Echoing findings from IDC earlier this month, market research firm Gartner this week estimated global iPhone sales hit 60.2 million units for the first quarter of 2015, in large part thanks to a surge in China.

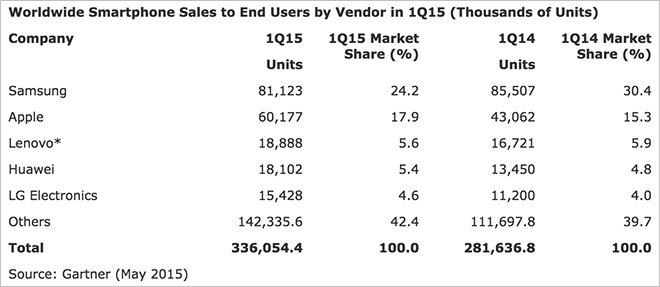

According to Gartner's latest data, Apple's 60.2 million worldwide unit sales amounted to 17.9 percent of the market, putting the company in second place behind Samsung. The Korean tech giant moved 81.1 million handsets for a 24.2-percent marketshare, down from 30.4 percent in 2014.

Compared to the same time last year, Apple grew its slice of the global smartphone pie 2.6 percent on an unseasonably strong performance in China, where iPhone surpassed Xiaomi's offerings to become the top-selling device for the first time ever. During the first quarter, iPhone sales grew 72.5 percent in Greater China, making the region Apple's largest volume market ahead of North America.

"Apple's extension into more Asian markets helped it close the gap with Samsung globally," said Anshul Gupta, research director at Gartner. "In the same period last year, there was a difference of more than 40 million units with Samsung; this difference has been halved, within one year, to just over 20 million units."

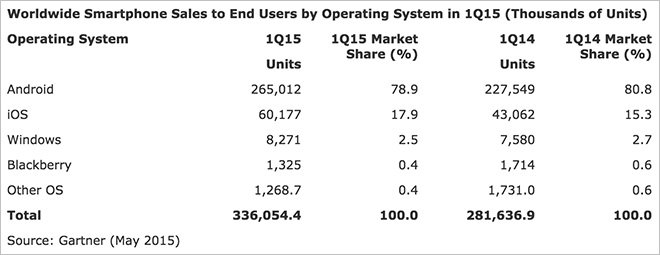

Samsung's lackluster performance contributed to a 1.9-percent slip in Android's hold on the market. Apple's iOS, on the other hand, enjoyed continued growth for the third consecutive quarter after a hugely successful iPhone 6 launch. Microsoft's Windows Phone platform and BlackBerry both dropped 0.2 percent over the same period.

Earlier in May, researchers at IDC found similar growth in Asian iPhone uptake despite seeing a contraction in the Chinese smartphone market. IDC was slightly more conservative with its iPhone numbers, pegging Apple's China growth at 62.1 percent year over year.

Gartner saw an uptick in overall smartphone sales with numbers jumping from 281.6 million devices sold in the first quarter of 2014 to 336 million this year. The firm associated the sector's strong performance with boosted sales in emerging markets across Asia/Pacific (excluding China), Eastern Europe and the Middle East and North Africa.

AppleInsider Staff

AppleInsider Staff

-m.jpg)

Marko Zivkovic

Marko Zivkovic

Christine McKee

Christine McKee

Andrew Orr

Andrew Orr

Andrew O'Hara

Andrew O'Hara

William Gallagher

William Gallagher

Mike Wuerthele

Mike Wuerthele

Bon Adamson

Bon Adamson

-m.jpg)

11 Comments

Super useful research when "Others" is bigger than Apple and Samsung combined.

The real market share numbers should be on a $ in sales rather than 1 unit sold. Dropping your price to increase market share only works if you are the dominate player with current control over the market. There is no dominate player in unit sales. There are dozens of companies selling Android and Android knock off phones. There are no advantages for these companies except for price, brand prestige, and design specs(all of which cost money to add to their products). The average price for an iPhone is 2.7 times higher than an Android phone. This means that Apple actually has 37% of the market share with $687 average selling price. Samsung, if it is an average seller of Android phones, has only 18% of the market share and the rest of Android has 42%. If the average price of a Samsung phone is below $254 which is the number listed by Forbes as the current average selling price for an Android phone then they are even lower down in market share. Needless to say the market share that Apple holds in phones priced over $500 is north of 50% and perhaps north of 60%. Those are world wide numbers and yes I just used the time honored analyst technique called a wag, or wild ass guess. I bet mine is closer than theirs!

[quote name="LarryA" url="/t/186473/iphone-sales-surge-in-q1-on-strong-china-emerging-market-performance#post_2728466"]Super useful research when "Others" is bigger than Apple and Samsung combined.[/quote] You have to wonder if most of the 'other' even qualify as a smart phone in the sense an iPhone is! What the data does show is most of 'other' is running some form of Android. I hate to imagine what version. Of course if 'other' didn't qualify then Android OS (as used on phones that did qualify) would not be in the lead by very much at all. But then Gartner et al probably wouldn't get their monthly checks.

Gartner didn't estimate Apple's Q1 iPhone sales at 60.2million, Apple reported iPhone sales of 60.2 million (shipments of 61.2 million and a channel inventory increase of 1 million). One could I suppose say that Gartner calculated the number, but that seems a grandiose term for subtracting 1 from 61.2. All the other numbers on that report may be estimates, but that one is hard data, and month old hard data at that.

Super useful research when "Others" is bigger than Apple and Samsung combined.

Nothing wrong with the research. They listed the top 5, anything else is smaller than 4.6%. This is called a "long tail". Fault of the market, not the researcher.