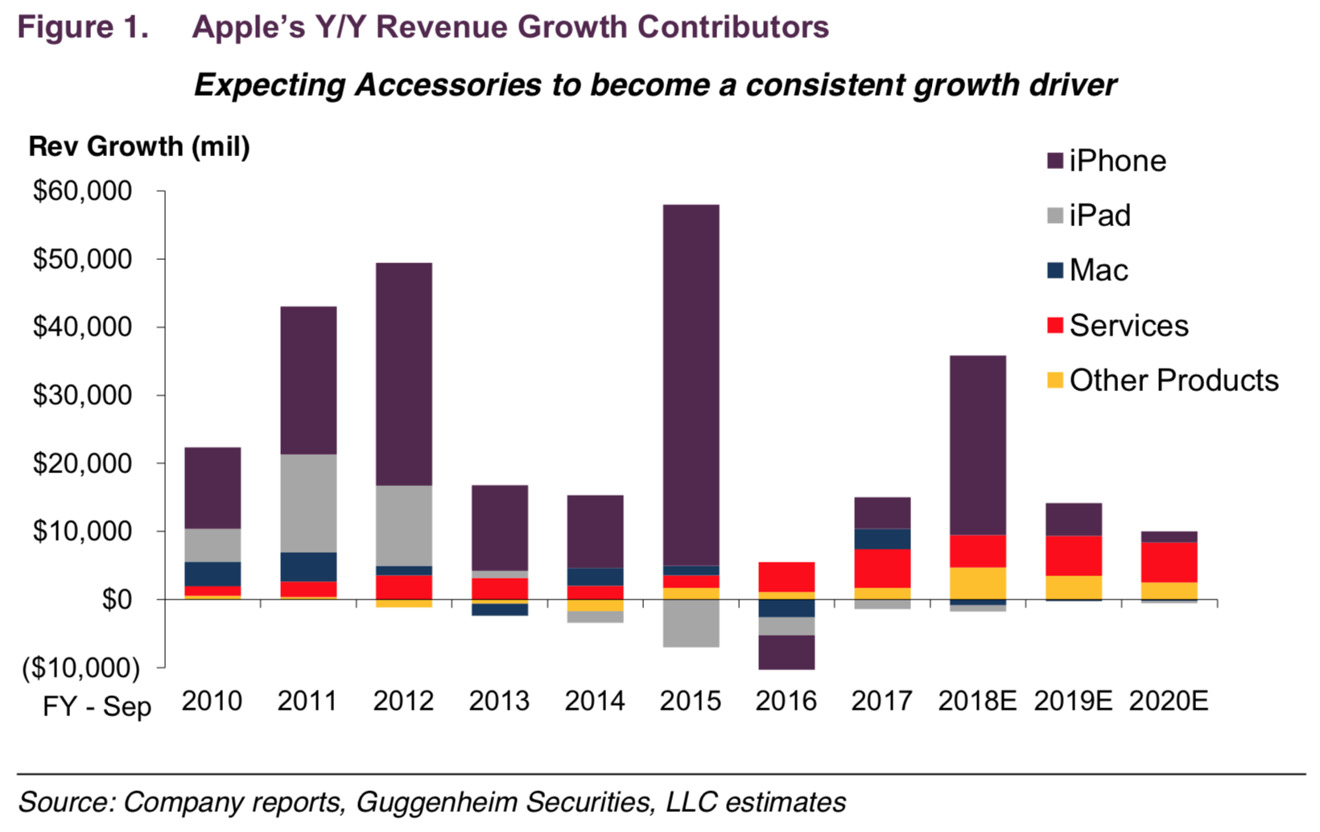

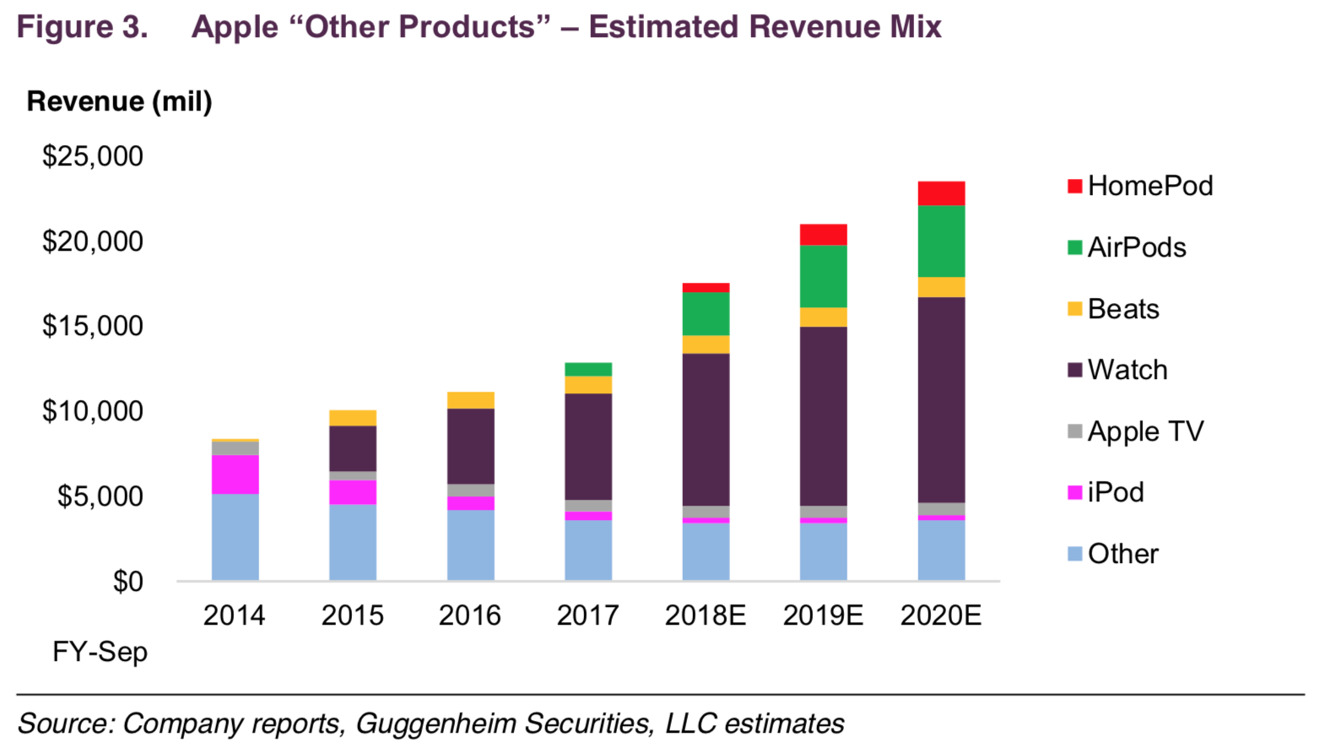

Fueled by a trio of new product categories, Apple's all-encompassing "other products" are poised to become the company's fastest growing segment, further fueled by the recent launch of HomePod.

Apple lumps products for which it does not offer sales data into the "other products" category on its earnings reports. Beyond HomePod, it also includes AirPods and the Apple Watch.

As of calendar year 2016, Apple's "other products" brought in $11 billion in revenue. But analyst Robert Cihra of Guggenheim said in a note to investors this week, a copy of which was provided to AppleInsider, that he sees the number doubling by calendar year 2019 to $22 billion.

This year alone, Cihra believes the Apple Watch, AirPods and HomePod will push the category to $19 billion, or 7 percent of Apple's total revenue. In addition, he sees it being Apple's fastest growing segment, posting 34 percent year over year improvement.

To put the 7 percent share for "other products" in perspective, Apple's iPhone accounts for 63 percent of revenue, while the company's services business represents 13 percent, and the Mac brings in 9 percent. Cihra believes that "other products" will surpass the revenue share of the iPad this year — Apple's touchscreen tablet is projected to account for less than 7 percent of total revenue.

While Apple doesn't break down products in the category, Cihra believes the big winner is the Apple Watch, which is forecast to account for 50 percent of "other products" revenue in calendar year 2018. He sees the company shipping 22 million watches this year, representing 26 percent year-over-year growth and earning $9.5 billion, or 3.6 percent of the company's total revenue.

As for AirPods, if Apple can sell to 3 percent of its 750 million iPhone installed base, that would amount to 23 million sales this year, or revenue of more than $3 billion. Those numbers would allow AirPods to surpass Apple's Beats division and account for 16 percent of "other products" revenue, or more than 1 percent of total revenue.

Finally, with HomePod, Cihra estimates a 10 percent attach rate to Apple Music subscribers, resulting in sales greater than 3 million and revenue of nearly $1 billion. He believes Apple could further drive sales with a so-called "HomePod mini" at some point in the future.

Guggenheim has maintained a "buy" rating for AAPL stock with a 12-month price target of $215.

Neil Hughes

Neil Hughes

-xl-(1)-xl-xl-m.jpg)

-m.jpg)

Amber Neely

Amber Neely

Wesley Hilliard

Wesley Hilliard

Marko Zivkovic

Marko Zivkovic

Andrew Orr

Andrew Orr

Malcolm Owen

Malcolm Owen

Andrew O'Hara

Andrew O'Hara

11 Comments

That's some really sketchy math using total installed base as the foundation rather than expected yearly sales of each product and then expecting the initial adoption rate of a new product to continue indefinitely. You are using a number that is three times as high as total annual sales and still forecasting revenue growth at the same rate. If you look at the chart he is forecasting AirPod sales to be almost $6B in 2020 which would amount to 46 million AirPods. Most customers are going to buy a set of AirPods at the same time they purchase a new phone. That implies an adoption rate of almost 20% of all new iPhone purchases.

Same thing by tying HomePod sales to total Apple Music subscribers. You may get 10% of everybody in the first year, but after that you are looking at 10% of new subscribers plus any people replacing their HomePod. Unless this guy expects everyone to replace their HomePod yearly his growth rate assumption is highly skewed.

I don't know about the Apple Watch, but I suspect the HomePod and AirPod sales will stabilize fairly quickly and the revenue growth rates will flatten out just like the Beats revenue looks in the chart.

Saw in Twitter that Apple Watch shipment has surpassed Fitbit now. I know it’s an estimated number but still quite surprised.

HomePod Mini: nope. That ain't happening.

Are "other products" hardware or software/service? If the former, I wonder what that could be?