In what Apple calls a "WWDC Spotlight," it has selected three apps that are targeted at financial wellness and education.

Apple's Worldwide Developer's Conference, or WWDC, is in June and Apple usually takes some time to discuss some of the innovations being shared by developers. Tuesday's spotlight focuses on financial apps, specifically ones that help the people who need it most.

Banking, credit building, and investing are three tentpoles to a better financial future but often left out of the hands of marginalized communities. Goalsetter, Perch Credit, and Ellevest are three apps that hope to improve financial literacy and bring more financial freedoms to women, children, and people of color.

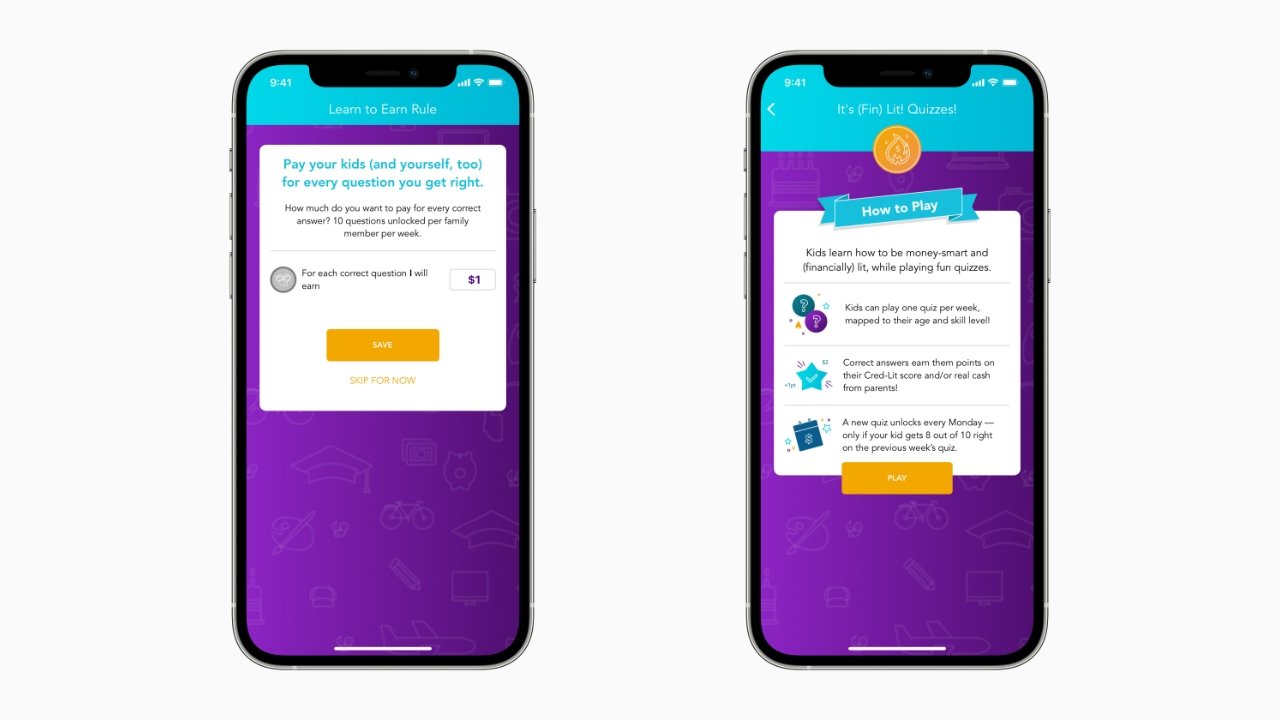

Goalsetter is an app focused on family and kids' savings and education. It is one of the first Black-woman-owned fintech and financial education apps on the App Store.

The app encourages children to start thinking about starting a savings account using quizzes, GIFs, memes, and partnerships. One partnership had the NFL Players Association launch the "Dropping Jewels" campaign in which players talk with kids via Zoom about financial literacy.

"The only way to permeate people's lives in a way where they are using your service at different times throughout the day and throughout the week is if they have it constantly in their hands and it's integrated into everything they do," says Goalsetter CEO Tanya Van Court. "Apps connect families. Goalsetter connects grandmas, aunties, and uncles to kids in their lives, and lets them easily send money to the kids because they both have the app. It connects parents to kids, and lets kids complete their chores and ask for allowance, which can easily be sent to them through the app. It's all of these real-time life moments that happen and the ways that we are integrating ourselves into the family that are only possible because Goalsetter is an app."

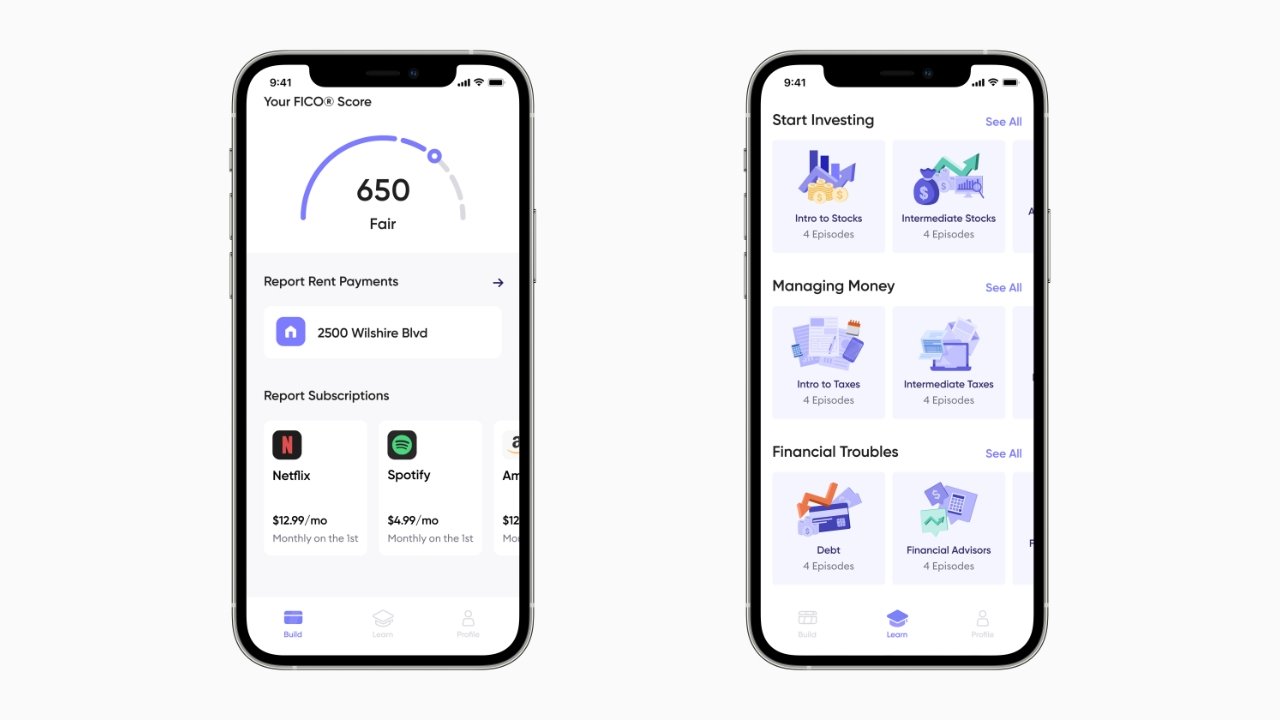

Perch is a different fintech app focused on establishing creditworthiness for those who find it difficult to obtain credit. It ties bills and subscriptions to a user as viable data points for creditworthiness.

The app allows users to view their FICO score and find information about the importance of building credit. Since the app's data is tied directly to the three credit bureaus' databases, it eliminates the boundaries for establishing credit.

"There is a huge community of credit-invisible and low-income individuals who don't have access to credit," explains Michael Broughton, CEO of Perch Credit. "There are 55 million Americans in the US who can't even get a credit score. In the Black community alone, there's a 6 percent approval rate for their first credit card if they don't have a preexisting credit score. Perch lives on the spectrum where anyone trying to build, establish, or grow their credit can use the app.

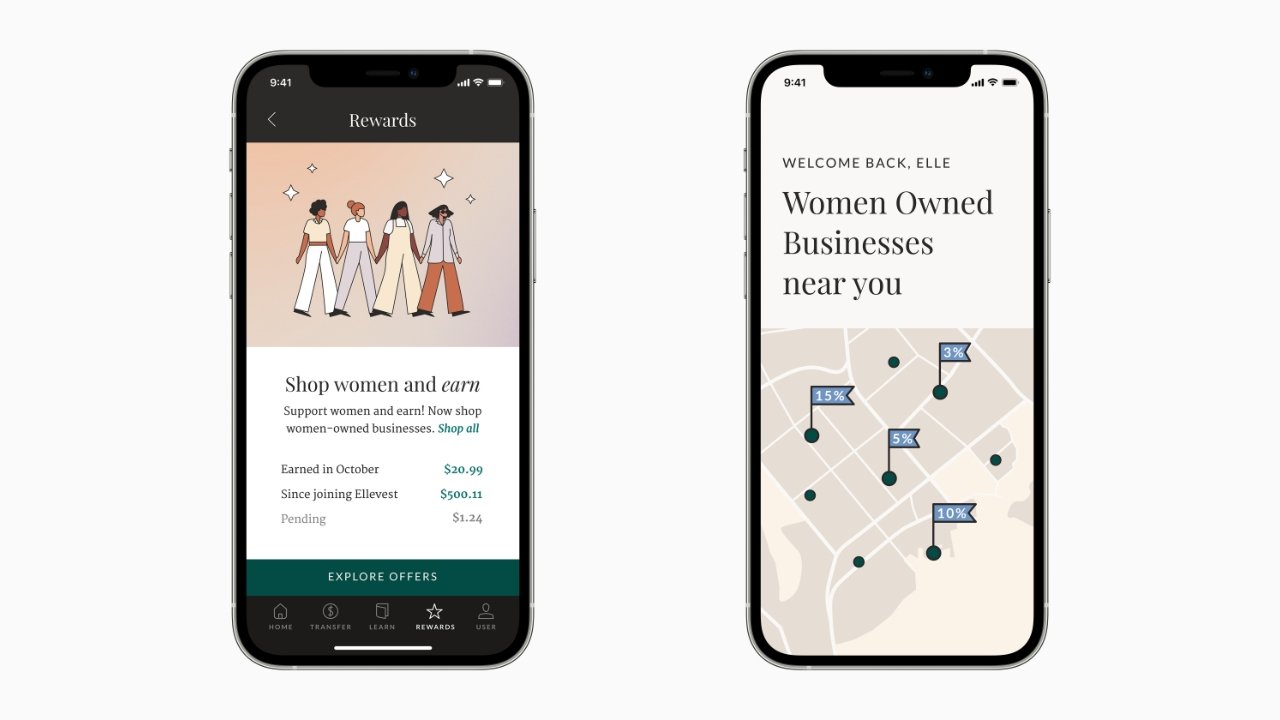

The third and final app highlighted by Apple is Ellevest, a financial app built by women for women. It is an app with a full range of financial tools, from investing to spending. It even offers a debit card that gives cash back when used at women-owned businesses.

"There really had not been any innovation in the financial industry since the ATM in the 1980s," Krawcheck says. "But starting a handful of years ago, there's been this fintech explosion where an enormous amount of power has been delivered to users through apps. iPhone is in the pockets of millennials, Gen Xers, and the Gen Zers. The amount of convenience of all of this being in people's pockets is a massive game changer."

Stay on top of all Apple news right from your HomePod. Say, "Hey, Siri, play AppleInsider," and you'll get the latest AppleInsider Podcast. Or ask your HomePod mini for "AppleInsider Daily" instead and you'll hear a fast update direct from our news team. And, if you're interested in Apple-centric home automation, say "Hey, Siri, play HomeKit Insider," and you'll be listening to our newest specialized podcast in moments.

Wesley Hilliard

Wesley Hilliard

-m.jpg)

-m.jpg)

William Gallagher

William Gallagher

Christine McKee

Christine McKee

Andrew O'Hara

Andrew O'Hara

Mike Wuerthele

Mike Wuerthele

Malcolm Owen

Malcolm Owen

5 Comments

This is nice to help people, but this is not going to solve the problem people having with money management.

Knowing your credit score does not solve anything and those who find out now they have a bad credit score and no one will lend you money is too little too late, it could take years to repair years of bad decisions.

Most people have no ideal what a budget is or how to live within a budget. Part of the problem of living in the wealthiest country in the world is everyone looks around and wants what everyone else has around them. No one seem to be willing to go without things they do not have money to afford and all we hear today this is because of some sort of "ism" as the reason people are not better than they should be or do not have what someone else has. Today, only 30% the people had any sort of saving , most people have more than 10K in credit card debt,

My dad taught me a very simple rule of money do not spend what you do not have in your pocket, that was in the days of cash, today spend what you do not have in checking account, and only use a credit cards to facilitate a simple transaction (ie not having to pull out check book). I taught both my kids these simple skills, and my daughter adopted her own if you have $20 only spend $9 and put away the $1 of the $11 you get back in change. She did this since she was small and one day we found a stash of $1 bills she was keeping if was a significant amount she did not spend over the years of having money gifts and working.