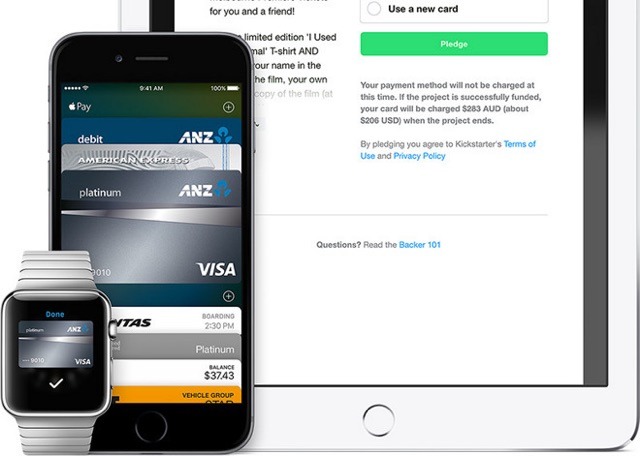

Apple has complained to the Australian Competition & Consumer Commission over the resistance of major banks in the country using Apple Pay, with a recent filing claiming a request to open up access to the iPhone's NFC controller would effectively allow banks to avoid using Apple Pay entirely.

Submitted to the ACCC by Apple on January 23, the statement concerns a draft determination from the ACCC issued in November last year. The determination concerned an attempt by the largest Australian banks to negotiate terms over Apple Pay's deployment, including fees and access to the iPhone's NFC controller, a request denied by the ACCC

In the submission, Apple claims the collective bargaining and attempts to access the iPhone's NFC functionality by the banks "will not achieve any of the public benefits claimed" by the Commonwealth Bank of Australia, National Australia Bank, Westpac Banking Corp, Bendigo, and Adelade Bank. As Apple considers this "cannot satisfy the statutory test," Apple "will not and cannot agree to the terms sought by the banks."

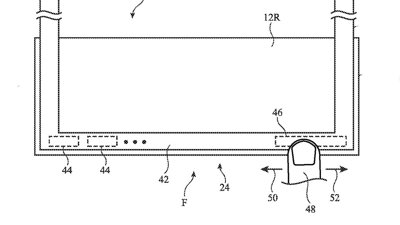

The banks want access to the NFC controller to be able to offer their own digital wallet systems, which is claimed in the application to provide competition. Apple doesn't believe this to be the reason, writing in the submission that the banks want NFC access to bypass Apple Pay entirely, avoiding transaction fees in the process.

Banks in Australia want access to the NFC chip found in the iPhone, but Apple objects, contending that the banks want to avoid transaction fees associated with Apple Pay.

Apple alleges the "increased competition" claim doesn't apply, as if the banks were given NFC access, they could start "specifically charging" customers for using Apple Pay, discouraging the use of the mobile payments platform and thereby reduce competition with their own proprietary wallets." Offering NFC access to the banks also creates significant costs, "including negative effects on consumer security and data privacy," the ability for users to select their payment card at the point of sale, and a depreciated customer experience."

The only benefit that would arise from NFC would be to the banks, not the public, Apple suggests. Banks "would be allowed to continue to free-ride on the significant investments made by Apple in its devices, iOS platform and App Store infrastructure," and the technology used to make NFC payments, "without paying any fees for transactions processed via Apple Pay's secure element infrastructure."

Apple also accuses the banks of using the ACCC authorization process itself to delay negotiations, with the process taking "some ten months" until the date of "Final Determination."

The forced delay is affecting approximately 70 percent of Australian cardholders, namely customers of the negotiating banks, with Apple suggesting the slow expansion also harms "smaller card issuers who already, or could in the future, rely upon Apple Pay" to provide mobile payments to compete against its larger rivals.

"The applicants' refusal to engage with Apple during the authorization process provides evidence of the chilling effect of the proposed collective conduct on the benefits of competition through innovation in digital payments offered by over 3,500 banks to millions of consumers in 13 countries."

The ACCC's interim ruling suggests that the use of Apple Pay instead of allowing the banks NFC access could in fact increase competition, by "making it easier for consumers to switch between card providers and limiting any 'lock in' effect bank digital wallets may cause."

The banks have called Apple's assertions "incorrect and supported," in a statement received by Bloomberg. The Application wasn't about preventing Apple Pay from expanding in Australia or reducing competition, the banks claim, suggesting it as being "about providing real choice and real competition for consumers and facilitating innovation and investment in the digital wallet functionality available to Australians."

A formal response to the ACCC's draft determination is expected to be published later this week.

Malcolm Owen

Malcolm Owen

-xl-m.jpg)

-m.jpg)

Thomas Sibilly

Thomas Sibilly

Wesley Hilliard

Wesley Hilliard

Christine McKee

Christine McKee

Amber Neely

Amber Neely

William Gallagher

William Gallagher

Mike Wuerthele

Mike Wuerthele

29 Comments

Apple Bank. It's coming. Count on it.

UNsupported, of course (sorry to nitpick).(god, I hate autoblunder

:(

"Sure, but we'll charge 30% of the transaction." lol