Apple has been attacked throughout the year for failing to jump on the Virtual Reality headset bandwagon following Facebook, Samsung, Google, HTC, Microsoft, Sony and others. Yet after a year of hype, VR headsets remain a niche that's failing to live up to even conservative expectations.

Wheels come off the VR hype wagon

Apple's "failure" to deliver a VR headset product this year has been the subject of many handwringing articles from analysts and journalists expressing concern for the company given the exciting future promised by VR.

However, a variety of research firms are now reporting much slower VR sales than expected— due to both limited content and high hardware costs.

Further, the fragmented market split between higher end PC and console-based headsets (including Oculus Rift and Sony's PlayStation VR, below) and various lower end smartphone-based headsets (including offering by HTC, Samsung and Google) has resulted in a dearth of compelling content for any particular ecosystem.

An article by Monica Chen and Joseph Tsai for Digitimes stated that the virtual and augmented reality "market was originally expected to pick up strongly in 2016, but demand for related applications has been weakening recently."

The emergence of new flavors of VR in 2017, including Asustek's ZenFone AR based on Google Tango and Acer's VR HMD based on Windows Holographics, has "some market watchers are concerned that the VR/AR ecosystem may not be mature enough to contribute much to the players," the article noted.

VR Fail Sales

A report by James Brightman for Games Industry Biz, citing sales figures from SuperData, indicated that while premium gaming consoles such as Sony's PlayStation 4 were selling well due to aggressive promotions (recently having reached sales of 50 million units, across three years), Sony's $399 PSVR offering fell far short of its estimated forecast of 2.6 million units.

SuperData said that only 750 thousand PSVR units have shipped, explaining that "notably fewer units sold than expected due to a relatively fragmented title line-up and modest marketing effort." The research firm stated that VR is "the biggest loser" of the season. VR is "the biggest loser" of the season - SuperData

Facebook's Oculus Rift is expected to only sell 335,000 units this year, while cheaper smartphone-based VR headsets such as HTC's Vive, Google Daydream and Samsung's Gear VR are not doing much better.

Google's effort to standardize VR for Android with Daydream has only shipped about a quarter million units, nearly half the number it was estimated to achieve, while even Samsung's heavily promoted Gear VR has failed to sell (or give away) more than 2.3 million units across 2016.

VR vs Apple Watch

Samsung's Gear VR is low end, $100 headset peripheral that requires a premium Samsung phone (such as a Galaxy S6, S7 or Note 5). As a vehicle for drawing interest to Samsung's high end, it has clearly failed.

Contrast that with Apple's own peripheral for its late modeled iPhones: Apple Watch, which has sold by millions each quarter, profitably, at prices from $300 to more than $1,000, while creating demand for fashionable bands, drawing attention to Apple Pay and attracting sports enthusiasts to Apple's ecosystem.

Even if Samsung had shipped each Gear VR at full retail price, its total sales would only amount to a quarter billion in revenue. Apple Watch has contributed billions of dollars in high-margin reviews for Apple each quarter. That hasn't stopped industry wags from portraying Apple Watch as a "failure" while remaining giddy about the hyped potential of Gear VR.

Another similarity between the emerging market for VR headsets and smartwatches is that various industry players— lead by the same firms, including Samsung and joined by Google and Microsoft and their various licensees— also raced to market watches that saw minimal interest from consumers.

However, immediately after launching Apple Watch it took majority market share among smartwatches, trouncing years-old efforts by Samsung Gear and Android Wear, neither of which remain very relevant today.

Apple sees AR as a bigger opportunity

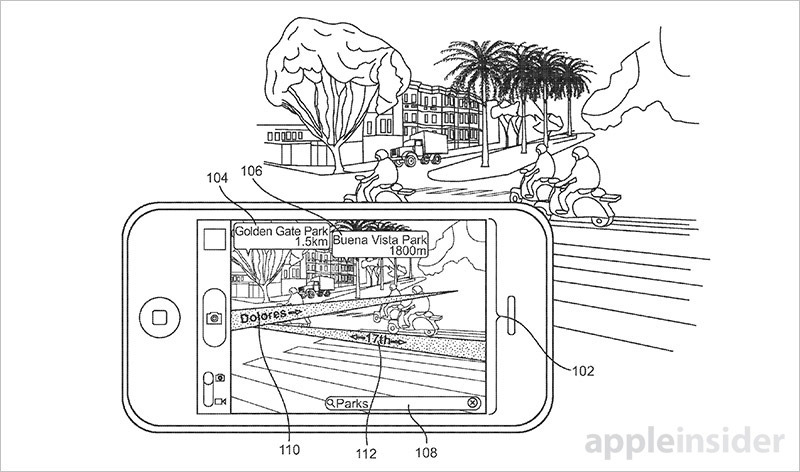

In August, Apple's chief executive Tim Cook told the Washington Post that he thought augmented reality was "extremely interesting and sort of a core technology."

In September, Cook said in an interview with ABC News, "there's virtual reality and there's augmented reality — both of these are incredibly interesting, but my own view is that augmented reality is the larger of the two, probably by far."

In October, Cook again touted the benefits of AR over VR, stating "There's no substitute for human contact, and so you want the technology to encourage that."

As with the smartwatch, Apple has repeatedly arrived to market with offerings that were years behind the unfinished, inferior products of its competitors, using new technologies and a fresh approach to addressing users' needs and desires.

Apple's iPod was a substantially better music player; iPhone was a vast advancement over the status quo of smartphones, and iPad crushed existing tablets and has never been bested since by any other tablet maker. That bodes well for Apple's next leap into the AR/VR market, particularly given the poor sales and apathetic response current VR headsets are experiencing.

Daniel Eran Dilger

Daniel Eran Dilger

-m.jpg)

Thomas Sibilly

Thomas Sibilly

Wesley Hilliard

Wesley Hilliard

Marko Zivkovic

Marko Zivkovic

Malcolm Owen

Malcolm Owen

Amber Neely

Amber Neely

64 Comments

I'm hoping Apple does something great with AR. At this stage the technology fits Apple's MO in general by coming in "late to the game", but with something innovative and "obvious" as it concerns how people actually use, or are comfortable using the technology. Also, it would be cool to have another contributor in developing the technology overall.

VR is expensive, lacks content, and its based on what hardware you buy.

AR, on the other hand has been adopted by millions of users already (pokemon go).

VR has hardly been a failure for Sony. How on earth could they sell 2.6 million VR headsets in less than 2 months? Playstation VR has only been on the market since October. Every retailer has been saying they fly off the shelves when they are in stock. Even Sony has said sales have been great and are on track to meet sales expectations. Sony is expanding VR production to meet demand. Playstation VR is sold out just about everywhere. Whoever estimated Sony to sell 2.6 million VR units in less than 3 months is a complete idiot.

That's obvious because a tethered headset and joystick are ridiculous things. If it is joystick then I already do that in my 2D flat sreen why would I wear the whole display assembly on my head?

There is no VR unless you introduce your very self into the scene. That requires an untethered headset and a body kit.

The first picture - of a dude with the beard and the mouth open in wonder - should actually show a pic of Carmack - the guy from "Pseud's Corner" that thought all this VR stuff had any value.

VR is something you might do in your bathroom (if you were sad enough) but in public, it's all of the downside of Google Glass on steroids.

AR - indications of interesting/important events close-by - has much more appeal, utility (and class).