Apple's iPad lineup clearly follows a "good, better, best" pricing strategy, but consumers consistently reach for either the cheapest or the priciest iPad option, leaving the middle tier behind.

Apple doesn't need to play the pricing game the way other companies do. While most brands steer shoppers toward a middle-tier "better" option, Apple customers routinely gravitate to the top.

A new report from Consumer Intelligence Research Partners (CIRP) tries to frame this as a fresh insight using iPad sales, but it mostly confirms what anyone paying attention already knows — Apple's best products sell best.

iPads follow the pricing pattern, but with quirks

In most industries, especially consumer electronics, companies split products across three pricing tiers — good, better, best. These tiers help corral buyers into a midrange "better" tier by framing it as the sensible compromise. Across most industries, sales are distributed on a bell-curve with that tier, with most buying into the "better" pricing.

The low-end is there for budget-conscious shoppers, and the premium tier often exists to make the mid-tier look reasonable by comparison. Apple consumers break this model.

Not only are its "best" products frequently the most popular, but buyers often ignore the cheaper options altogether. This is especially true for the iPhone and Mac, and CIRP argues it's largely true for iPads too.

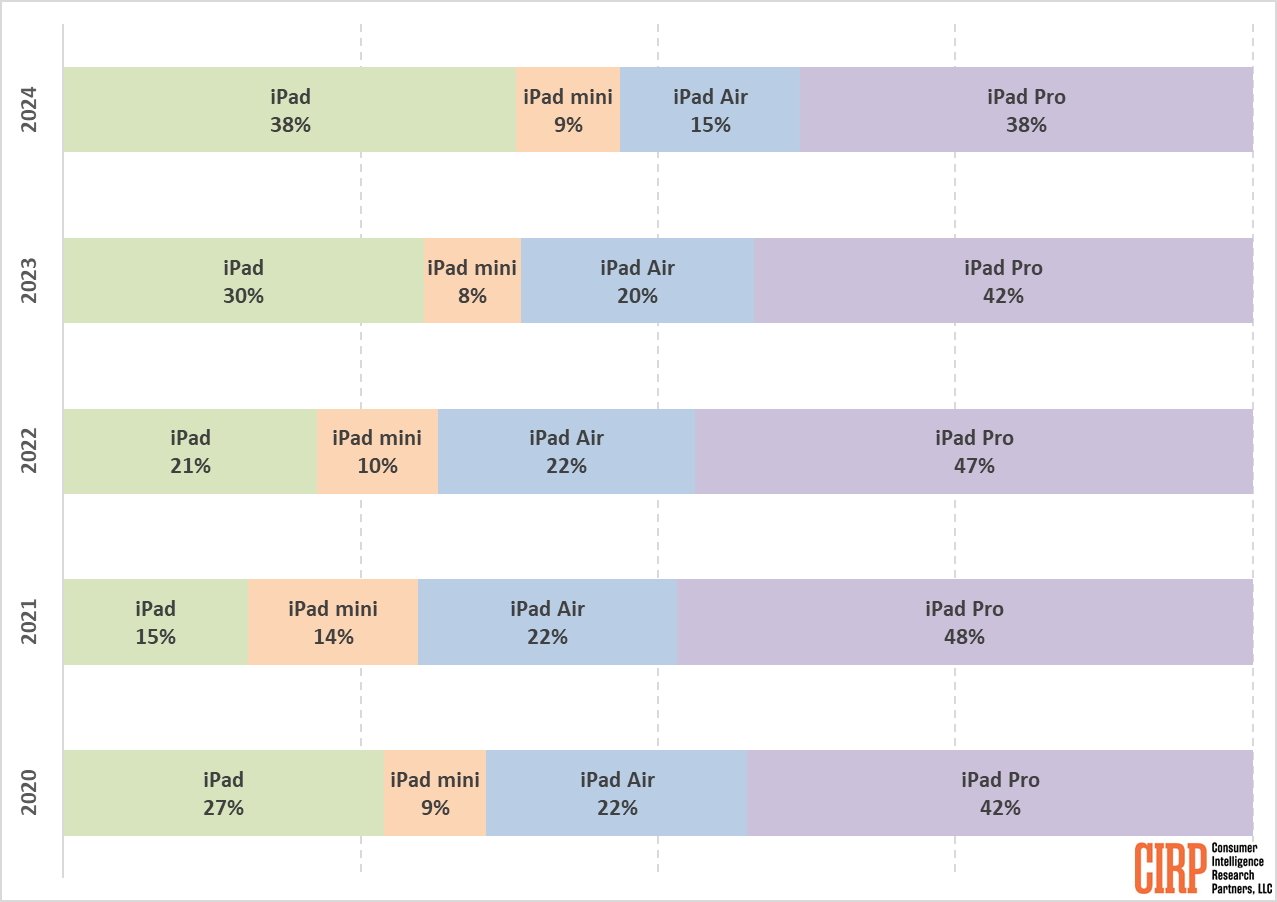

Across the past five years, the iPad Pro accounted for between 38% and 48% of all U.S. iPad sales. That defies conventional industry wisdom, and mirrors the trend seen in other Apple lines, that customers are willing to spend more for the top-tier experience.

But while CIRP presents this as something surprising, it's an old pattern. Apple has long cultivated a premium image, and its users have consistently proven willing to pay for it.

What's mildly interesting in the report is the recent shift in the "good" tier. In 2024, the entry-level iPad surged to 38% of U.S. unit sales, tying the iPad Pro. The jump likely reflects the release of the 10th-generation iPad in late 2022.

That's the highest share the basic model has seen in five years, possibly pointing to a more cost-conscious wave of buyers. Whether that holds in 2025 depends on Apple's pricing, positioning, and the upcoming iPad refreshes.

The middle tier problem

The iPad Air, intended to be the better option, has struggled. It held around 20% of unit share until 2024, when it dropped to just 15%, despite a 2022 refresh with the M1 chip, 5G support, and a front-facing camera with Center Stage.

The hardware upgrade brought it closer to the iPad Pro on performance, but the price gap wasn't wide enough to make it feel like a strong value, especially as the base iPad caught up on design and display.

The base iPad is good enough for casual use, and those who want performance or premium features simply jump to the Pro.

Then there's the iPad mini, which doesn't fit neatly into the tiered pricing structure. Despite its higher-than-entry price, it's smaller and more niche, appealing to a segment that values portability.

These customers include frequent travelers, field workers, and users who want a compact device for reading, note-taking, or drone control. However, the iPad mini's share dropped from 14% in 2021 to 9% in 2024.

The drop was likely due to the lack of updates and rising competition from larger iPhones and more capable base iPads. Apple refreshed the iPad mini in 2021, but its high price and aging specs have made it less appealing compared to the standard iPad.

Apple's iPad sales aren't a mystery

CIRP frames the iPad's distribution as "a bit of a conundrum," but in context, it's quite straightforward. Apple's users tend to skew affluent and brand-loyal.

The brand's halo effect nudges people toward the top of the line, whether they need it or not. The middle tier is often left behind unless there's a meaningful distinction — something the iPad Air arguably lacks right now.

Sales breakdowns can be useful. But the headline takeaway, "Apple is not like other companies," is about a decade late.

We already know customers reach for the top of the line, and we already know Apple designs products, marketing, and pricing to make that happen.

What will be worth watching is whether that 2024 bump in entry-level iPad sales holds. If so, it could reflect inflationary pressures and a shift in consumer behavior.

But Apple would likely counter with upgrades across the line, reinforcing the usual tilt toward the "best." Because that's always been the playbook.

Andrew Orr

Andrew Orr

-m.jpg)

Christine McKee

Christine McKee

Marko Zivkovic

Marko Zivkovic

Mike Wuerthele

Mike Wuerthele

Amber Neely

Amber Neely

Sponsored Content

Sponsored Content

Wesley Hilliard

Wesley Hilliard

7 Comments

Since the iPad’s last for a long time particularly the iPad Pros (6 to 7 years) the big screen iPad if you can afford it is the best buy as a handoff to a relative younger or older perfect in fact, (done it twice).

The most current iPad Pro 13” and iPad mini are a perfect combination for me.

The Air is now thicker and heavier than the Pro, which defeats the entire purpose of the Air. The Air was meant to be the thinner and lighter model, as it once was. But all iPads run the same OS and apps so the base model runs everything equally well compared to the Pro or Air.

But wait!!! It was less than three months ago, on January 3rd, when AI ran a headline article about iPad Pro sales being so weak that Apple was shutting down and redeploying production lines for its display! The sky is falling! https://appleinsider.com/articles/25/01/03/weak-ipad-pro-sales-prompt-oled-supplier-to-switch-to-making-more-iphone-screens

And here we are, just 82 days later, and now the story is that the iPad Pro is and has been the best-selling model for years, including last year. So which one of your polar opposite reports would you like AI readers to believe? Or should it be "none of the above?" It would also be informative, when discussing "sales," to know if we're talking about dollar amount or units sold. It would not be all that surprising if Pro models led in dollar amount of sales, considering their much higher selling prices. But if Pro models were grabbing 42% of unit sales, I would find that surprising given their high cost.