This fall's launch of iOS 11 will include secure person-to-person money transfers authorized by Apple Pay, but if you use it with a credit card instead of debit, the service comes with a caveat: an industry-standard 3 percent fee.

Apple's fee, which was first reported by Re/code, is right in line with competitors such as Venmo and Square Cash. The 3 percent fee goes toward covering the overhead associated with credit card transactions.

For those who don't want a 3 percent fee tacked onto a person-to-person transfer, a debit card offers the same service with no fee.

Once money is transferred, it will be available in a prepaid "Apple Pay Cash" card through partner Green Dot. The cash card can be used to make Apple Pay purchases in stores, in apps, or on the web, or it can be transferred to the user's bank account.

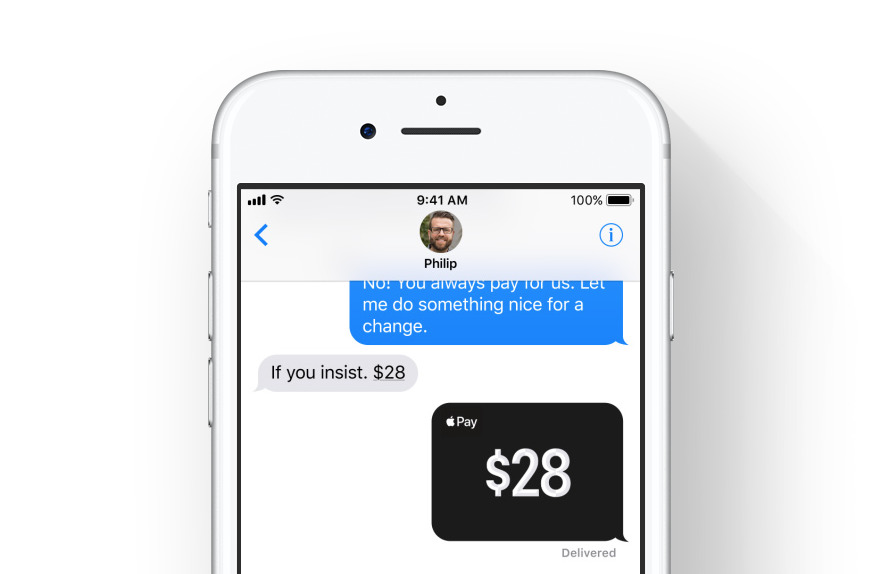

P2P Apple Pay payments will be initiated through a dedicated app in Apple's Messages app in iOS 11. The service will even integrate with Siri's new machine learning capabilities, offering suggested amounts to send based on the context of conversations had within messages.

Neil Hughes

Neil Hughes

William Gallagher

William Gallagher

Malcolm Owen

Malcolm Owen

Brian Patterson

Brian Patterson

Charles Martin

Charles Martin

33 Comments

Any idea on the transfer limit yet?

Green Dot, eh?

I'm sure MCX's CurrentC is prepping the next big competition to ApplePay. /s

That fee is to be expected and presumably a person to person transfer also won't be considered as a purchase by credit cards; it would be considered a cash advance which potentially (depending on your bank) comes with its own one off % fee added by the bank and would incur interest from day one (no interest free days) and will have its own special interest rate (often much higher than the interest rate for purchases).

Here's hoping people realize the likelihood of this.