Major retailers and payments associations filed letters in support of a regulatory request from Australia's three top banks that would force Apple into collective negotiations over third-party access to iPhone's secure NFC module.

In separate responses to the Australian Competition and Consumer Commission, Coles Supermarkets, the Australian Retailers Association, Bluechain, the Australian Payments Clearing Association and Australian Settlements Limited all voiced support in favor of establishing digital wallet access standards, ZDNet reports. The letters were posted as the ACCC denied the banks interim approval to negotiate last week.

Australia's "big-three" banks, the Commonwealth Bank of Australia, National Australia Bank and Westpac Banking Corp, along with Bendigo and Adelaide Bank, last month lodged a request with the ACCC to collectively negotiate terms under which Apple would allow installation of third-party digital wallet apps onto iPhone hardware.

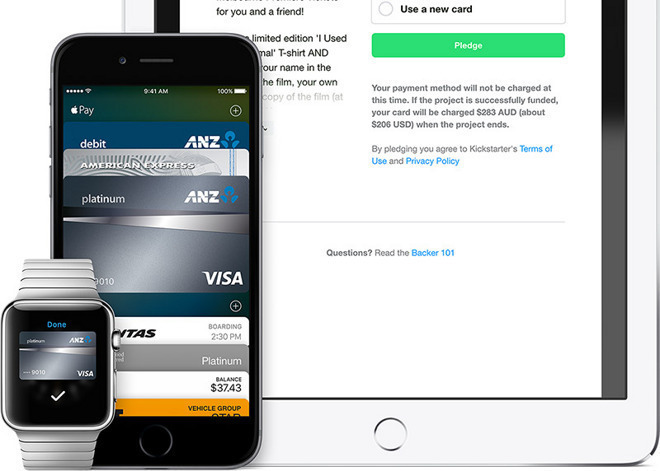

The process would require Apple to open its secure NFC technology to third-party applications, presumably bank cards, loyalty cards and other branded assets marketed by the applicant banks. Apple currently restricts iPhone and Apple Watch NFC module access to Apple Pay, a strategy the banks view as anticompetitive.

Coles in its response said NFC is a key technology in furthering mobile wallet solutions, an area of interest for the company since it rolled out NFC enabled point of sale terminals in 2012. The company, which is also a credit card issuer marketing the Coles MasterCard, says a collective negotiation on industry standards and guidelines is in the customer's best interest.

"We note there has been an ongoing movement in Australia to improve the transparency of costs to consumers related to their banking products," said Nikala Busse, Head of Payments at Coles. "We would envisage that activity that supports cost transparency or creates incentives to lower costs for the benefit of consumers would be in the public interest."

Similarly, the ARA believes negotiations would spur competition in the mobile payments space, providing more choice for customers, card issuers and merchants. The group also argues an open standard can stimulate innovation, investment efforts and transparent interchange fees otherwise stymied by closed systems.

"In our view, for as long as Apple Pay remains the only app that can use the iPhone's NFC functionality, the potential for innovation in mobile wallets and mobile payments will be limited," ARA said. "A number of banks and merchants overseas have tried to develop mobile wallets and payment services using alternative technologies, but none have been successful."

Letters from the APCA, ASL and Bluechain read much the same.

PayPal also submitted an opinion, but fell short of endorsing the banks' request for negotiations. Instead, the digital payments giant took issue with the application's definition of "mobile wallet," calling the provided definition too broad. Additionally, PayPal noted the APCA's voluntary Third Party Digital Wallet Security Industry Guidelines should not be mandated without an open discussion on standards.

For its part, Apple contends the banks' ACCC application boils down to competition. Apple Pay, the company says, is perceived as a threat and the banks' request to negotiate an open standard is a strategy meant to "blunt Apple's entry into the Australian market."

Mikey Campbell

Mikey Campbell

-m.jpg)

William Gallagher

William Gallagher

Christine McKee

Christine McKee

Malcolm Owen

Malcolm Owen

Marko Zivkovic

Marko Zivkovic

Andrew Orr

Andrew Orr

Andrew O'Hara

Andrew O'Hara

-m.jpg)

43 Comments

I guess if I were Apple, I'd just say fuck Australia! Sorry to those who live there and can't use it, but if banks and retailers want to be dipshits then I guess Apple has no choice.

"

Are you sure about that? See macxpress' comment, above.

Yep, time to tell Australia to pound sand and remove ApplePay from there.

Not really a surprise. 3 out of 4 banks that form a cartel trying to control the market. Coles Supermarket - 1 of 2 Duopoly jumping on the bandwagon to control their rewards programs and credit cards. Reduces their ability to mine data from purchases if Apple controls the payments mechanism. No need to leave Australia though. You think they should leave every country that puts up a fight? Its called disruption for a reason.