market share for Apple in most of the regions tracked, outside of Spain, China and Japan.

The firm's data on the three months ending in January showed 2.9 percentage points of new market share in the U.S. over last year to claim 42 percent of sales in the period, gains made at the expense of both Android and Windows Mobile.

In Europe's top five markets, Apple climbed a similar 2.4 percentage points but remains at a smaller share of the market with 22.7 percent share, figures that include sales of much cheaper phones.

However, the report noted that "iPhone 7 remained "the top-selling device in Great Britain, France, and Germany," highlighting that market share alone doesn't say anything about sustainable profitability. The only reported European country where Apple's share fell was Spain.

Apple's share in Austrailia reached 42.4 percent, slightly higher than its proportion of sales in the U.S.Apple continues to collect the vast majority of profits in the smartphone market

In China, Apple's overall share of the entire market fell by 8.4 percent, but those figures include large volumes of phones being sold in tier 2 and tier 3 cities in more rural areas, where many buyers are new the growing market.

In "Urban China," a reference to its massive modern cities, Apple continues to sell the most premium phones. "iPhone 7 remains the top-selling smartphone in Urban China," Kantar noted.

Apple's share also fell slightly in Japan over the past year, but remains at 49.5 percent market share, the highest figure of any country.

The report stated that "re-born brand names" Nokia and BlackBerry made "a splash with retro market features and styling," but also acknowledged that "no other ecosystem is challenging the two giants - iOS and Android."

Apple continues to collect the vast majority of profits in the smartphone market. Last year, it earned 5.4 times the profits of Samsung as its various rivals in China (Huawei; BBK subsidiary brands Oppo and Vivo; Xiaomi and ZTE) all collectively amounted to less than 5 percent of the industry's profits, despite the surge of new phones being produced in China that helps to depress Apple's market share there.

Daniel Eran Dilger

Daniel Eran Dilger

-m.jpg)

Amber Neely

Amber Neely

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

Christine McKee

Christine McKee

-m.jpg)

6 Comments

but Ninny Patel said "

lol. Guess he should leave product design to the experts and stick to making a fool of himself.

Affordability is one of the big reasons of the great divergence of market share in different countries. Most countries charge a hefty import tax for iPhones which are expensive in the beginning. US does not charge import tax. In China the price of iPhone is 30% higher than in US.

The other reason is carrier rates differ from country to country. In US the carrier monthly rates are very expensive. The rate is the same whether you are using an iPhone or a cheap Android phone. The combined cost of phone and carrier rate makes the iPhone not significantly more expensive in the US.

The situation could be quite different in some countries. The carrier rates could be very low. Using a dirt cheap Android is very affordable to a lot of people.

In addition to profit being a more useful metric than market share I would argue that lifespan of devices is also important.

I have had my iPhone 6 for almost 3 years now and the 4S that it replaced is still being used by the person I sold it to. I subscribe to Apple Music as well as several other services through my iTunes account, make purchases from iTunes and buy Apps. Looking at market share of device sales doesn't matter nearly as much as profit and active users. From my observations based on friends that have bought devices from other manufacturers (Mostly Samsung) the lifespan of their devices would be two years at most. Often they need to be replaced sooner than that. They also don't generate any income for those manufacturers outside of the initial purchase price.

What's the point of having a large market share if you make less money on the sale of each device, don't generate ongoing income from services and don't have a large install base of users buying used phones that also generate income from services.