Zaky, a frequent AppleInsider contributor, was profiled today by Fortune blogger Philip Elmer-DeWitt, who noted that "his estimates over the past four years have been considerably more accurate than your average Wall Street analyst."

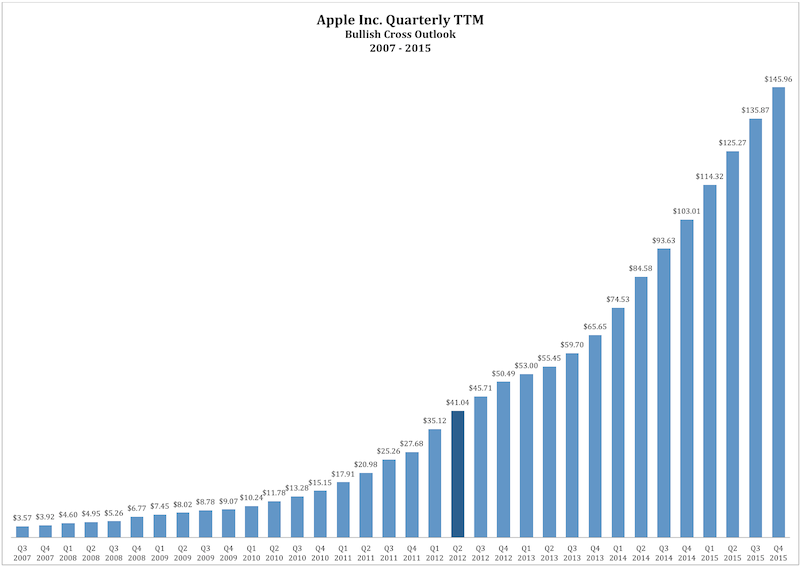

In looking at Apple's performance long term, Zaky notes that Apple's "Trailing Twelve Months" (TTM), a figure that represents a company's financial performance over the last 12 months, is poised to more than triple over the next three years, largely due to continued growth in its iPhone sales.

Given that Apple is currently trading under 14 times its current TTM of $41.04 (closing today at $569.18), Zaky notes that by Q4 of 2015, the company's estimated TTM of $145.96 will make even the same conservative 14x P/E valuation result in a share price of $2,043.44, giving the company a two trillion dollar market cap, something the world has never seen before.

Zaky wrote, "I'm fairly confident about these numbers. Here's what I think will guide that: Q1 2013 = 55 million iPhones shipped. Q1 2014 = 80 million iPhones shipped. Q1 2015 = 110 million iPhones shipped."

Zaky further predicted, "2014 is the golden age of Apple and the peak growth year. After 2015, growth will stall and Apple will become a mature company — at least for this era."

Daniel Eran Dilger

Daniel Eran Dilger

Charles Martin

Charles Martin

Wesley Hilliard

Wesley Hilliard

Marko Zivkovic

Marko Zivkovic

Andrew O'Hara

Andrew O'Hara

Malcolm Owen

Malcolm Owen

Amber Neely

Amber Neely

74 Comments

I guess the likelihood of this happening would be driven by whether or not our economy collapses again.

Yet analysts predict that Apple's products will continue to lose market share to Android and Windows phones, tablets, PCs, whatever, and will dwindle to nothing in just a few years. And since market share is the only thing analysts seem to care about why would Apple's stock price go anywhere but down?

Wow...one of the stupidest posts yet. Stock analysts can't accurately predict prices 6 months down the road, so guessing what a stock will be worth 3 years from now is ludicrous! The graph reminds me of Mark Twain's discussion of the "shortening" of the Mississippi River and the dangers of extrapolation.

It seems that all one needs to do to get covered in AppleInsider is mention Apple, no matter how silly what you say is.

I guess the likelihood of this happening would be driven by whether or not our economy collapses again.

Its more a question of do you believe Apple can maintain its growth. IF they don't introduce new products they will need to introduce lower line products in there categories. They can't maintain that growth selling only premium products because they will saturate the premium segment of there markets.

The iPad and iPods are doing great regarding price/value ratio, but the iPhone and mac lines are still premium products. They will need to find a way to do what they did with the iPad and be more competitive on prices.

Are these jokers flipping kidding me?