Apple is holding an event in San Francisco next weekend to promote the use of Apple Pay in stores and restaurants, with a number of merchants in two popular shopping areas offering exclusive Apple discounts for customers using Apple's mobile payment platform to pay for goods and services.

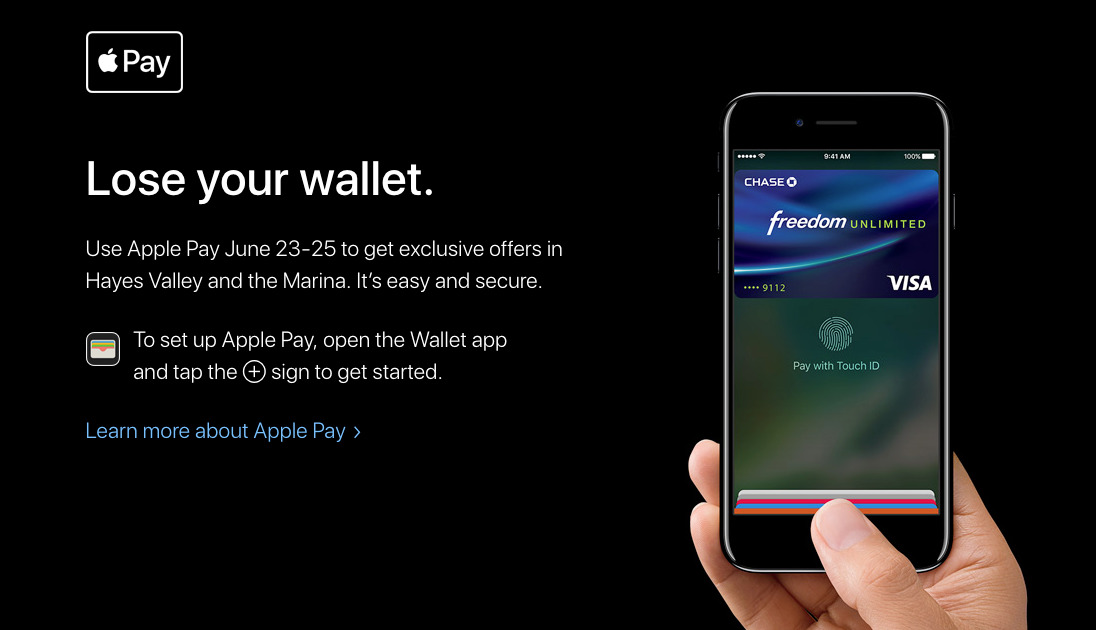

A special Apple Pay Lose your wallet page advertising the promotion advises offers will be available in specific stores in the Hayes Valley area and the San Francisco Marina. The offers run from June 23 to June 25, and will only be available to in-store customers using Apple Pay for the transaction.

A total of 20 merchants will be providing Apple Pay-exclusive offers in Hayes Valley, with the majority taking between 10 percent and 25 percent off orders, including Azalea, Blue Bottle Coffee, Dish, Minimal, and Welcome Stranger. A few of the other offers include Souvla's Crumbled Melamakarona frozen yogurt for $1, large fries for $1 from Double Decker, and a free gift card from Aether.

In the Marina, 16 merchants have a similar selection of discounts and free items with Apple Pay orders for the weekend. For the Marina, the stores taking part include Over the Moon, Peet's Coffee, Gala, and Pladra.

There are also four listings on the page for "exclusive app and partner offers," including $5 off an order from Caviar and a Square pop-up shop in both areas. Two parking services are also taking part in the promotion, with Spot Hero offering a 50 percent discount on parking in San Francisco, and Pay By Phone holding a contest where participants can win a month of free parking.

Apple Pay is a considerable driver of revenue for Apple, forming part of its steadily growing Services product category that brought in $7.04 billion in revenue in the most recent quarterly earnings report. Apple's future plans to expand the use of Apple Pay includes a focus on person-to-person payments, with users able to transfer money to each other, then spend the funds on a prepaid "Apple Pay Cash" card.

Malcolm Owen

Malcolm Owen

-m.jpg)

Chip Loder

Chip Loder

Wesley Hilliard

Wesley Hilliard

Marko Zivkovic

Marko Zivkovic

Christine McKee

Christine McKee

Amber Neely

Amber Neely

16 Comments

i love Apple Pay, but to call it a "considerable driver of revenue" is a bit of a stretch. They make .15 cents on every $100 spent.

"Piper Jaffray’s low-end estimate forecasts that this fee will bring in $118 million in revenue in 2015, increasing to $310 million in 2016. On the high end, Nomura’s equity analysts estimated it could account for $1.6 billion in revenue by 2017 – two years from now."